Our Investment Portfolio Asset Allocation and Location

Post on: 7 Июль, 2015 No Comment

While Ive written a bit about our investment allocation in the past, weve tweaked things a bit recently so I thought Id lay thing our here for all to see. Before we go any further, I should note that we have a number of different accounts, including two Roth IRAs, three different employer-related retirement accounts, a SEP-IRA, and a taxable brokerage account.

Because of the complexity of our situation, I have decided to treat our investments as one big pot of money rather than trying to manage each account individually. Thus, weve locked in certain accounts with just one investment type, and we adjust the overall allocation using my SEP-IRA. This management is made far easier by Vanguards Portfolio Watch tool. which allows us to track and visualize everything in one place.

Here goes

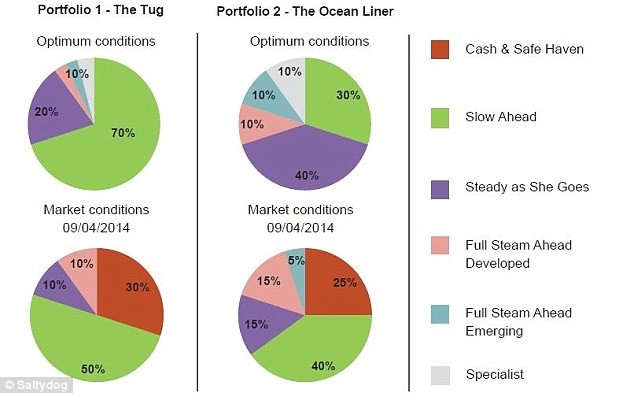

Our current allocation is an 80%/20% split between stocks and bonds. Our stock holdings are further split 70%/30% domestic vs. international. for an overall total of 56% domestic equities, 24% international equities. and 20% domestic bonds. Heres what it looks like in a bit more detail:

Domestic Equities

51% Total Stock Market (VTSMX or the equivalent)

5% Small Cap Value (entirely VISVX )

Foreign Equities

24% Total International (entirely VGTSX * )

Domestic Bonds

20% Total Bond Market (VBMFX or the equivalent)

The Total Stock Market fund gives us relatively broad diversification in domestic equities, whereas the small cap value fund adds a bit of additional weight to small, beaten down companies. Ive considered adding a small amount of REIT exposure (VGSIX ) for additional diversification, but havent made a final decision yet. If/when we do this, it will likely come out of the Total Stock Market portion of our portfolio.

As far as asset location goes, the taxable portion of our portfolio is entirely invested in the Total Stock Market, with our Small Cap Value, Total International and Total Bond Market holdings residing in tax-advantaged accounts. Weve further subdivided things by making the Roth IRAs 100% equities in hopes of maximizing growth there (theyre tax free, after all). As noted above, my SEP-IRA contains a little bit of everything just to balance things out.

For the sake of comparison, our previous allocation looked like this:

75% Total Stock Market

16% Total International

9% Total Bond Market

This previous portfolio was based largely on Vanguards Target Retirement 2035 (VTTHX ). The problem with the Target Retirement solutions (for us) is that we havent been able to find our desired level of aggressiveness combined with our desired glide path (change in holdings as we approach retirement). The Vanguard funds in particular start out more aggressive than wed like, and then transition over to the conservative side too quickly. I also wanted a bit more small cap and international exposure.

Now that we have everything set up, were on auto-pilot. The only thing well have to do is to periodically rebalance my SEP-IRA holdings to keep things on track.

*Note : If our international holdings were in a taxable account, wed likely use VFWIX instead.