Operating Income and Operating Income Margin Indicators of Profitability

Post on: 12 Апрель, 2015 No Comment

Operating income definition

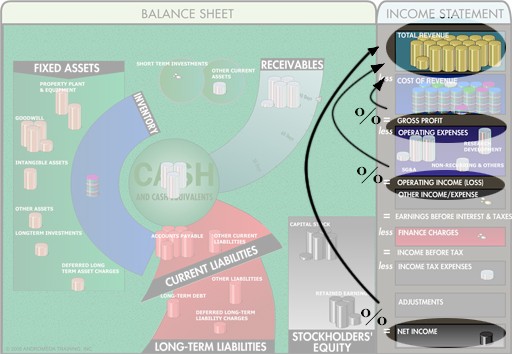

Operating income is defined as the total sales income of a company minus its operating expenses and is an important measure of the companys financial health and profitability. Along with earnings before interest and tax and operating income margin. operating income is one of the most useful indicators of the financial situation currently experienced by a company and a valuable comparison tool for investors.

Gross operating income formula

Gross operating income includes the entirety of a companys revenues from sales and normal business operation, but excludes one-time windfalls such as court settlements that do not arise from the regular operations of the company. This exclusion is necessary in order to ensure that the gross operating income figure provides an accurate picture of the current operating finances of the company in question. Essentially, operating income is calculated by subtracting operating expenses from operating revenues:

- Operating revenues operating expenses = operating income

Operating revenue includes earnings from the companys normal operations, but typically excludes interest earnings and dividends.

Net operating income

Net operating income is also used to determine the profitability and earnings potential of businesses; it is derived by multiplying the operating income by one minus the current tax rate, as in:

- Operating income (1 tax rate) = Net operating income

By factoring taxes into the assessment of a companys operating income, analysts can derive a more accurate picture of the companys overall profitability.

Net operating income of a bank

Because the primary business of a bank or financial institution is by nature financial, the net operating income of a bank or holding company includes profits and losses derived from financial transactions excluding the purchase or sale of securities and stocks. The resulting figure is referred to as the net operating income of a bank. Because banks both pay and collect interest on various transactions as a normal part of their business operations, interest payments are included in the overall net operating income reported by banks.

Operating income margin

The operating income margin is a financial indicator of the health of a company and is derived directly from the operating income. Basically, the operating income is divided by sales in order to produce the operating income margin figure, which is expressed as a percentage. A company with a 10% operating income margin makes $.10 of profit on each dollar of sales; thus, the higher the operating income margin, the more profitable the company is likely to be. The operating income margin is a good indicator of the companys efficiency and profitability, but fails to take into consideration one-time losses or gains from legal actions or other singular events.

For most companies, the operating income and operating income margin figures offer a snapshot of their current financial condition. This information can be used by analysts and investors to determine the advisability of investment in a particular firm, bank, or concern.