Pattern Day Trading Best Chart Patterns For Day Traders

Post on: 16 Апрель, 2015 No Comment

Chart Pattern Day Trading Is A Skill Anyone Can Develop

Often times chart traders who make the transition to day trading from swing trading look for pattern day trading set ups that worked for them in the past. The problem is many chart patterns that worked for short term traders do not apply or will not work for day trading because many technical patterns such as head and shoulders or cup and handle can take months to set up correctly and may require a holding period of several day or even more once you enter the position after the pattern completes.

Chose Your Chart Patterns Wisely

The first thing most day traders do when they first start out is reach for their favorite pattern or other trading method that they are comfortable and familiar with. Unfortunately, many find out that their favorite pattern that worked wonders when holding positions for 2 weeks does not work or works poorly when applied to intraday time frame analysis. Unfortunately, I have seen many traders go through this process and Im going to show you a few patterns that tend to work just as well or better when used for intraday trading as opposed to swing trading or other longer term trading methods. Whats really great about these patterns is they are formed using daily chart patterns, so traders who are familiar with daily chart pattern analysis will feel right at home making the transition to day trading.

The Channel Breakout

The channel breakout is one of the most popular day trading strategies. You simply find a stock or other market that has been in a trading range for at least 2 weeks. You start monitoring the market and wait for a breakout. You can see how a Channel Breakout Pattern sets up in this example.

The Stock Was Range Bound For Over One Month

After you find a good range bound channel, you should monitor it daily prior to the opening bell. As soon as the stock breaks the channel you would enter your order. In this example you can see a good breakdown to the downside. You would place your stop loss $0.05 above the entry bar and take profits at the close of the day. You can use MOC or Market on Close orders to that you dont have to sit and watch the market all day. Your entry would be $0.05 cents below the lowest price reached during the consolidation period.

You can see the entire sequence on this chart. I only use intraday charts once I isolate the pattern on the daily chart. I typically have both charts placed next to each other so I can see how the pattern is turning out on the intraday time frame and daily time frame at once. I could have gained more by getting out early, but statistically holding stocks till the end of the day produces the best risk to reward over the long term.

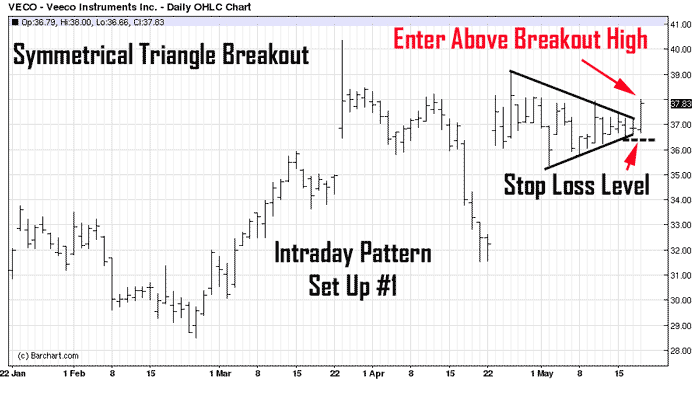

Triangle Breakouts

Another very effective pattern for day trading is the triangle pattern. Its effective for two great reasons. The first reason is the triangle consolidates and tightens as the pattern gets closer to ending. This is a great low risk entry opportunity level for traders who want to risk as little as possible while day trading. The second reason why the triangle pattern works well for day trading is because when triangles breakout they are typically accompanied by very strong volatility. Here is a good example of a Triangle pattern that works very well for day trading.

The Triangle Can Take Anywhere From 10 Days To 30 Days To Form Properly

The best type of breakouts from Triangle patterns are accompanied by gaps. You should make this a rule when day trading Triangle breakouts. Notice how the stock gaps up and continues moving with very little retracement. This is the type of momentum you want to see when day trading Triangles.

You can see the entire sequence in this particular graph. Dont be afraid of a big gap, its a strong confirmation that you are on the right track. The entry should take place immediately after the open when the stock gaps up. You would place your stop loss level a few cents below the low that day and the stock should not turn back. The exit is MOC so you dont need to monitor the position during the day too much.

Dont Forget About The Tail Gap Strategy

Lastly, one of my favorite day trading set ups is the Tail Gap Strategy. I use this strategy often for swing trading as well as day trading and heres a good example of a set up that occurred few days ago. Keep in mind two important things when trading this strategy, the gap has to go against the main trend and the trade has to go with the main trend. I use 10 day lows against the trend when looking for Tail Gap Set Ups.

The Gap Should Be Away From The Main Trend

You would place a buy stop order $0.05 cents above the previous days high price. If the trade doesnt get triggered within the first hour and half of the trading day I would cancel the order. There would be not enough time for the trade to develop if you are day trading and entering orders too late in the day, especially with stocks. Place your stop loss order $0.05 cents below the entry day low. The stock should not come back to that level and if it does the trade doesnt have enough momentum to continue.

You can see the entire sequence in this example. Notice that we did not enter right at the open but waited till the stock rallied a few ticks above the previous days high price. This is a good test to make sure there is sufficient momentum to make the trade worthwhile. Always place your stop loss order a few cents below entry day low and place your profit target at as a MOC or Market on Close Order.