Options Basics

Post on: 8 Апрель, 2015 No Comment

An option is an agreement between two parties to buy and sell a security. Today, the listed options that trade on exchanges are standardized contracts that give the owner the right to either buy or sell a fixed number of an underlying instrument at a specific price for a set period of time. An option can be listed on a futures contract, an exchange-traded fund, an index, or a foreign exchange pair. There are a number of different ways to use options including hedging, speculating, and creating more advanced strategies like spreads and straddles. Important first steps to successful trading in the options market are to understand both the underlying instrument and the options product. In this case, once the investor understands stocks and stock options, they can the move on to the more advanced strategies like vertical spreads, butterflys, and volatility trading.

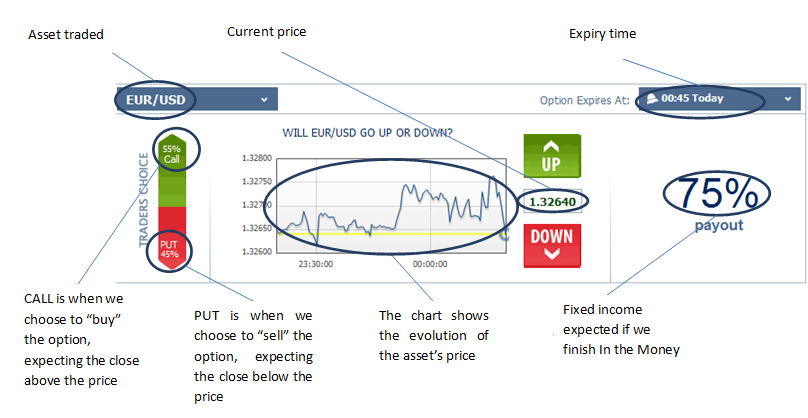

What’s the difference between a call option and a put option? There are two flavors of options, puts and calls. As the name implies, the call gives the investor the right to buy or “call” the underlying instrument for a specific price through a set period of time. The predetermined price is called the strike price. The call option will cease to exist once the owner either exercises the contract or it expires. All options have a fixed expiration date.

A put option is the opposite of a call. The contract gives its owner the right to sell or “put” the underlying instrument. Both puts and calls have strike prices and expiration dates. Once the expiration has passed, the contracts cease to exist. Expiration dates can vary by instrument, but for most options, the date is the Saturday following the third Friday of the expiration month.

What if I cant find somebody to take the other side of my contract? You dont need to worry about that. If theres a quote, you can initiate a trade to buy or sell a contract and the liquidity providers do the rest.

When do I exercise my option? If you bought a put or call option, you have the right to exercise the contract and sell or buy the underlying instrument through the expiration, but you are under no obligation to do so. Options are typically exercised when the contract is in-the-money, near the expiration, and the option holder has determined it makes economic sense to buy or sell the underlying under the terms of the contract.

On the other hand, an option seller, or writer, has an obligation to buy or sell the underlying instrument according to the terms of the contract. When an option seller or writer is asked to fulfill the terms of the put or call, they have been assigned on the contract. The odds of assignment increase as the contract approaches expiration, if it is in-the-money. and/or it the contract has little or no time value .

Is it true that most options expire worthless? An option expires worthless if it is at-the-money [ATM] or out-of-the-money [OTM] at the expiration. An ATM put or call option has a strike price equal to the underlying price. A put is out-of-the-money if the strike price is below the stock price. An OTM call has a strike price above the current stock price. An options contract can also be closed out or offset at any time before the expiration and before it expires worthless.

How do I avoid assignment? There is no way to avoid assignment, once you have received the notice that the short option contract has been assigned. The key is to close or offset the position before assignment comes into play.

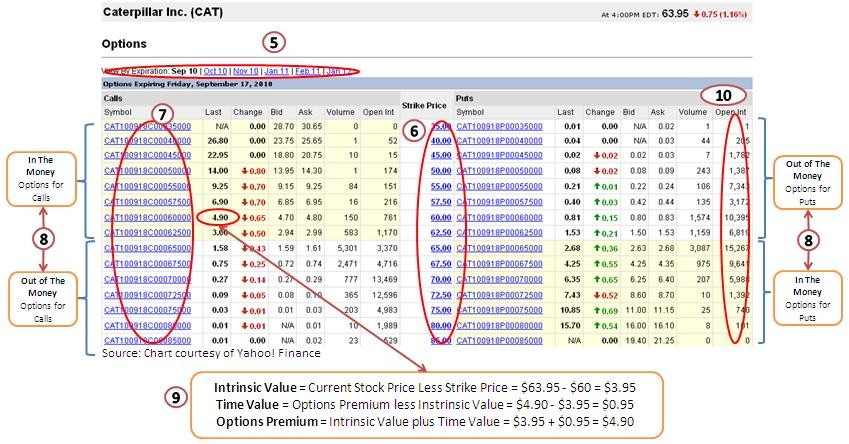

How much is an option contract worth? The cost, or premium, for an options contract is based on several factors including the strike price relative to the stock price, the amount of time left until expiration, and the volatility of the underlying. More volatile markets tend to have higher premiums compared to low volatility markets. Why? Very simple. There is a greater probability that puts and calls will end up in-the-money [ITM] at expiration when a market is making big moves from one day to the next.

How much can I make trading options? There’s no limit to how much you can make, but we typically look at the risk-reward of one specific strategy at a time. Each trade, whether it’s a simple play like a call purchase or a more advanced position like a butterfly spread, has a risk-reward potential that can be viewed on a payoff chart or risk graph. Payoff charts for specific options strategies are provided in later sections.

To understand the concept of a payoff chart, consider a long position in Facebook calls. The stock is trading for $21 and well below its post-IPO high of $45. But you think the stock will easily fetch more than $30 by the middle of 2013. So, you buy 10 June $25 calls on FB for $1 per contract. The cost of the trade is $1000 (or 10 contracts X $1 X the 100 multiplier). The risk to the trade is $1. If the stock is at $25 or lower at the expiration, and the position is left open during that time, the $25 calls expire worthless and the entire debit is lost. The breakeven is at $26, or the 25 strike plus the $1 debit. At that price, the investor can buy (call) the stock for $25 and sell it in the market for $26, which is a $1 profit and covers the cost of cost of the premium paid. There’s profit above the breakeven. For instance, if FB is trading for $30, the calls are worth $5. Subtract the debit paid, and the profit is $4 per call option. On 10 contracts, the profit is $4000.00. A payoff chart or risk graph simply shows the risk-reward graphically.

I want to trade call options on Apple, how do I get started? The first step is education and to understand the options product. Most reputable options brokers have free educational materials including web site content, webinars, and live seminars. Check our Toolbox section for additional resources. Once you understand the strategies and the risk-rewards, begin with paper or practice trading. See how changes in market conditions and changes in the underlying price, volatility and time affect an option. Then monitor the order flow for trading ideas and opportunities that fall within your longer-term trading plan and risk tolerance.