Patience Required With Emerging Markets ETFs WisdomTree Emerging Markets HighYielding Fund ETF

Post on: 16 Март, 2015 No Comment

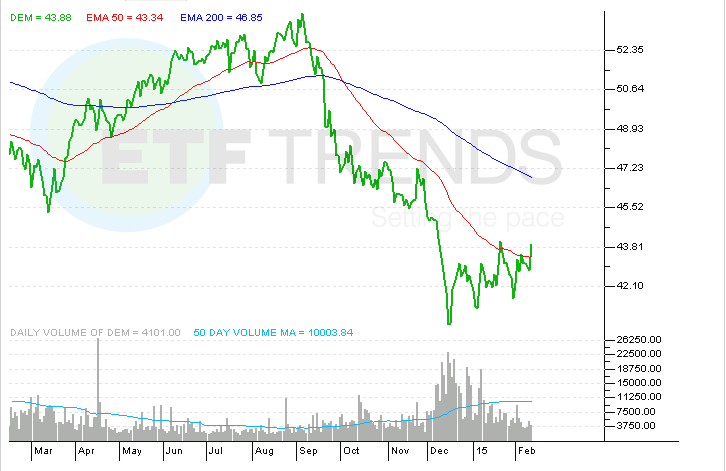

It is now mid-July and at this point, it is fair to say most investors know 2013 has been a rough year for emerging markets ETFs. Select single-country funds have been disasters and the major diversified emerging markets ETFs have not been picnics, either. The Vanguard FTSE Emerging Markets ETF (NYSE: VWO ), the iShares MSCI Emerging Markets Index Fund (NYSE: EEM ) and the WisdomTree Emerging Markets Equity Income Fund (NYSE: DEM ) are all saddled with large year-to-date losses.

Investors’ patience with those ETFs and other funds is likely fried. They probably do not want to hear about investing for the long-term when so many emerging markets ETFs have disappointed in significant fashion relative to safer U.S. stocks.

The reality is patience is required with ETFs tracking developing world stocks and while investors do not need to rush into the aforementioned funds right now, there are some signs that 2014 could be a stronger year for emerging markets equities and not just because scores of these markets are cheap on valuation .

Dividends, a growing part of the emerging markets investment thesis, are improving. On a historical basis, a year following a big or elevated yield year, which 2013 is shaping up to be, can prove rewarding for emerging markets investors .

In March, WisdomTree Research Director Jeremy Schwartz noted that following high dividend years, the MSCI Emerging Markets Index returned an average of 33.03 percent compared to its average 24-year return of 17.47 percent.

The good news is emerging markets dividends showed signs of growth for the one-year period ending May 31, a factor that could buoy the likes of VWO. but in particular the dividend-focused WisdomTree Emerging Markets Equity Income Fund, which has a distribution yield of 7.5 percent.

Five of DEM’s top-10 country weights showed double-digit dividend growth over the past year, lead by 35.2 percent dividend growth in Thailand, the ETF’s sixth-largest country weight. More importantly, China is now the largest emerging markets dividend payer in dollar terms with a dividend stream of almost $27 billion, according to WisdomTree data .

The best year-over-year dividend growth among the four BRIC nations came by way of Russia, a country that desperately wants to increase its allure as a dividend destination. According to WisdomTree. Russia’s dividend stream jumped almost 29 percent for the year ending May 31.

Russia and China are DEM’s two largest country allocations, combining for 35.5 percent of the ETF’s weight.

We believe that it is particularly important to pay attention to signals such as this in the current environment, where equity markets such as the United States or Japan are performing so strongly, while emerging market equities have failed to keep pace but have retained their economic growth advantage over developed countries. The relatively high trailing 12-month dividend yields across companies are apparent when we look at the 10 largest contributors to the EM Dividend Stream, according to a research paper published by WisdomTree’s Schwartz and analysts Christopher Gannatti and Tripp Zimmerman.

While DEM has been criticized by some analysts for a large weight to Russia compared to VWO and EEM with those naysayers saying higher exposure to Russia means increased volatility for DEM, impressive is the fact the Russian dividends have grown even as state-run gas giant Gazprom’s dividend stream has fallen and as other large Russian firm’s have rebuffed President Vladimir Putin plans to force dividend payouts equivalent to 25 percent of net income.

Seven of the top-10 holdings in the WisdomTree Emerging Markets Equity Income Index, DEM’s underlying index, had higher dividend streams at the end of May 2013 than they did at the end of May 2012. Gazprom and Banco de Brasil were the only members with lower dividends while Taiwan Semiconductor (NYSE: TSM ) was flat, according to the data.

As for how things may be shaping for 2014, remembering that a big dividend for emerging markets can be followed by a year of impressive returns, the average yield on the top-10 holdings in DEM’s index rose 80 basis, or 15 percent, to 5.6 percent for the year ending May 31. For example, shares of Brazilian mining giant Vale (NYSE: VALE ) currently yield 5.6 percent, up from 4.5 percent on May 31, 2012. OAO Rosneft. Russia’s largest oil company, has seen its yield climb nearly 400 basis points. Those stocks combine for nearly 8.3 percent of DEM’s weight.

For more on ETFs. click here .