PIMCO Total Return ETF (TRXT) Launches Yahoo Finance Canada

Post on: 11 Июль, 2015 No Comment

Although numerous active ETFs have hit the market over the past few years, very few have managed to achieve a solid asset base. Actively managed bond ETFs though, have seen more interest than most corners of this market segment as some believe there is a greater opportunity for manager outperformance in the fixed income world. As a result, these bond funds command the lion’s share of assets in the active ETF world including two funds with more than a billion dollars in assets (read Three Outperforming Active ETFs ).

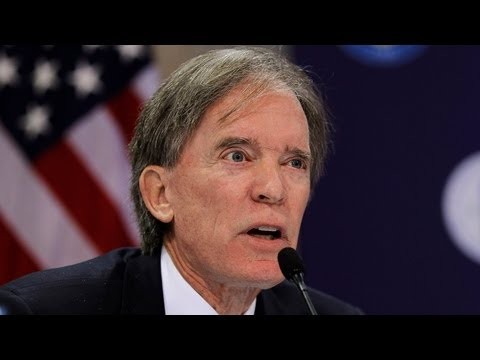

Yet while this corner of the ETF market has been popular, many believe that there are more gains to be had, especially considering that investors haven’t seen very many ‘superstar’ bond fund managers apply their strategies to the ETF structure. While the generally lower fees and more rigorous disclosure requirements have probably kept many of these managers away, the increased popularity of ETFs among many investors is becoming too hard to ignore for many issuers. Thanks to this trend, arguably one of the most famous bond managers in the world has just launched a new active fund; legendary bond guru Bill Gross and his PIMCO Total Return ETF (TRXT ).

The new fund, which has been in registration with the SEC for almost a year, looks to give investors access to the strategies that Gross uses for his ultra-popular PIMCO Total Return Fund (PTTAX ) (PTTRX ). However, TRXT will charge investors 55 basis points a year in fees. 30 basis points below the class ‘A’ version that is most widely used by retail investors, but nine basis points above the institutional class of the product. These forms of the product have seen strong performances over the past few years, suggesting that if investors seeking are seeking an active play on the bond world, this new ETF could be the way to go (also read Follow Buffett With These Developed Market Bond ETFs ).

Total Return ETF Portfolio

At time of writing, TRXT is heavily exposed to American securities although it does have some holdings in Canadian and developed European markets as well. Additionally, it should be pointed out that the fund has a large short component—equal to about 26% of the total—while securities that are not rated comprise about half the fund. In terms of holdings, the fund has 83 securities in its basket, with an effective duration of about 5.2 years. Top individual holdings go to long term FNMA securities—which make up the top three spots and about 45% of the fund—while short term U.S. Treasury notes take the fourth spot at about 13.1% of the portfolio (also read FWDB )>The Best Bond ETF You Have Never Heard Of ).

Key Differences

Investors should also note that the ETF, thanks to a broad hold by the SEC on funds using derivatives, will not be using swaps or other similar instruments which are in the mutual fund versions of the product. While this could change at some point in the future, there is no telling when—or if—the SEC will lift this ban. Additionally, like all ETFs on the market today, TRXT will have to disclose its holdings on a daily basis, a departure from what Gross has been used to in the mutual fund world with the quarterly disclosure requirements inherent to that space (read Do You Need A Floating Rate Bond ETF? ).

Thanks to these key differences, the ETF may deviate from the performance investors see in the mutual fund versions of the fund. “I think it would be reasonable to anticipate some short-term divergence between the ETF and Total Return” said Bill Gross of PIMCO. “However, the similarity of their approaches means that over longer periods we would expect outcomes to be well in line with each other.” Also, Gross seems to dismiss the daily disclosure requirements as a reason to be skeptical of PIMCO’s total return funds stating that ‘certainly, the market knows what we’re doing within the first few days of each month, when we release our sector holdings. So we’re not worried about the ETF structure exposing our ‘secret sauce.’”

Nevertheless, it will be interesting to see if the strong brand name of PIMCO and their total return fund can carry over into the ETF world. The company has already seen a great deal of success in some of its other bond ETFs but is undoubtedly looking to crush those figures with this incredibly famous strategy. Yet, given some of the key differences between the ETF and the mutual fund, it remains to be seen if investors will embrace Gross’ strategy in the exchange-traded structure or if they will just stick to what they know in the mutual fund space.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>