Periodically Rebalancing Your Investment Allocation Is Crucial

Post on: 3 Июнь, 2015 No Comment

Periodically Rebalancing Your Investment Allocation Is Crucial.

Periodic portfolio rebalancing helps reduce risk and improve performance.

However. only a small percentage of individual investors ever do it.

Too few clearly understand how and why it reduces risk and improves the chances of building wealth.

At first glance rebalancing runs counter to our natural inclination.

Then come back here to learn the power and importance of periodically rebalancing your diversified investment porfolio.

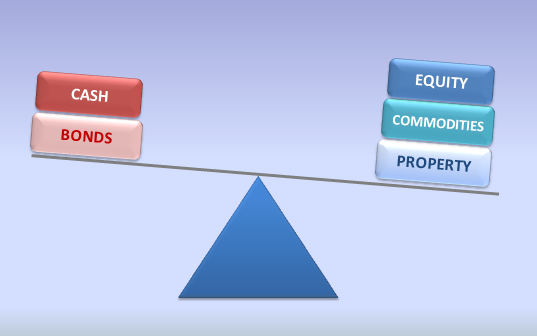

Let’s use a very simple allocation model example to explain. the need to rebalance.

Suppose you have invested in four major asset classes. stocks, bonds, international stocks, and cash.

And for simplicity. lets say that you have allocated equal amounts into each asset class.

In other words 25% in stocks, 25% in bonds, 25% in international stocks, and 25% in cash.

It would stand to reason that. over time. some asset classes might perform better than other asset classes.

If so. your original allocation model of 25% in each asset class would change in size and proportion.

Your carefully crafted asset allocation model has morphed into a different model.

In order to get back to your custom designed allocation model.

And. in order to maintain diversity and thus minimize your investment risk. you must periodically adjust for this change.

In other words. you must sell some of the assets that have made the most money and buy more of the assets that have made the least money.

You must sell the winners so that you can buy the losers!

Do what. you say?

Our natural inclination is to do. exactly the opposite.

We want more of the one that is doing well and less of the one that has not done as well.

Am I right? Be honest. You know it’s true.

However. the truth is. following your natural inclination will cause you to. buy high and sell low.

Take a moment to think about that.

Buying high and selling low is just the opposite of what you should be doing.

And yet. that is exactly what most individual investors do over and over.

They want to buy more of the asset that has gone up and they want to sell the asset that has gone down.

And so. they end up buying high and selling low.

Wall Street itself even warns investor to buy low and sell high.

But. our natural inclination is to do. just the opposite.

The reason that you don’t naturally want to sell the winners so that you can buy the losers is because.

you believe that past performance predicts future results.

And yet every prospectus, every mutual fund advertisement says: Past performance is no indication of future results.

So why do we believe that past performance predicts future results?

The answer is that. over and over again in our daily lives we have become accustomed to being able to use past performance to reliably predict future results.

You open the refrigerator door and the light comes on.

You turn the key in your cars ignition and the engine starts.

You step on the brakes and the car stops.

Medicine works because doctors know from past performance how the body can be expected to react.

There is little doubt that.

We count on past performance for just about everything in our daily lives.

We are naturally inclined to count on past performance.

However. if you do that in the financial world. you will lose.

The laws of nature do not apply to Wall Street!

Instead. economic theories apply. and theories are not sure things.

Consider this. even though we know what happens to bond prices when interest rates change. We do not know when and how (up or down?) interest rates will change.

Even though we may know what happens if.

We have no way of knowing what will happen next.

Today’s economic environment is completely different than the previous one.

- the inflation rate is different

- taxes are different

- interest rates are different

- currency valuations are different

- the political environment is different

- the social environment is different

- even the weather is different.

With all of these continually changing influences. how can we expect investments to perform the same as they did before?

This is the reason that. Past Performance Is No Indication Of Future Results.

This is the reality of the financial world. disbelieve it at your own peril.

So now you know why periodically rebalancing your investment portfolio is so important.

Portfolio rebalancing restores your personally designed asset allocation model back to it’s original proportions.

Sidebar:

Since rebalancing involves buying and selling of securities. sales charges, expenses, etc. may be involved.

Certain situations, scenarios, and products allow for position modifications without cost.

Always talk to your investment adviser to clarify what costs (if any) might be associated with rebalancing your portfolio.

Have your adviser run comparative historical illustrations of your portfolio (with and without rebalancing) over the appropriate timeframe. Include expenses (if any) in the illustration.

It reestablishes the investment format designed either by you or for you. to address your specific objectives, goals and risk tolerance.

Asset rebalancing is not about. market timing or sector rotation.

In fact. you should rebalance on a set periodic schedule. with no regard being given to the current market condition.

Periodic investment rebalancing is about. maintaining a highly diversified portfolio and therefore reducing your investment risk.

In addition. the process of rebalancing guarantees that you will always sell high and buy low.

If your investment life consists only of selling assets at a profit. you will become wealthy.

Because It Matters. Jim