Picking the Best Australian ETF

Post on: 7 Апрель, 2015 No Comment

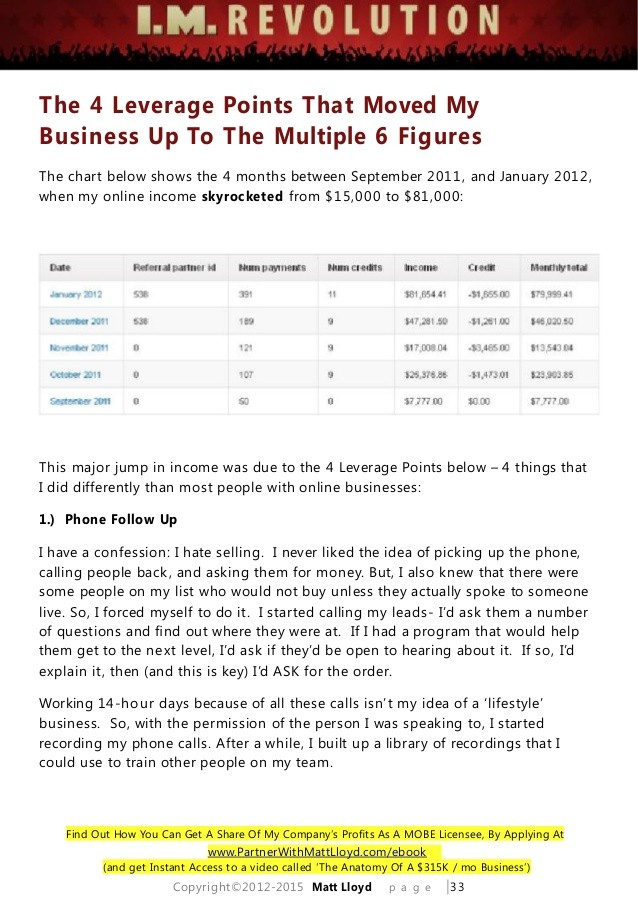

Today we pick the best ASX listed, broad-based, Australian ETF for a passive aggressive investor.

As a passive aggressive investor you seek the cheapest and most liquid way to gain exposure to a market, however you also want to make sure that your ETF isnt hiding any risks under the bonnet. All of these criteria are considered in choosing an Australian ETF.

Index (Market)

Nightly news programs normally discuss share market performance with reference to the All Ordinaries and the S&P/ASX 200 . These are examples of broad-based Australian indices . They are broad in the sense that they cover a large portion of the shares listed on the ASX (in fact 80-90% of the total market value). The largest stocks are included regardless of their performance or characteristics. Each stocks weighting is determined based on its relative size, so larger stocks have a higher weight. This technique is called Market-capitalisation weighted (or more concisely Market-cap weighted).

These two indices are seen as being the true indicators of the Australian share market, but they arent the only indices available.

More concentrated indices (such as the S&P/ASX 20 or MSCI Large Cap ) cover only the larger end of the market and are referred to as Narrow indices. Such indices might cover 45-70% of the market. A passive aggressive investor might choose a narrow index if its management fees were substantially lower, but otherwise broader is better.

At the other end Small Cap indices (such as the Small Ordinaries or MSCI Small Cap ) generally include the 101st to 300th largest stocks. Despite including 200 stocks small cap indices only account for 15-20% of the market.

The Market Vectors Australian Equal Weight index includes 75 stocks but weights them equally, rather than by market-cap. This falls under a new category of passive investments called Smart Beta strategies. The marketing for such strategies lets you think that you can have your cake (higher than market returns) and eat it too (lower cost than active managers), but these claims are dubious at best. This article from Forbes represents a sensible view of such strategies, but to summarise generally they cost more, increase risk and frequently do not generate better returns.

Why am I spending so much time talking about Indices? Because an index defines an ETF. The ETF manager has no discretion as to how funds are invested, they invest however the index tells them to.

Even within the broad-based index group there is variety. 200 shares. 300 shares. MSCI vs S&P vs FTSE. Fortunately none of this detail matters too much. Provided that the index is market-cap weighted then basically its ok. There is one other caveat (investability) but Ill save that for future post.

Runner-up: STW, QOZ, IOZ

This is a simple one. Lower cost is better! This is probably a good time to note that the Vanguard funds are the cheapest in every index category no surprise! Vanguard is a cost leader in this industry, their $2 trillion of managed funds worldwide average 0.19% in fees.

Winner: VAS (0.15%!)

Runner-up: IOZ (0.19%)

There are two relevant aspects to liquidity. The first is the bid/offer spread and the second is the tracking error.

Bid/offer Spread: Is the difference between the bid price and the offer price (normally expressed as a percentage of the total value).

Lets say that the ETF was worth $100 and the bid/offer spread was $0.10 (0.10%). Imagine that you bought the ETF and then sold it straight away, you would lose 0.10% That is why the bid/offer spread is similar to the total of the entry and exit fee for a managed fund.

One great thing about ETFs is that market participants compete to offer the tightest bid/offer spreads yes evil high frequency trading firms are actually working to your benefit here!

Those particularly astute readers will be asking about share brokerage costs, and they are right! If comparing an ETF to a managed fund the brokerage costs are relevant and should be added to the ETFs bid/offer spread to make a fair comparison. When comparing ETFs against each other brokerage fees are not relevant as they are the same for each ETF.

Winner: VLC and SFY (

0.05%)

Runner-up: ILC, STW, VAS, OZ (

0.1%)

Bid/offer spread is generally less important than ongoing management fees. As a long-term investor as you pay management fees every year, but the bid/offer spread you only pay once.

Tracking Error: Tracking error is a measure of how closely the price of an ETF matches its Net Asset Value (NAV). For Australian ETFs you can always view the NAV by simply using the NAV code, which is simply a Y in front of the ETF code. So if you want the NAV for STW it is YSTW, for VAS it is YVAS etc.

Type this code into your brokerage system the same way you would to get a stock price quote. Any difference between the ETF price and the NAV should be minimal, and if it isnt then consider holding off trading until it comes back into line.

Unfortunately I cant offer an overall measurement here as I dont have access to the right data. Hopefully in the future!

Any Surprises?

All of the Australian ETFs listed are managed using the physical replication technique. The replication technique guarantees that the ETF performance will match the index performance. Physical means that the ETF owner does not face any risk of the manager going bankrupt above that impact that bankruptcy would have on the index.

Again Ill talk more about the other, less desirable, management methods in a future post.

VAS is clearly the best Australian ETF for passive aggressive investors. Its index is broad (300 stocks, 80%+ coverage), its fees are the lowest (0.15%) and its bid/offer spread is very reasonable (0.11%). You can see how VAS stacks up against its competition below:

Do you invest in an Australian ETF that isnt VAS? If so I would love to hear why and if you plan to sell it and buy into VAS instead?