Options Gamma scalping strategy

Post on: 23 Апрель, 2015 No Comment

Trading is serious business with the strong possibility of financial loss. Unless you profit regardless of market direction, you are subject to the whims of market.

Studying the current headlines likely will add to your confusion. We are either in the midst of the newest or greatest bull market or on the precipice of destruction.

Based on this outlook and the How about this Apple? chart, where do you think Apple Computers is headed?

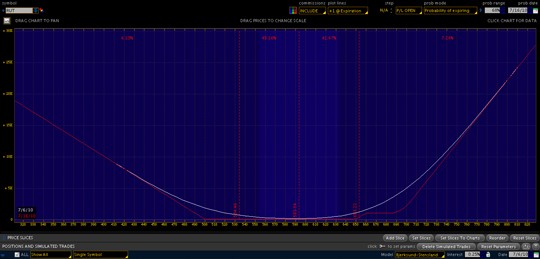

Fortunately for option traders, a straddle can be utilized to trade the market in both directions with relative safety. A straddle is the simultaneous purchase of a call and a put. As long as the underlying instrument moves more in either direction than the investment of both options, a profit will result.

You may ask: How can I go wrong with this trade? Two things can transpire against you: time decay and/or a decline in the implied volatility of the options. These two negative variables (referred to as theta and vega) can be greatly mitigated via gamma scalping. Gamma scalping also is a powerful tool to use when you purchase a straddle, and the stock moves considerably (as you would like) but then retreats back to the starting price on the following day.

Delta measures the amount an option moves based on a one-point move in the underlying. A long call has positive deltas. It makes money as the underlying advances. A long put has a negative delta.

An at-the-money (ATM) option has a 50/50 chance of being worth something on expiration. That option is thus called a 50 delta option and it will move $0.50 for every dollar that the underlying moves. Thus, the Apple 200 call will make $0.50 when the stock advances from $200 to $201.

As the market moves in either direction, the call or the put usually will become more valuable, while the other option becomes less valuable. With enough movement, the probabilities (thus the deltas) of the options will change. When the positive deltas of the calls and the negative deltas of the puts get dramatically out of balance, the positions total net delta becomes unbalanced. That imbalance of deltas allows us opportunity.

To get back to delta neutral, we will buy or sell stock. Because every share of stock has a delta of one, the math is easy. Taking profits in midstream illustrates how money is made by trading stocks to remain delta neutral with your straddle. In our example, we have on 10 long straddles at 200. If Apple rallies to $210, we sell 400 shares to bring us back to delta neutral. If consequently Apple goes back to $200, we buy back the shares returning to a delta neutral position and banking a $4,000 profit.

Gamma scalping can offset the negative effects of time decay and vega collapse. There are many more factors that can influence this particular strategys profitability; however, this is a basic depiction of the power of gamma scalping. Many large proprietary trading firms use gamma scalping (and reverse gamma scalping) as their core fulcrum to trade around while they wait for a regression back to the mean.

Alex Mendoza, chief options strategist with Random Walk, has produced numerous articles, books and CDs on options trading including the quintessential option text on broken-wing butterfly spreads. Visit their Web site, www.RandomWalkTrading.com

About the Author

Alex Mendoza is the chief options strategist with Random Walk, which has produced numerous articles, books and CDs on options trading, including a book on broken-wing butterfly spreads. Visit their Web site: www.RandomWalkTrading.com