Performing a SWOT Analysis on Your Personal Finances

Post on: 11 Май, 2015 No Comment

by Craig August 4, 2012

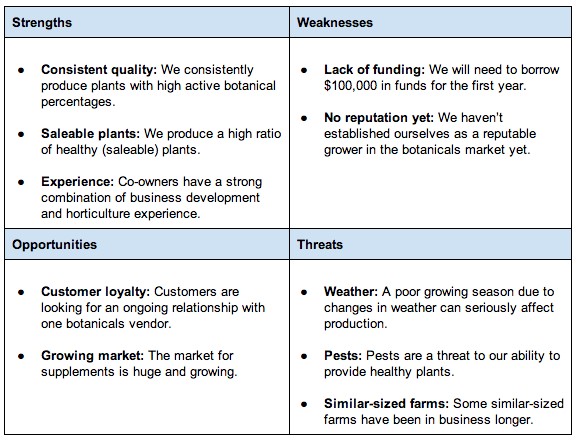

A SWOT analysis consists of looking at the (S) trengths, (W) eaknesses, (O) pportunities and (T) hreats (SWOT )concerning your personal financial situation in order to maximize your personal financial potential.

Your personal financial situation is composed of incomings (income ) and outgoings (expenditure ), and these can be further subdivided into earned and unearned income, and fixed and variable expenditure. Lets take a look at them in finer detail.

Inspect Your Income

Earned income is the financial reward you receive for your regular employment, which is usually transferred to your bank account at the end of each month. Unearned income is the financial benefit you accrue from investments such as stocks and shares, interest on savings accounts etc.

When looking at your source of earned income, both its strength and weakness lie in the security of tenure; that is how likely it is that you will keep your job, and for how long. Examine your contract to see how secure your job really is, particularly in a time of an economic downturn when redundancy may rear its ugly head.

As for opportunities, is there a possibility of renegotiating your contract to make it more secure or better paid? Think about the effect that going on a training course and learning new skills could have.

Finally, we come to threats. These could come from the outside in the form of new trends in your line of work, a slowing down of the wider economy or new technology that replaces certain job functions. The threat may even come internally from your colleagues, who may be in competition with you for your job or even that promotion you want. And dont forget the trickle-down effect of company politics that can make or break a career. Are you playing the game or, at least, being seen to be playing the game?

The financial gains from unearned income sources also need to be evaluated. Again, how steady are they? Do they provide a regular source of income you can count on or are they risky so that you never know where you stand? Is there an opportunity to change your investments around to produce a higher reward or a lower risk?

Look closely at the financial markets and take advice to see if you could do better and make your money work harder. Threats, in the case of investments, can come from your own complacency in just going with the flow and trusting that everything will look after itself, or from external economic factors in the economy over which you have no control. However, you can still make a difference and minimize the threat by constantly monitoring the situation.

Examine Your Expenditure

Expenditure is generally thought of as a weakness in a persons financial situation. So, here it is important that you look to eradicate these weaknesses and to take advantage of any opportunities you have to spend less. Youll also have to evaluate outside threats to your spending such as inflation, particularly in areas such as food and heating.

Fixed expenditure refers to those expenses which have to be met month after month, year after year, such as utility bills, which are essential to your very survival and your way of life.

On the other hand, variable expenditure refers to items that you purchase on an irregular basis, such as clothes, holidays and restaurant meals, which all go to make your life more pleasant, but which you could do without if you were forced to economize.

While you cant do much about fixed expenditure, this is not to say that you cant do anything at all. Check out your suppliers for things such as energy, insurance and car servicing and compare them to their competitors for value for money. Satisfy yourself as to which one provides the best service at the lowest cost and, if necessary, make a change. You will start to see considerable savings over time.

It is variable expenditure that provides the greatest opportunities for saving. Comb through your spending over the past two or three months and youll discover all sorts of things you bought, but didnt actually need. Do you really have to go for a drink after work every night? Do you need to drive your car everywhere you go, or could you start walking to the local shop? Do you need that new release DVD or could you wait until its a bit cheaper? Ask yourself searching questions about everything you buy, see where the threats to your financial wellbeing lie and spot the opportunities to eradicate them.

A SWOT analysis of your personal financial situation will take a while, but you will undoubtedly benefit as you discover areas where you can improve your income prospects and tighten up on wasteful expenditure. However, you must be thorough and not afraid to confront the status quo.

Michael Morregan has a personal interest in personal finances after recently losing his job and experiencing the adjustment that comes with it but he is now helping others to get the most out of their finances and writes for a number of websites. One of these is Borrowers Recommend which helps people utilise credit in a safe and sensible manner where it is appropriate to their circumstances.