Penny Stock The Pros and Cons of Trading Penny Stocks

Post on: 24 Июль, 2015 No Comment

A penny stock is an equity that has its shares valued at less than five dollars, and usually less than a dollar. Since the NASDAQ and NYSE have certain price requirements to maintain a listing on their indices, a penny stock is usually listed on the “Over-The-Counter” (OTC) or Pink Sheet market. What this normally means is that the stock does not have the coverage that big name indexes can typically offer, and thus are relatively unknown to an average investor.

This doesn’t necessarily indicate that all of these companies are small or undiscovered: Nestle, Deutsche Telecom, and British Sky Broadcasting all list on these secondary markets.

There are many reasons that these tiny equities might be hidden to most investors. A major reason is that analysts won’t cover, or provide analysis, on stocks that aren’t listed on a big board exchange like the NYSE or NASDAQ. It doesn’t matter what the valuation of the stock might be, or its potential. Another reason could be the fact that the stock simply cannot afford the huge costs (upwards of 250,000 dollars) in applying to the major exchanges at this time, and would rather use the capital to expand or improve their business.

Or, it could just be that it has not been discovered yet. Once this does occur though, the share price often dramatically rises, which can sometimes allow them to qualify for major exchanges and mainstream analyst coverage.

So what are the pros and cons of buying hot penny stocks?

Pros

Exciting Potential

Some of the largest companies in the world traded for pennies at one point. Even Microsoft was once classified as a penny stock. Many of these small companies are either on the ground floor of their respective industries, or simply do not have the exposure yet to be covered by analysts or recognized by major institutional investors. Penny stocks are opportunities to discover these hidden businesses before they grow to become the next big thing.

Better Risk to Reward Ratio

Every stock has market risk, no matter how large or small the business. There are many outside factors that affect the market like natural disasters, government squabbles, and consumer sentiment. There is substantial risk whenever you buy any stock. Just look at the multinational, multi-billion dollar companies like GM, AIG, and Citigroup. They all needed bailouts to stay afloat in the 2008 stock market crash. Many big names went under completely. Any company can be dangerous to invest in, but the potential rewards are much larger with penny stocks. Thinly traded stocks can make gains in the triple and even quadruple digits within weeks, days, or even a single day.

Penny stocks allow for large gains in days or weeks. NYSE or NASDAQ stocks may take years to achieve gains of equal size. With all the uncertainty in today’s marketplace, it isn’t surprising that this type of reward is so alluring.

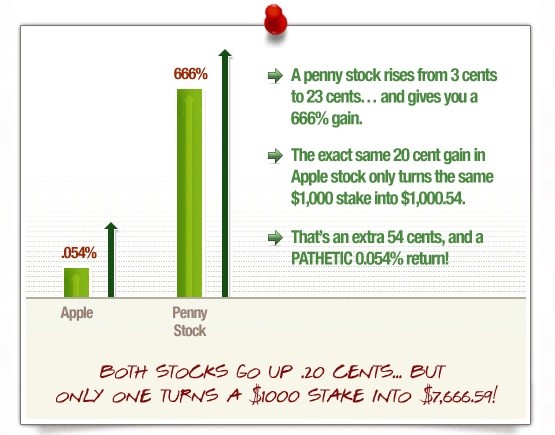

This has to deal with the way people perceive percentage gains versus real gains. An average investor might not conceptually grasp that buying a stock for .10 cents and selling it for .20 is the same as buying a stock at $100 and selling it at $200, but it is. Even better is the fact that it is much more common for a stock to rise from .10 cents to $1 than it is to go from $100 to $1000, based simply on the growth potential of a penny stock versus a large cap equity.

Cons

With most of these penny stocks flying under the radar, there are very few large institutional holders or analysts who will cover the stock. This can result in a limited amount of buyers and sellers who trade the stock, which can lead to exaggerated price swings.

Most Penny Stocks are Small Businesses

This is not to say they aren’t growing or won’t become larger in time, but there are inherent risks to investing in a small company. Some might not achieve profitability for years, or could go through several changes in management before getting it right. They also may not ever get it right. While the 2008 meltdown showed us that the size of a company doesn’t guarantee anything, there are still more companies that lose a great percentage of their value on the OTC and Pink Sheet exchanges than on the NYSE or NASDAQ.

More Benefits for Active Traders

While you don’t have to be a full time day trader to trade a penny stock successfully, with the volatility penny stocks experience, it can be much safer to cash in gains as soon as you’ve achieved a large profit. Many investors make the mistake of buying and holding for too long and can see a large profit turn into a smaller profit, a breakeven, or even turn into a loss. This requires watching the stock a little more closely than is typically required of a big board stock. There is a lot of volatility on the big boards in today’s market, but it still does not approach the degree of volatility in the penny stock market.

Thinly Traded

This is both a plus and a minus. Like you read above, this fact can lead to large runs as traders that normally would not have traded the stock start to discover the company. On the other hand, this can also lead to a sharp decrease in price. Volatility can lead to hefty gains, but can also result in losses if you’re not careful.

There are ways to reduce the risks of penny stocks. Using tight stop losses can help eliminate most of the downside dangers. Also, you must possess the disciple to know when to sell and lock in profits.

All in all, penny stocks are a high risk / high reward venture. Unlike large companies, these stocks have the potential to skyrocket for gains that would take years, if not decades for an NYSE or NASDAQ traded stock to achieve. Hot penny stocks can double or triple faster than most would believe. It simply takes the right knowledge, tools, and discipline for you to experience exciting gains in penny stocks.

How do people find these hot penny stocks? There are literally endless ways to research them, and thousands of penny stocks to sift through. You should try as many as you can and see what works best for you! Our stock newsletter finds potentially big gaining penny stock picks. If you’d like to get our next free penny stock pick, click here .