Permanent Portfolio 2013 Results Crawling Road

Post on: 10 Июль, 2015 No Comment

by Craig Rowland 31 December, 2013

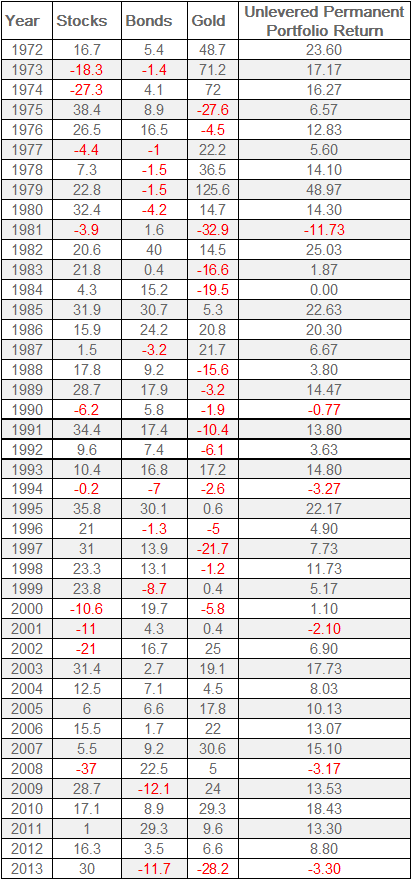

In 2013 the Permanent Portfolio returned -2.4% for the year according to Morningstars data.

2013 End of Year Result w/Short Term Bonds for Cash: -2.4%

If you used the more conventional Treasury Money Market Fund instead of the Short Term Bonds for the Cash allocation you did the following:

2013 End of Year Result w/Treasury Money Market for Cash: -2.5%

NOTE ON THE CHARTS: The charting site Im using (www.stockcharts.com ) may not be showing all dividends yet which is why some of the final totals are lower. Just use the charts for general trend visualization.

Stocks

This was the year for stocks as they put in the top performance across the board compared to just about anything else you could own. In fact, the market this year is at an all-time inflation adjusted high. This of course means you should pile in with everything youve got. Just kidding! It probably means you should be watching your rebalancing bands. If you have hit an upper limit, you rebalance out your profits back to the 25% core allocation range and put the profits into your losers. At least, thats what I did myself earlier this year.

In terms of stocks, its really important to ignore the hype and stick to your plan in terms of rebalancing. I cant help but think that this years IPO of Twitter is giving me fond memories of the tech bubble in the late 1990s in terms of stock valuations. Twitter had a market cap near the end of this year of around $40 Billion dollars (Bigger than mega-retailer Target!). Not too shabby for a company with no significant revenues, a business model that is unlikely to ever produce any serious revenues, and a product that seems like a passing fad. #suckerborneveryminute.

Interestingly, emerging market stocks actually showed negative returns for the year trailing the U.S. Total Stock market by over 30 points. This mostly shows that just because you split up your stocks into various markets they may not all benefit from a stock rally where you happen to live.

2013 Total Stock Returns

Bonds

Bonds finally started coming back down to earth with announcements from the Fed about tapering of their infamous Quantitative Easing (QE). As interest rates rose, bond prices fell and this hurt the portfolios bond allocation. The good news here is that new bonds you purchase for the Permanent Portfolio will have a higher yield going forward. The other good news is that the mild interest rate rise seems to indicate that the markets dont feel inflation is a very big threat right now. Inflation is the #1 threat to investors in my opinion because it can destroy wealth across the board so quickly. So, lets hope high inflation stays away.

Most bonds showed negative returns this year. This even includes the much vaunted Treasury Inflation Protected Securities (TIPS) funds which chalked up -7.4% losses in the Vanguard version. Just remember that all bonds have risks regardless of how they are being advertised. This even includes TIPS (a bond I actually dont like and dont recommend buying for inflation protection). In the case of the bonds the Permanent Portfolio holds, the biggest risk is that of interest rates. Meaning that as rates rise, the long-term bonds the portfolio uses will go down in value. This year they lost around 12% after a brief gain earlier in the year as the markets were having problems.

2013 Long Term Bond Returns

Cash is still around 0% yield for U.S. investors. I dont know what to say except that cash continues to be a real stinker in real return terms and likely will remain that way until the Fed winds down their activities. There isnt much to do about the situation because having cash in a portfolio is really important in terms of covering emergencies, living expenses, rebalancing opportunities, etc. For now, its just about grinning and bearing it with the paltry interest.

Just like with bonds, I again caution investors to not chase after yield by going for higher risk assets that are often sold to be just as safe as Treasuries. All of these options have higher risk than Treasuries and that risk tends to show up during market crashes right when you dont want it to.

Note the volatility in this Short Term Treasury 1-3 year chart is actually not that volatile. The Y Axis is a very small range and the returns fluctuated between about -0.2% and +0.4% so its basically flat for the year. If you used the even shorter term 6-12 month T-bill fund for your cash the fluctuation was even smaller.

2013 Short-Term Bonds

Gold

Gold finally got the snot beaten out of it after a decade+ of gains. In April this year it took a huge dive and continued a slow decline for the biggest loss in 30 years. The fickle markets dumped the metal and put the money somewhere else. Since the Permanent Portfolio holds stocks, the blow to the gold portion was largely absorbed as hot money moved around. I talk about this idea in my post on Portfolio Capital Flows .