Options Trading With The Iron Condor_2

Post on: 8 Июль, 2015 No Comment

The Iron Condor strategy is known as a neutral strategy as well as a non-directional trading strategy. A trader needs to combine a bear Call spread and a bull Put spread in order to create a neutral position. The reason for this is when an asset is ranging or trading horizontally, there is very little price movement. So in the case that the asset price does not move by the expiry of the trade, the result is a profitable neutral position. Also, by positioning oneself on both sides, Call and Put, a trader can profit even if the market moves up or down. It is for this reason that the Iron Condor strategy is called a non-directional strategy.

In order for a trader to construct an iron condor, they will need to make four trade movements as follows, the trader will purchase a lower strike Put option that is ‘out of the money’ and will also then purchase an ‘out of the money’ Put option at an even lower strike price. The trader will then sell a higher strike Call option that is ‘out of the money’ and will then buy an ‘out of the money’ Call option at an even higher strike price. All these trades will need to have the same expiry month. By doing this, that is buying and selling Call and Put option trades, the end result is a net credit which can then be put on the trade.

In order to understand how one can apply the iron condor strategy to their trading let us look at an example. Here we will assume that Facebook shares are trading at $75 in June. The trader will need to purchase a JUL 85 Call option for $100 and will also purchase a JUL 80 Call option for $50. They will then purchase a JUL 65 Put option for $50 as well as a JUL 70 Put option for $100. By purchasing these four trade options, the net credit received when the trader enters the trades, is $200. The two hundred dollars also marks the total profit that the trader can make. At the end of July, when the trades expire, the Facebook stocks are still trading at $75. This means that all four trades are worthless and the trader will keep the $200 invested in the trades.

So you might be wondering how you can use the Iron Condor strategy in order to make a profit. In order to benefit from this strategy, the price of the asset you are trading in will need to move between the strike prices of the sold Call and Put options at the expiry of the trades. If the asset price falls at or below the lower strike price of the Put option that was purchased or it increases above or is equal to the higher strike price of the bought Call option, a loss will occur. This loss, however, is limited and it will equal the differences between the strike prices of the Put option trades or the strike prices of the Call option trades. The success of the Iron Condor trading strategy rests on knowing exactly when to enter the trades so that the price movement of the asset will be at the required rate by the expiry of the trades. This takes time and experience.

The Iron Condor Strategy and Binary Options Trading

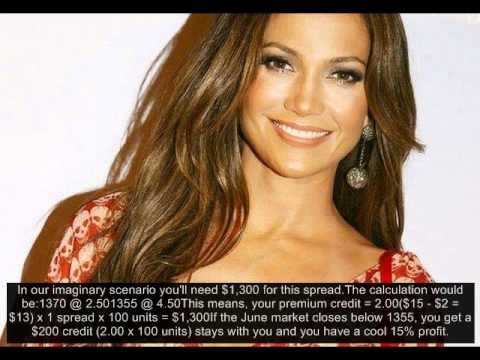

At this moment, you might be wondering how one can apply the iron condor strategy to binary options trading so let us explore this. Traders make money using the iron condor strategy with credit spreads and in this case, when we talk of a Put credit spread this is below the market while a Call credit spread is above the market. To clarify, when we talk about a credit spread, we are talking about a strategy of selling options. For example, a trader will purchase a Call option trade which is ‘out of the money’ for $50 and will then also purchase another ‘out of the money’ Call option trade for $100. The trader will then sell the more expensive Call option trade and get back a portion of their original investment. If the second call option trade ends ‘at the money’, the trader will get to keep their original investment amount of $50. In this way, the loss is minimized. If, however, the second Call option ends ‘in the money’, the trader will make a profit. This strategy is most effective when used while trading indices since there is often limited volatility in index prices.

Conclusion

It is evident that the Iron Condor strategy can be quite complicated and for this reason, you need to ensure that you practice this strategy and familiarize yourself with market movements. Remember also to ensure that the asset you are trading in has limited price movements. This is vital to the success of the strategy. Learning when to enter and exit an Iron Condor also takes experience and if you require any assistance, please feel free to contact VXmarkets and ask about their Personal Broker service.