Options Strategy Adjusting Diagonal Spreads Tom Armistead

Post on: 8 Апрель, 2015 No Comment

Options Strategy: Adjusting Diagonal Spreads 0 comments

Jan 6, 2010 9:31 PM | about stocks: PRU

Back in May last year I wrote an article on the diagonal spread strategy. going over my thinking when setting up these positions and describing some of the situations where it works well. Because the differing expiration dates of the long and short sides of the position create a degree of asymmetry, calculating the expected return can be complex, and it is best just to look at the first expiration date.

The initial trade is actually the opening gambit, taking a position which can be modified or adjusted as the situation develops. Using trades made on life insurer Prudential (NYSE:PRU ) (53.41 as of Wednesday’s close) as an example, this article discusses some of the adjustments that can be made, and the reasoning behind them. I wrote PRU up favorably in a recent article, and it is a good example because the volatility gives the trader something to work with.

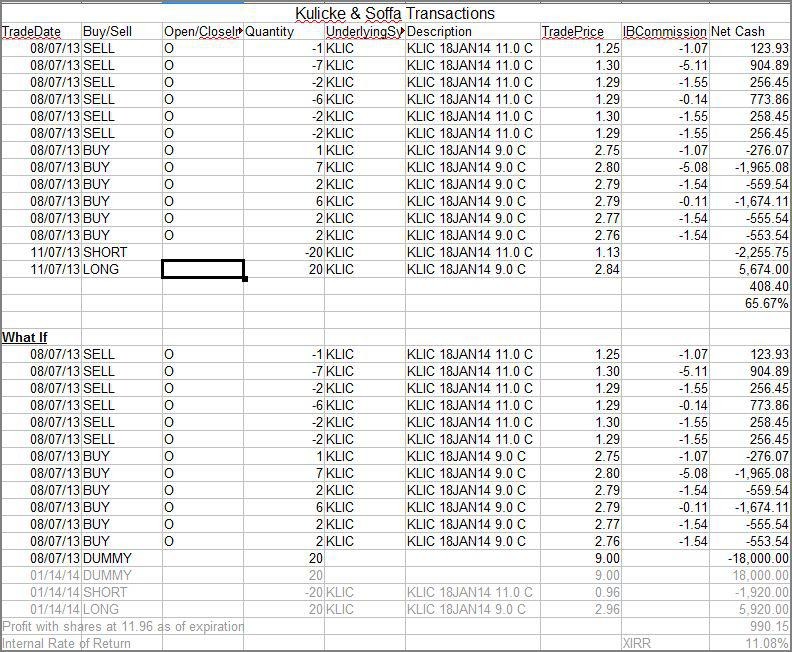

Here are the trades, with a possible future scenario highlighted in gray:

Rolling down the first adjustment involves rolling the long side of the position — the Jan11 40 calls — down to 35. This was done in response to a drop in the share price, from 52 when the position was opened to 43.xx at the time of the roll. Under the circumstances, the Jan11 35-40 call spread could be bought for a net debit of 2.80, with an expected value of 5 if the shares remained above 40 at expiration.

This is somewhat counterintuitive — who wants to take more downside exposure when the shares are sinking like a stone? However, if the price recovers to what it was when the original position was opened, the result is a profit for the round trip.

As a rule of thumb, I will roll down any time I can pay less than 3 for a 5 spread, or 1.50 for a 2.50 spread, and if my opinion on the stock has not changed.

Rolling out the second adjustment involves rolling the short side the Dec2009 55 calls out to Mar2010. This garnered a net credit of 3.14. It’s something of a guessing game whether to make this move or to wait for the original call to expire and then sell a replacement.

When the situation develops favorably, the trader has the prospect of selling another set of calls every few months, collecting rent until the position resolves itself one way or the other.

Looking forward because the short calls may develop quite a bit of time value, or even go into the money, the profits being earned need to be projected to expiration. Hopefully in March it will be possible to sell another 2 calls to expire in June. Patience is required.

The trader can take comfort from the fact that time is now on his side: if the share price remains unchanged he has a decent profit, most likely more calls can be sold in March, and it may be possible to keep this going along similar lines until January next year.

A comparison in many ways this works better than owning the shares. An investor who bought shares at the same time as this position was opened and plans to hold them to the same closing point would make 411 plus dividends, quite a bit less than the 1,083 that the options will earn in due course if the shares stay where they are now.

Compared to a covered call strategy, the use of the LEAPs provides a limit on downside risk. Also, time value for an option increases as it is closer to the money, and volatility generally increases when share prices sink rapidly. The result is that the Jan11 40 calls had something of a volatility hedge built in, giving the investor some optionality about what to do when the stock went down to 43.xx.

Note that on 11/05/2009 the options investor could have closed the position for a loss of about 6 dollars, while a position in the shares would have lost about 9.

Risk and optionality investing frequently involves calculating odds as a means of getting at risk/reward. The use of LEAPs as a substitute for share ownership provides leverage, and leverage magnifies both profit and loss. However, when looking at the loss potential of a position of this type, it is important to consider the what-ifs.

When this position takes a turn for the worse, the investor has several alternatives. Instead of rolling down, it would be possible to sell a put at 40, garnering a good premium, and creating a synthetic position in the shares. On 11/5/2009, the put involved would have fetched 7.85, according to an option price calculator on the CBOE site.

Selling a put instead of rolling down, the total cost of the position would have been 18.20 minus 3.86 minus 7.85 equals 46.39 as a break-even. Or it would have been possible to replace the Jan11 calls with the actual shares, in effect pocketing the inflated time premium created by high volatility. At that point the investor has created a synthetic covered call.

Thinking along these lines, risk can be reduced by having the resources (cash) available to respond under adverse conditions, and by having done enough homework to be comfortable making decisions when the situation is developing unfavorably.

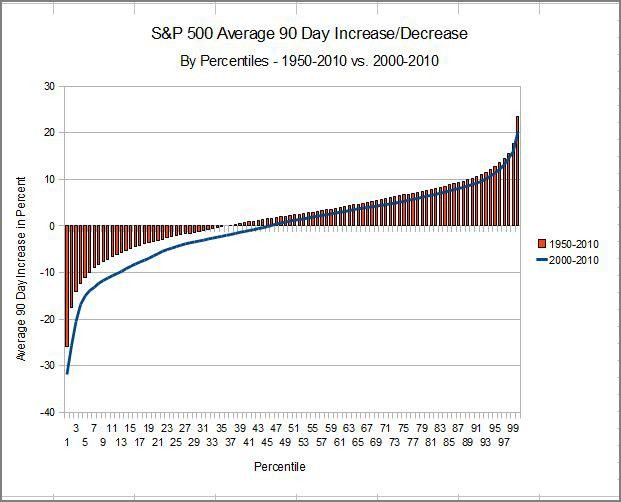

The role of volatility here is a chart of implied volatility during the time during which the adjustments were made:

Note that in early November volatility spiked, creating the opportunity to roll down at an advantage. Also, volatility has declined since early December, suggesting smoother sailing going forward.

Disclosure: Long PRU