Pimco s Gross Defends Competitive Culture

Post on: 16 Март, 2015 No Comment

Pimcos Gross Defends Competitive Culture

Allianz is Very Happy with Pimcos New Management Structure

GREGORY ZUCKERMAN and KIRSTEN GRIND

Feb. 27, 2014 8:20 p.m. ET

Bill Gross isnt changing his style—and his bosses say they are fine with that.

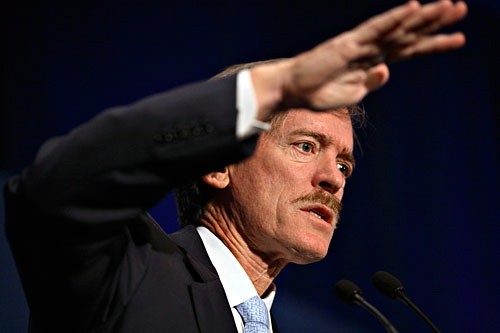

The co-founder of bond behemoth Pacific Investment Management Co. on Thursday defended its competitive culture, saying in an interview that the trading floor cant thrive on sweet talking alone but that the firm is still a family of sorts.

Mr. Gross is manager of the biggest bond fund in the world. Last month, Mohamed El-Erian, who was considered Mr. Grosss heir apparent at the head of Pimco, stepped down amid clashes between the two men, The Wall Street Journal reported this week.

After Mr. El-Erians resignation, Pimco announced a revamped structure that included a new CEO and six deputy chief investment officers.

Michael Diekmann. chief executive of Pimco parent company Allianz SE , ALV.XE -2.29% said that the company was very happy with Pimcos new management structure and saw no need to exercise more control over its ultraprofitable U.S. unit. The changes address the long-term question whether Pimco is a Bill Gross one-man show or more than that, Mr. Diekmann said.

In the interview, Mr. Gross, 69 years old, said he is focused on the Newport Beach, Calif.-based firms performance and that no one had raised concerns about his behavior. He said he understands why some employees may perceive him as difficult to work with, but that not everyone feels that way. He is challenging at times, he said, in the interest of running the company well.

Its like dealing with family—you dont always produce a productive family by sweet talking and always being inclusive, Mr. Gross said. Theres a time for soft love and time for hard love.…I can admit to both.

Mr. Gross said the recent executive changes show he is sharing power at the helm, including by reducing his participation in investment-committee meetings. Its a huge change, he said, noting the executive shuffle was under way months before Mr. El-Erian resigned.

Allianzs asset-management segment, which includes Pimco, on Thursday reported a 23% drop in fourth-quarter profit. Pimco, which oversees nearly $2 trillion in assets, has been under pressure in recent months as tumult in the bond market led to rising losses and a decline in assets under management.

A number of financial advisers and investors said they were paying closer attention to Pimco.

The concern is that before, with Bill and Mohamed, they could challenge each other and I think the funds benefited from that, said Chad Carlson, an Itasca, Ill. wealth manager. Without Mohamed, there is not so much a challenge to what Bill thinks.

Mr. Carlson said he reduced his Pimco holdings last year amid tumult in the bond market, and is weighing whether to trim them further.

Likewise, Richard Kaye, 69, who is retired and lives in Chicago, says he was concerned about his investment in Pimcos funds, including Mr. Gross Pimco Total Return Fund, after reading about the internal clashes at the firm.

Mr. Kaye said he views Mr. Gross as brilliant and the equivalent of Steve Jobs of the financial world. But Mr. Kaye emailed his financial adviser nonetheless to see if he should make changes to his portfolio. Mr. Kaye didnt make a change.

I am cautious, Mr. Kaye said. I just think that at least for the time being Im going to certainly keep an eye on whats going on at Pimco.

Pimcos incoming CEO, Douglas Hodge, said few clients have contacted the firm in recent days, saying it had been remarkably quiet and that he didnt think many cared about the internal dynamics. They hire us not because its happy talk around here but because we deliver performance, he said.

So far this year, Pimcos flagship bond fund—run by Mr. Gross—has turned in mixed results. The Pimco Total Return Fund has scored a return of 1.86% this year through Wednesday, nearly eliminating the loss of 1.92% for 2013, according to fund tracker Morningstar Inc. The $237 billion fund has benefited from a surprising drop in U.S. bond yields that has boosted prices of many U.S. fixed-income assets.

But the funds return has been slightly behind a gain of 1.9% by the Barclays US Aggregate Bond Index and the funds return trails 64% of its peers. The fund remains a winner in the longer term, gaining an annualized 6.68% on average in the past 15 years, beating the 5.44% return on the benchmark index and ahead of 96% of comparable funds, Morningstar says.

Pimco contributes about 80% of Allianzs asset-management revenue. Mr. Diekmann, the German insurers CEO, said the management changes reflected deeper diversification at Pimco, and dismissed calls for Allianz to exercise more control.

We are very active in the governance issues, but were not getting involved in investment decisions because those are third-party assets, he said.

Meanwhile, Allianz signaled its interest in continuing to work with Mr. El-Erian. The company said he would become the chief economic adviser to Allianz, formalizing a previous decision to continue to employ Mr. El-Erian on a part-time basis.

Daniel B. Roe, chief investment officer in Budros, Ruhlin & Roe, Inc. said his firm and other large advisory firms he has spoken to see no cause for changes. We are sticking [with Pimco] for now, he said.