Option Trading

Post on: 6 Июль, 2015 No Comment

Stock Option Trading Education

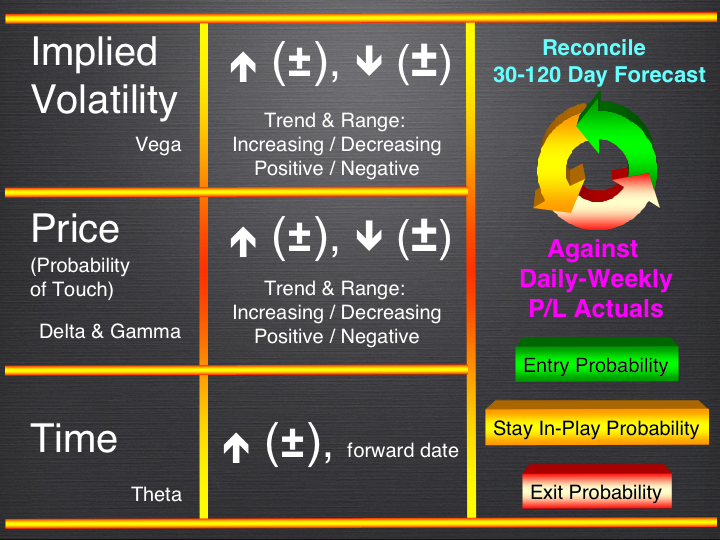

- Definition of Option Vega. An Option Vega measures the change in the price of a stock option relative to a 1% change in. read more

- Parity and Stock Options. Stock Option Parity means that the stock option is trading at its intrinsic value. If a $100 call. read more

- Index Options and Indices. Index options include baskets of stocks that are combined from group or sector indices. The most. read more

- Options Listed on Multiple Exchanges. Multi-Listed Stock Options are stock that have options that are listed on more than one exchange. read more

- Definition of Option Theta. An Option Theta measures the rate of decline in a stock option due to the passage of time. Theta. read more

- Derivatives & Underlying Stock Option Value. A derivative in the context of finance is a contract whose value is dependent on another. read more

- Intrinsic Value and Option Trading. For in-the-money call options, intrinsic value is the difference between the stock price and the. read more

- Diagonal Option Spread. A Diagonal Spread is an option spread where the trader buys a longer-term option and sells a. read more

- Definition of Option Gamma. An Option Gamma measures the change in Delta for every one dollar change in the underlying price. read more

- Time Decay and Options. Stock options are a wasting asset. From the day you purchase them, their value goes down if the. read more

- Accelerated Time Decay. Accelerated Time Decay refers to options that have less than a month to maturity decay at an. read more

- Option Trading for Investment, Speculation and Hedging. Option trading involves investors and speculators buying and selling stock options before they. read more

- Synthetic Put Position. Option traders often construct synthetic put positions to hedge their short stock positions. When. read more

- Married Puts Options Strategy. In a married puts option strategy. the investor owns shares of stock and purchases an equal number. read more

- Out of the Money (OTM) Options. A call option with a strike price that is much greater than the current stock price is considered. read more

EXCLUSIVE ONEOPTION LIVE EVENT

1Option has launched two new automated trading systems. Our new platform uses real-time streaming data to trigger trades. See how our rule base will get you in and out of high probability set-ups. The platform will alert you on when to get in and out and the positions are tracked continuously. The price of the Swing Trading just went up and it will go up again in the next 2 weeks. The introductory period is ending. Attend the webinar and get on board while the price is still low.