Peak Career Risk Only 8% Of Hedge Funds Are Outperforming The Market

Post on: 21 Май, 2015 No Comment

Peak career risk . That’s how one can summarize what the hedge fund community, long used to nimbly outperforming the market populated by slow, dumb money managers and getting paid 7+ digit bonuses, is feeling right now.

The last time we looked at relative hedge fund performance, because let’s face it: indexing is a polite word for underperforming and anyone who says otherwise is rather clueless about the asset management industry in which the only thing that matters is always outperforming everyone else, only 89% of hedge funds were underperforming the S&P500 through mid-August. A month later, this number is now up to 92% as of September 14.

Inversely this means that only 8% of hedge funds are outperforming the market with just 3 months left in the year. It also explains the dramatic ramp in the Russell 2000, aka 3x+ beta central, and of course Apple which is the designated hedge fund hotel from which nobody can ever check out, in the past two weeks, as every hedge fund manager has thrown caution to the wind, and in a desperate attempt to preserve their career, is hoping and praying to have some good news for their LPs ahead of the September 30 redemption submission deadline. By the looks of things there will be a scarcity of good news and the capital reallocation out of the losers and into the winners will be fast and furious leaving hundreds of hedge fund managers out on the street.

As a reminder, this is precisely the mindless, idiotic strategy we expected would occur when we posted three weeks ago a list of the most shorted Russell 2000 stocks, as desperation forces managers to attempt a short squeeze among these names.

Goldman explains:

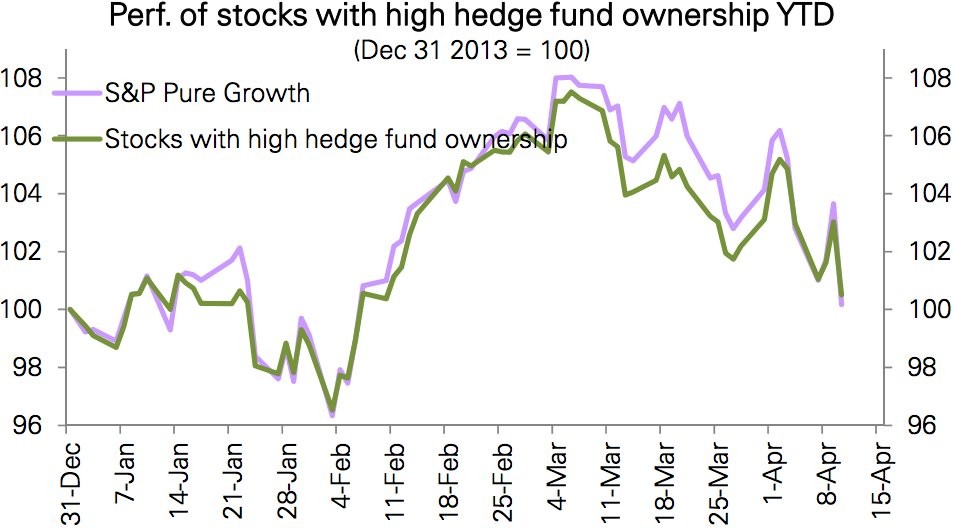

S&P 500 has surged 11% since June and the index has now advanced 18% YTD as of September 20th. However, most investors lag the benchmark. The average large-cap core mutual fund has returned 16.3% since the start of the year and 29% of these funds have outperformed the index. The rising equity market has presented an even greater challenge for hedge funds, which by their very nature have some short exposure. The typical levered investor has returned 6.7% YTD through September 14 and only 8% of hedge funds have outperformed the S&P 500 on a year-to-date basis (see Exhibit 1).

Investors have been understandably frustrated given the powerful market rotations in 2012. The S&P 500 rose 13% during 1Q, then retreated by 7% over the following two months, and has rallied 12% since the start of June. Average sector correlation has remained high YTD while the monthly return dispersion has been below average at 29th percentile of the 30-year average.

So what does Goldman, which still has a 1250 S&P price target for year end, suggest: 4 strategiest: i) Sell laggard YTD performers versus S&P 500; ii) ‘Fiscal cliff’ will drive S&P 500 lower in 4Q; iii) Focus on top-line revenue growth; iv) Seek dividend yield and growth. Of course, none of this matters, and what desperate hedge funds will do is chase even more high beta stocks, and rush even more into winners, leading to a gross disconnected between market values and fundamentals.

In other words, expect the unwind to take place long before the market is faced with the fiscal cliff reality, which a multi-year high market will almost certainly not be resolved before year end. The catalyst will be redemption letters, once HFs know who will and who will not be around into year end. Furthermore, those remaining funds will seek to lock in profits immediately once they get fund of funds and other disenchanted LPs rotating capital out of losers and into them, which is all that will matter for the HF community heading into 2013.

So keep an eye on news about whose fund shut down, and whose didn’t in the first days of October: that will be the first fire alarm across the entire HF hotel universe.