Overpriced The 10 mostexpensive stocks

Post on: 1 Май, 2015 No Comment

The rising stock market has sounded a giant cha-ching for most investors. But some stocks are definitely getting more appreciation than others meaning investors are paying dear prices for them.

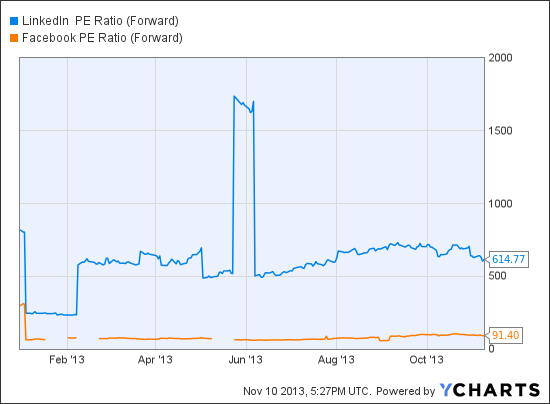

There are 10 stocks trading in the broad Standard & Poors 1500 index valued at $1 billion or more, including Starbucks (SBUX). 3D Systems (DDD) and Netflix (NFLX). that not only have trailing price-to-earnings ratios of 100 or more, but sport higher than average price-to-book, trailing price-to-sales and forward P-E ratios, according to a USA TODAY review of data from S&P Capital IQ.

To be 100% clear, just because these stocks are pricey relative to their earnings over the past twelve months, doesnt necessarily mean theyre not good stocks or even that theyre overpriced. All but two of the stocks, TW Telecom (TWTC) and Netflix, are still recommended by Wall Street analysts by having average ratings of outperform or buy, S&P Capital IQ says. Theres a world of difference between stocks with high valuations and those that are dangerous .

And it cant be stressed enough that when it comes to measuring valuation, theres always a healthy dose of analysis and perspective in order. Lists like these help investors dig further into companies results to see how theyre truly being valued. To help filter the noise, the other valuation measures are included in the analysis. Also, the P-Es in this analysis are adjusted to remove unusual gains and losses considered to be extraordinary by accounting rule makers. That means gains and losses from items like accounting changes and income-tax rulings are disregarded. But theres still more to the P-E than just the number.

Take Starbucks, the priciest stock on the list with a price-to-diluted earnings per share ratio of 242 based on earnings the past twelve months. That sky-high valuation is mainly due to the fact the coffee company took a $2.8 billion hit to earnings in the October quarter due to the conclusion of its legal action with Kraft Foods.

Investors appear willing to disregard that hit, even though accountants include it. Yet, that doesnt mean the stock isnt pricey relative to the market. The coffee company commands a 25.8 price-to-earnings ratio based on expected earnings over the next twelve months, which doesnt include the legal settlement. Thats higher than the 21.8 average forward P-E of the other stocks in the S&P 1500, says S&P Capital IQ. Starbucks also sports a price-to-book of 12, much higher than the 3.9 average price-to-book. Also, Starbucks has a 3.7 price-to-revenue ratio, which doesnt include any hit due to legal issues, which is above the 2.7 average of the S&P 1500.

Another case to consider is Netflix. The companys 127 trailing price-to-earnings ratio brings back memories of the dot-com era. Theres no question this is a company thats putting up the growth, something investors are more than willing to pay for now, clearly. The company reported revenue growth of 25% in the second quarter. Revenue topped expectations as did profit. But such gains arent being missed by investors who have driven shares up 17% this year. And the stock has a rich valuation even if it hits lofty expectations. The company sports a P-E based on expected earnings over the next twelve months of 89.

These companies definitely are running on a fast treadmill. Hope they can keep up.