Pick your investment approach BottomUp vs TopDown

Post on: 7 Апрель, 2015 No Comment

Where should you begin your analysis? Get an understanding of the different approaches on how to identify what stocks to pick.

This article explains the main difference between Bottom-Up and Top-Down approaches to identify stocks.

The purpose of bottom-up and top-down approaches is the same, which is to identity what stock to purchase. However they have different approach to it. The difference boils down to the following question where to start?

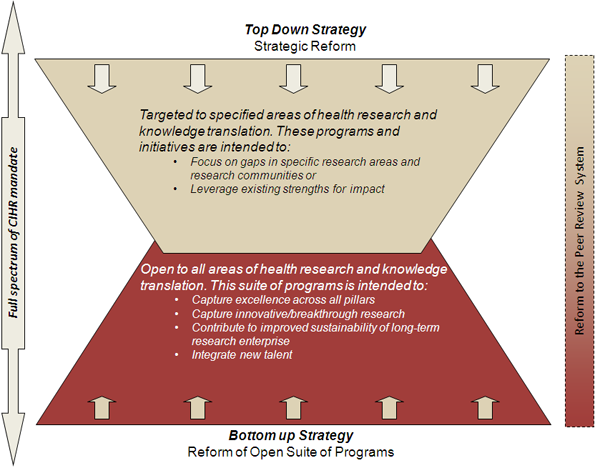

Their main difference lies where the investors begin his screening. In the top-down approach, the investor starts by analyzing the microenvironment, while a bottom-up investor screens on individual company factors, without any concerns on its market environment.

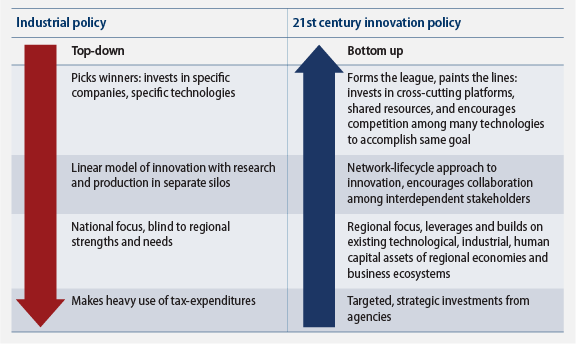

Top-down Approach

Top-down approach begins by an analysis of the broader economy, both domestic and international. These are factors such as GDP, interest rates, inflation, commodity prices and exchange rates.

Consequently, the investor narrows his scope to analysis of different sectors and their characteristics. Sector specific factors are such as; sales, competition and other consensus estimators which are important to get better understanding of which industry or sector will outperform others in the near future.

Lastly, the investor identifies the most promising companies within the sector to add to his portfolio.

Industries and sectors typically follow certain market cycles and trends. Supporters of the top-down approach use this assumption as the main view-point and accordingly start broad before narrowing down to more specific factors.

Example of Top-down approach

An example of a top-down investor approach would be an investor that realizes that the European Union (EU) is in difficulties that might potentially affect European stocks. He furthermore considers that the growth in Asia is slowing and realizes that US stocks should outperform in the near future, accordingly he decides to invest in U.S. stocks.

He assumes that due to globalization the Electronic and Software industry will stay strong and likely to outgrow other industries in the following years, consequently he chooses the best performing stock in that sector and chooses e.g. Apple (AAPL).

Bottom-up Approach

A bottom-up investor neglects the broad macroeconomic analysis and focuses merely on selecting a specific stock based on its individual qualities.

Supporters of the bottom-up approach simply seek fundamentally healthy companies, regardless of sector or macroeconomic factors.

What stocks to choose however can differ from investor to investor and include value-, growth- or income investing.

The view of this approach is that an individual company can perform well even though its sector or industry is performing badly. Accordingly, if the fundamentals are good, the stock is a buy potential regardless of outside factors.

A bottom-up approach requires a thorough research to get an understanding of the company’s business and its products; hence it might be hard to know where to start. However, a very useful tool for this purpose is to use a stock screener to easily filter out the companies that match your criteria.

Example of Bottom-up approach

An example of investor using bottom-up approach could be one that wants to buy e.g. Apple (AAPL) because he did his homework and found out that they have dominant market share, cost benefit and innovating product compared to its peers.

This bottom-up investor would focus on these things and neglect any consideration regarding the market cycle and macroeconomic factors such as US GDP, interest rates and currency fluctuation.