Option Butterfly Strategy

Post on: 8 Апрель, 2015 No Comment

Top results for Option Butterfly Strategy

Butterfly (options ) — Wikipedia, the free encyclopedia

en.wikipedia.org

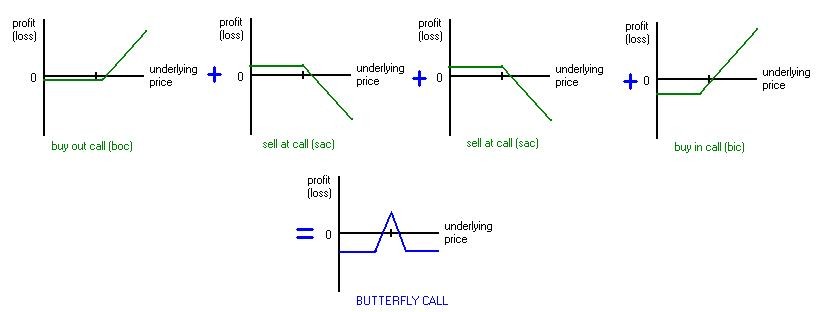

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability of earning a limited profit when the future volatility of the underlying is.

Butterfly Strategy | Options Trading at optionsXpress

optionsxpress.com

theoptionsguide.com

What is Butterfly Spread? See detailed explanations and examples on how and when to use the Butterfly Spread options trading strategy.

mysmp.com

The butterfly spread is put together to create a low risk, low reward options strategy and is designed to take advantage of a market or stock that is range bound. The butterfly can be created.

optionpundit.net

A long Butterfly Option Trading Strategy is a limited risk, non-directional options strategy that is designed to earn big (but limited) profits but with a low probability.

investopedia.com

A neutral option strategy combining bull and bear spreads. Butterfly spreads use four option contracts with the same expiration but three different strike prices to create a range of prices the.

Butterfly Option Strategy — Option Trading education.

option-info.com

Three ways to construct the butterfly trade. Strategy. Butterfly. The Outlook: Neutral. Not expecting movement up or down before the expiration of the options.

Advanced Option Trading: The Modified Butterfly Spread

investopedia.com

This strategy provides traders with the flexibility to craft a position with unique risk/reward characteristics.

Butterfly Strategy. Trading Strategies & Trading Classes by.

optionsmadesimple.com

The Butterfly Options Strategy is a limited risk, limited reward strategy that involves 4 options (all calls or all puts) at 3 different strike prices. Learn the Butterfly from.

en.wikipedia.org

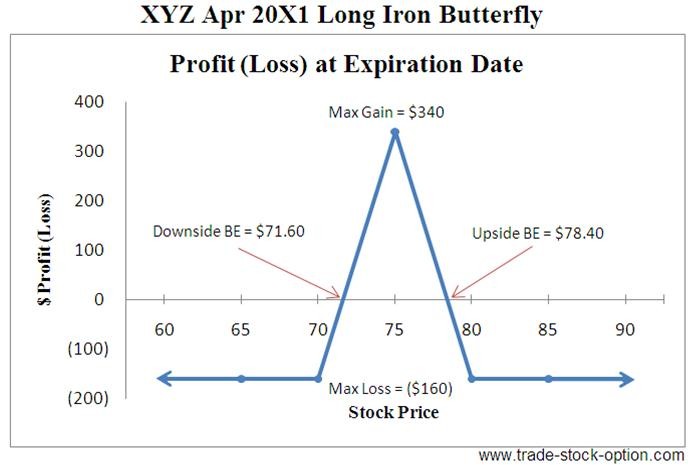

In finance an iron butterfly. also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three.

optiongenius.com

Butterfly Spread Option Trading Strategy. The butterfly is a neutral position that is a combination of a bull spread and a bear spread. Let’s look at an example using calls. IBM price: 60 July 50.

Long Call Butterfly | Trading Long Call Butterfly Spreads.

tradeking.com

How to trade a long call butterfly spread option. Get detailed strategy tips, setup guides and examples for trading long call butterfly spreads.

IronButterfly — Option Trading Strategies — India

optionwin.com

×Please subscribe to get access to all the powerful features View option strategies for all the stocks (currently you are limited to only 1 stock)

Butterfly Spreads — Options Trading Mastery, Learn Option.

options-trading-mastery.com

Butterfly Spreads are one of the most well known and popular option strategies out there today. Combining a debit and credit spread, they have huge profit potential, sometimes 300 percent.

Using the broken-wing butterfly options strategy — FuturesMag

futuresmag.com

For decades, many astute option traders have relied on a modified butterfly spread either to supplement or ignite their monthly incomes. The broken-wing butterfly (BWB) is an advanced option.

Short Call Butterfly Option Trading Strategies

trade-stock-option.com

Short Call Butterfly is a volatility strategies used in a highly volatile stock. It involves selling one lower strike call, buying two middle strike call and selling one higher strike call options.

Broken wing butterfly option spread strategy

tradecommodityoptions.com

Income option strategies and speculative option strategies. Broken wing butterfly option strategy involves 4 legs of options similar to butterfly.

butterflies .optionetics.com

butterflies.optionetics.com

butterfly option — Free Articles Directory | Submit Articles.

articlesbase.com

However, though butterfly option is a good option strategy. this could be expensive compared to other option strategies. A warning in both types of butterfly option is.