Picture Edition S P 500 ETF (SPY) V Assets

Post on: 18 Апрель, 2015 No Comment

by Stoyan Bojinov on October 9, 2013 | ETFs Mentioned: SPY

The appeal of alternative asset classes has grown considerably over the last few years for a number of reasons. ETFs have opened up the doors to previously difficult-to-reach corners of the market, allowing for self-directed investors of all sizes to tap into everything from commodities to merger arbitrage strategies through the purchase of a single ticker. The increasing correlation among stocks and bonds from around the globe has further prompted many to seek out alternative assets capable of generating uncorrelated returns to broad markets [see Visual Guide: Major Index Returns by Year from 1970 ].

Another breed of alternative assets also exists, but unlike ETFs, these investment opportunities are embraced for their tangibility and exclusivity.

Forget Stocks, Buy Stamps: Historical Hard Asset Returns

Hard assets like antique cars, classic paintings, and rare stamps have long been regarded as alternative safe havens for those looking to steer clear of traditional financial instruments; whats appealing is that a number of these alternative assets have delivered eye-popping gains over the past years, many of them grossly outperforming the S&P 500 Index [see Visual History of The S&P 500 Index ].

Below we examine the trailing returns for a number of alternative assets compared to trailing returns of State Streets SPDR S&P 500 ETF (SPY, A ) over the last one, five, and 10 years; please note these returns are as of Q2 2013 from Knight Franks Wealth Report .

At first glance, these returns are very exciting, and even compelling enough to make you dig up grandmas stamp collection. Its no wonder that many would consider investing in classic cars or classy bottles of wine when you see appreciation well upwards of 100% over the last decade. However, upon closer consideration, it becomes apparent that getting your hands on a 69 Shelby Mustang or an Andy Warhol original might be a bit tougher than logging into your brokerage account and placing a buy order for 100 shares of the S&P 500 ETF [see also Picture Edition: Major Asset Class Returns From The 2009 Bottom ].

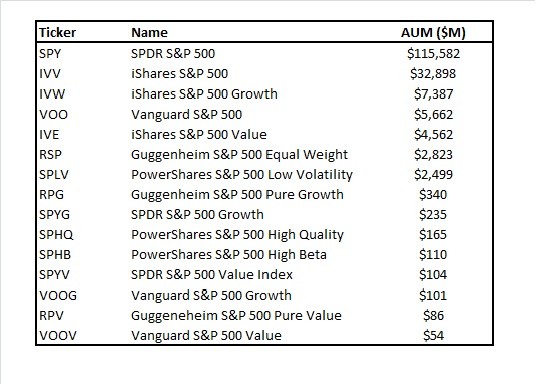

Lets say you are fortunate enough to get your hands on a luxury asset like a prized painting. Where and how will you store it? How will you find a buyer when it comes time to sell? Can you sell it tomorrow? With SPY, your costs are very clear-cut; you have defined brokerage trading fees and an annual management expense of 0.09%. You also have the piece of mind knowing that you can liquidate your entire position (whether its thousands of shares or even millions) whenever you want during trading hours without a hitch.

While these sorts of questions are by no means meant to deter someone from investing in hard assets, they do illustrate the point of tradeability quite nicely. That is to say, SPYs returns are nothing to write home about, but its liquidity, transparency, and ease of use go a long way when it comes to democratizing the financial landscape for the average investor [see 10 Questions About ETFs You’ve Been Too Afraid To Ask ].

The Bottom Line

The most recent financial crises rightfully took a big bite out of many investors confidence in the stock market, paving the way higher for a number of alternatives that have historically held appeal as valuable hard assets. The scarcity value for a lot of these items will likely continue to increase over the years, inherently bolstering their prices even higher. For the average investor, however, the barriers to entry here are quite steep, if not altogether impossible to hurdle over. As such, while buying ETFs may be far less exciting than shopping around for antique shotguns, these financial instruments offer unparalleled liquidity, transparency, and cost-efficiency, making them viable instruments for investors of all sizes to utilize.

Follow me on Twitter @SBojinov

[For more ETF analysis, make sure to sign up for our free ETF newsletter ]

Disclosure: No positions at time of writing.