Peter Lynch on Stock Market Losses A Wealth of Common SenseA Wealth of Common Sense

Post on: 10 Июль, 2015 No Comment

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Peter Lynch

I recently came across an old Peter Lynch interview for Frontline on PBS from the mid-1990s. In it the legendary former mutual fund manager discusses a wide range of topics from how he got started in the investment business to the crash of 1987 to the psychology of average investors.

Lynch’s thoughts on losses in the stock market are still relevant today:

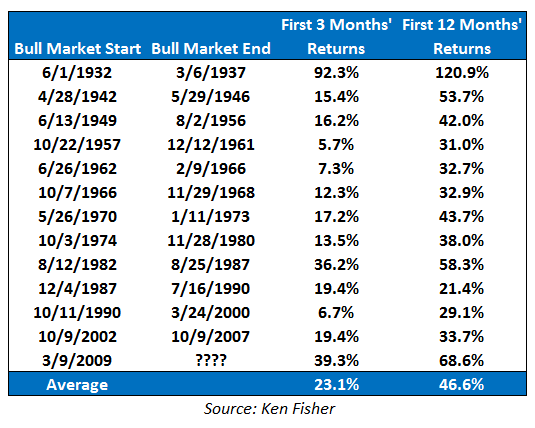

Now no one seems to know when they are gonna happen. At least if they know about em , theyre not telling anybody about em . I dont remember anybody predicting the market right more than once, and they predict a lot. So theyre gonna happen. If youre in the market, you have to know theres going to be declines. And theyre going to cap and every couple of years youre going to get a 10 percent correction. Thats a euphemism for losing a lot of money rapidly. Thats what a correction is called. And a bear market is 20-25-30 percent decline.

Theyre gonna happen. When theyre gonna start, no one knows. If youre not ready for that, you shouldnt be in the stock market. I mean the stomach is the key organ here. Its not the brain. Do you have the stomach for these kind s of declines? And whats your timing like? Is your horizon one year? Is your horizon ten years or 20 years?

What the markets going to do in one or two years, you dont know. Time is on your side in the stock market.

The most important point here is that no one knows when or why corrections happen. Investors are continually searching for reasons for stocks to fall. It almost becomes a game for some to say that the can predict the exact event that does it.

Theres always something to fear that will possibly derail the market profit margins, valuations, earnings shortfalls, economic growth, rising/falling interest rates, inflation/deflation, geopolitical risks and the list could go on forever.

The problem is sometimes stocks rise and fall for no apparent reason whatsoever. Occasionally these issues matter but other times the market simply shrugs them off.

This past Thursdays 2% loss in the S&P 500 is a case in point. The headline writers tried to come up with the news of the day to explain why the market fell, but there wasnt much there. Its not always a neat and tidy explanation except for the fact that there are times when theres more selling pressure than buying pressure.

Investors need to concern themselves with the fact that stocks do go down occasionally. Trying to continually predict the spark that sets it off can lead to more harm than good. Seth Godin had a good take on the idea that bracing for impact too often can be to your detriment:

Worse than this, far worse, is that we brace for impact way more often than impact actually occurs.[] All the clenching and imagining and playacting and anxiety—our culture has fooled us into thinking that this is a good thing, that its a form of preparation.

Its not. Its merely experiencing failure in advance, failure that rarely happens.

When you walk around braced for impact, youre dramatically decreasing your chances. Your chances to avoid the outcome you fear, your chances to make a difference, and your chances to breathe and connect.

Understanding stocks can and will fall is helpful to prepare yourself mentally for how youll react once they do. But bracing for impact at all times can be counterproductive to a good process.

Sources:

Brace for impact (Seth Godin)

Further Reading:

See my latest for Yahoo Finance on how 2% daily drops in the market aren’t as rare as most think (Yahoo Finance )

Thanks to @toddwenning for pointing this interview out to me.