Paying for Your House with Dollar Cost Averaging

Post on: 25 Апрель, 2015 No Comment

A close family member recently used dollar cost averaging and the power of compounding in such a creative way. that I thought it would be useful to share it. This technique, which he developed after studying the various returns available on different asset classes, was designed to show that two factory workers, both earning the same salary, paying the same taxes, and having the same expenses, could end up with vastly different levels of wealth based on what they did with their surplus cash each month. Lets take a look at this dollar cost averaging technique and how it helped him earn several extra hundred thousand dollars in profit.

How His Dollar Cost Averaging Plan Works

John Allen owns a house worth approximately $260,000. He has a thirty-year mortgage balance of $200,000 at 6% and monthly payments of $1,200 before property taxes.

For years, he had been making an extra $284 payment each month for a total of $1,484. This would allow him to pay off the mortgage in only 225 payments, instead of 360, saving him 135 payments, or $162,000.

According to his math, John would own his house outright in 18.75 years, save $162,000 in mortgage payments, and the property itself would have appreciated to $452,500 assuming 3% appreciation (that is, no real, after-inflation gain in property value). By the time he hit the 30 year point when his mortgage would have been paid off, his property would have a value of $631,100.

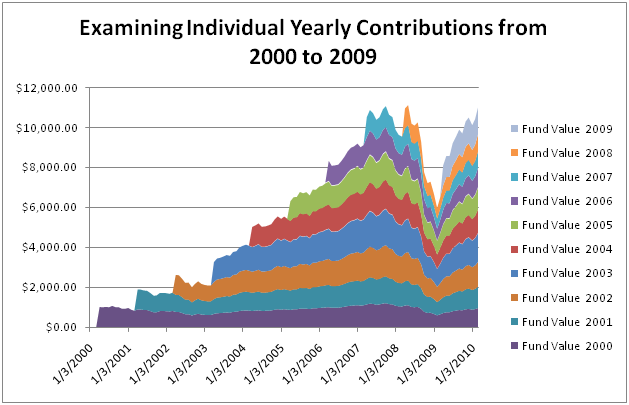

One day, John was doing math on the time value of money and reading about dollar cost averaging. He saw that stocks had returned an average of 10% per year compounded over the past century, despite experiencing extreme volatility ranging between the Great Depression and the Dot-Com bubble. He immediately opened a direct stock purchase plan account with U.S. Bancorp, the company that owned the mortgage to his house, and established a regular monthly withdrawal of $284. This money is taken from his bank account and used to buy shares of U.S. Bancorp. As part of his dollar cost averaging plan, John told the transfer agent to reinvest all of his cash dividends into additional shares of stock.

The result is that he went back to the regular $1,200 monthly mortgage payment, meaning he will own his house in 30 years instead of 18.75 years, and have to make the extra $162,000 in payments out of his pocket over those last 11.25 years. Yet, he is dollar cost averaging $3,408 per year ($284 per month x 12 months = $3,408 annually) into shares of the bank.

In 30 years, under this plan, John will own his house outright with a value of $631,100, he would have made an extra $162,000 in house payments, but his direct stock purchase account would have a balance of $506,500 and pay cash dividends of $2,300 per month in income off of which he could live without ever touching the principal. His assets would be $1,137,600 ($631,100 + $506,500) but he would have spent an extra $162,000 to achieve this so the net assets would be $975,600.

A Modified Form of the Dollar Cost Averaging Plan

One modified form of this dollar cost averaging plan is to continue to pay off the mortgage early so that the house is owned outright in 18.75 years. Then, for the last 11.25 years, take the entire $1,484 and invest it in high quality assets such as a diversified low-cost index fund. Had he done this, John would have ended up with almost the same amount of money in both his house and his investment account after adjusting for the extra payments saved (it would have been roughly $30,000 to $50,000 less). Yet, he wouldnt have had the pressure of making a house payment for more than a decade. If thats important to you, that may be a consideration.

Why are we skeptical of this approach? Human nature. The moment most people pay off their mortgage, they are going to see an extra $1,484 each month in spendable cash. Thats $17,808 annually. Kitchen upgrades, expanded bathrooms, new cars, nicer furniture, a new wardrobe people find a way to expand their costs to fit their budget and it seems foolish to assume that most people would maintain a pure investing program of that magnitude for 11.25 years. Saving $284 per month, on the other hand, seems much less noticeable and you have to make the mortgage payment so theres no sense of deprivation or loss.