Option Pricing Calculator

Post on: 7 Июль, 2015 No Comment

Learn about the Derivatives market. You can find useful information such as the basics of Derivatives, the products available, futures contracts and more.

Option Pricing Calculator

Introduction

Index Options involve risk, and are not suitable for all investors. It is important that you read and understand the information in this section, before you value and trade Index Options.

To download the OPTION PRICING CALCULATOR. please right click on the below link and save it on a disk. The above Options Pricing Calculator (OPC) is copyrighted in the name of the Bursa Malaysia Derivatives. All Rights are Reserved.

1.2 MB (ZIP)

Objective

The main objective of pricing models is to value fairly the prices of the index options (e.g. OKLI) and bring better awareness to investors before they decide to buy or sell the index options.

When the fair price of the index options is made known to the public, a narrow spread between the Bid-Ask price can be created, thus enhancing market liquidity and avoiding a wide spread between the Bid-Ask price.

Description

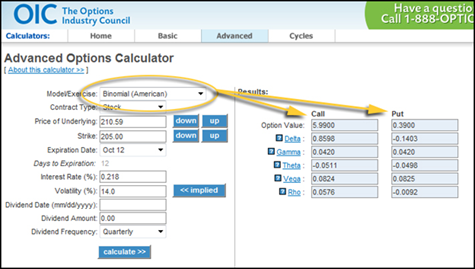

The option-pricing calculator takes current market factors as inputs then calculates an options theoretical fair value and associated risk parameters called Greeks. Additional values like Intrinsic Value, Time Value and Implied Volatility are calculated when the market value of the Index Options is entered.

This calculator contains three option models:

The pricing calculator assumes the Index Options being valued is a European style contract (exercisable only on the last day prior to expiration).

It is at the user’s discretion to use any of these three models. While Black-Scholes model is a popular model used for option pricing, other models exist that consider different factors. No model can be entirely accurate. The pricing models used here are not intended to provide any investment advice, but rather as an indication on whether the index options is over-, under- or fairly priced when compared with its market value.

The Calculator is designed for options on stock indexes. It can be used to analyze options on individual stocks under the assumption that dividend flows is continuous and even. This will cause the values generated to be different from, sometimes substantially so, from prices observed in the marketplace.

Instructions

INPUTS — The user is required to enter eight inputs being:

Option Type: A Call or a Put