PGGM targets ESG in emerging markets

Post on: 16 Март, 2015 No Comment

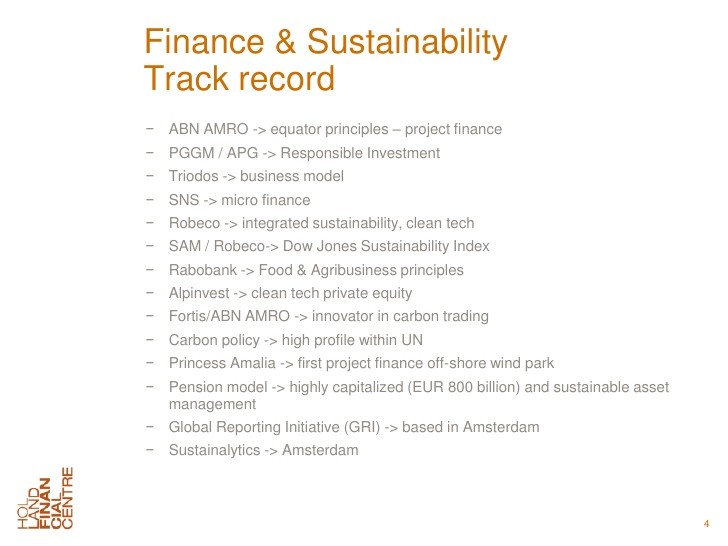

NETHERLANDS — PGGM, the 88bn Dutch healthcare pension fund, has asked Mercer to search for high-performing emerging markets equities managers, that have ESG at the core of their strategy.

Environmental, social and corporate governance is part of PGGM’s commitment to seek long-term investment opportunities, that recognises ESG factors as key value drivers of the overall investment process, Mercer said.

This is believed to be the first pension fund mandate to seek global emerging market equity strategies containing elements of ESG within its remit, albeit PGGM has told Mercer regional strategies and single country strategies may also be considered.

As far as we are aware, this is the first major emerging market equity mandate, that explicitly places ESG factors at the heart of the mandate, said Emma Hunt, European leader of responsible investment at Mercer.

Within this search, we expect to see a number of innovative processes and products, as investment managers begin to respond to increasing demand in this area, she continued.

According to Hunt, evidence linking ESG factors to investment performance is growing rapidly.

The nature of these linkages is being better understood, better quality data and analysis is now being produced, and investment managers are starting to evolve their investment processes and strategies to reflect this.

Marcel Jeucken, PGGM’s head of responsible investment, said: We believe ESG will add value to the financial performance of our investments, and we expect to find compelling opportunities in emerging markets.

We think it is crucial that managers start developing strategies that place such factors at the core of their investment strategies. This is why we are conducting a wide search on existing and new products in this area, he explained.

Earlier this year, PGGM and the 215bn civil service scheme ABP announced a combined 500m private investment in clean technology, as well as a combined 200m investment in a new fund in wind energy and biomass in Western Europe.

A PGGM spokesman said the scheme’s policy does not allow it to provide details of the returns on the specific investments.

If you have any comments you would like to add to this or any other story, contact Julie Henderson on + 44 20 7261 4602 or email julie.henderson@ipe.com .