Our Outlook For Consumer Cyclical Stocks 2015

Post on: 29 Апрель, 2015 No Comment

3A%2F%2Finvestorplace.com%2F?w=250 /% Consumer cyclical PHG stock is down 1.3% today. For more information on the best stocks to buy right now, check out the latest commentary on InvestorPlace.com. And for more on the hot stocks moving most on Wall Street right now, check out our archive

3A%2F%2Fwww.fool.com%2F?w=250 /% What: Analysts at Oppenheimer lowered their price target for oil services company Schlumberger (NYSE: SLB ) today from $110 to $101 while maintaining a rating of outperform on the company’s stock Truth is, oil is a cyclical commodity.

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% Which retailers are best positioned to respond to the threat of e-commerce? Technological advances have affected not only consumer behavior but also retailing itself. Consumers’ shift to e-commerce becoming apparent with holiday sales trends. Which

3A%2F%2Fmoneyweek.com%2F?w=250 /% Koesterich highlighted an important distinction that I think it’s worth us talking about – ‘cyclical’ stocks versus ‘defensive Last week, investors added $2.3bn to consumer cyclical exchange-traded funds (ETFs), while taking $1.6bn

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% Our first quarter outlook for 2015 reflects challenging trends as we continue to see softness in consumer demand as a result of weak traffic, said Chief Executive Julian Geiger. The stock has run up 60% in the past three months through Thursday’s close

3A%2F%2Fseekingalpha.com%2F?w=250 /% The company’s long-term returns have essentially boiled down to two things — reinvesting capital in its store estate, and using prudent leverage to buy back stock and grow without diluting shareholders. You might be wondering what our unique angle on

3A%2F%2Fwww.morningstar.com%2F?w=250 /% This will allow you to save and monitor these holdings within our Portfolio Manager. More Quarter-End Outlook Reports Stock Market Economy Credit Market Municipal Market Basic Materials Consumer Cyclical Energy Financials Tune in Tuesday for our sector

3A%2F%2Fwww.thestreet.com%2F?w=250 /% Geiger said, Our first quarter outlook for 2015 reflects challenging trends as we continue to see softness in consumer demand as a result of to achieve positive results compared to most of the stocks we cover. The company’s weaknesses can be seen

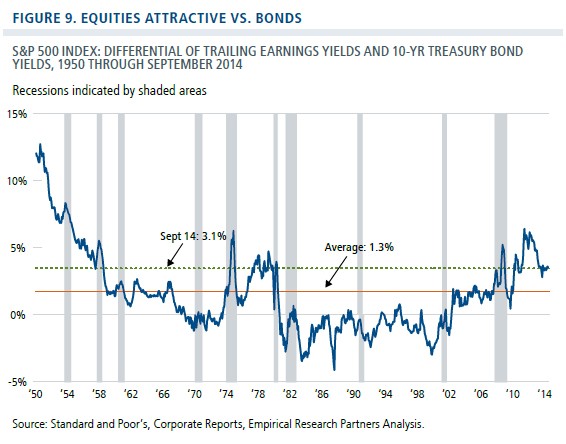

3A%2F%2Fwww.valuewalk.com%2F?w=250 /% The outlook for Conclusion: With stocks still expected to deliver better relative returns than bonds, we remain overweight stocks versus bonds and cash in client accounts. With so much uncertainty surrounding 2015 we expect our investment style should

3A%2F%2Fmarkets.financialcontent.com%2F?w=250 /% The majority of our customers are confident in their prospects down more than 30 percent from their mid-2014 highs. The outlook for demand is also relatively upbeat, with real consumer spending expected to grow 3.3 percent in 2015 as employment