Online Brokers

Post on: 28 Март, 2015 No Comment

Choosing between online brokers can be a difficult decision, especially since there are so many to choose from. They all want your business, so it is important to know what you are looking for ahead of time.

There are several things to take into consideration before picking one or another.

In this section, I will go over some of these things to help you make an informed decision.

Once you get closer to making a final decision, be sure to check each broker website to get current information.

I have prepared a chart with some basic information and links to several broker websites on my Online Broker Comparison page.

The two most common types of brokers are:

Most stock traders use a form of discount broker that has either optional or included, advanced features that they may choose from based on their particular needs. Here are some of the features and things to consider:

- You have to decide what type of trading you will be doing (scalping. day trading, swing trading, or buy and hold). Once you determine this, you can estimate the number of trades you could possibly make in a year.

This is very important. Your decision here could mean the difference of hundreds or thousands of dollars a year in wasted commissions.

Consider for example someone who determines the type of trading they will be doing is day trading. They figure that they will be making an average of 5 trades per day, 4 days per week (I’ll use 4 days per week so you can take a rest, you’ll need it).

That comes to 20 trades per week times 50 weeks in a year (I’ll also give you 2 weeks off for vacation time), which comes to 1000 trades in a year.

1000 trades per year from a Discount Broker at a commission of say $5.00 per trade comes to $5,000 per year in commissions. The same 1000 trades per year at another broker that charges you $10.00 commission per trade= $10,000 per year, another at $12.00 per trade= $12,000 per year.

Think about the person who pays $19.95 commission per trade, $19,950 per year. Ouch! Get the picture?

So you see, estimating the number of trades you will be making is very important. If you will only be making one trade per month, it may not be a big issue, but you should make sure ahead of time if possible.

A good idea is to review the number of trades you make periodically, to make sure your not paying too much for the service you are getting, which in turn is not hurting your bottom line.

- Another type of trading that could make a big difference is Penny Stock Trading. Several of the online brokers charge additional amounts for trading low priced stocks. Not all of them do, but it is important to consider if you will be buying stocks below a certain price.

Some of these additional charges could add up to $100 or more per trade! Every online brokerage firm has their own commission structure so be sure to check this out if it will apply to you.

- Also to consider is the availability of certain types of research and trading tools you will require. Some traders want to have everything in one place.

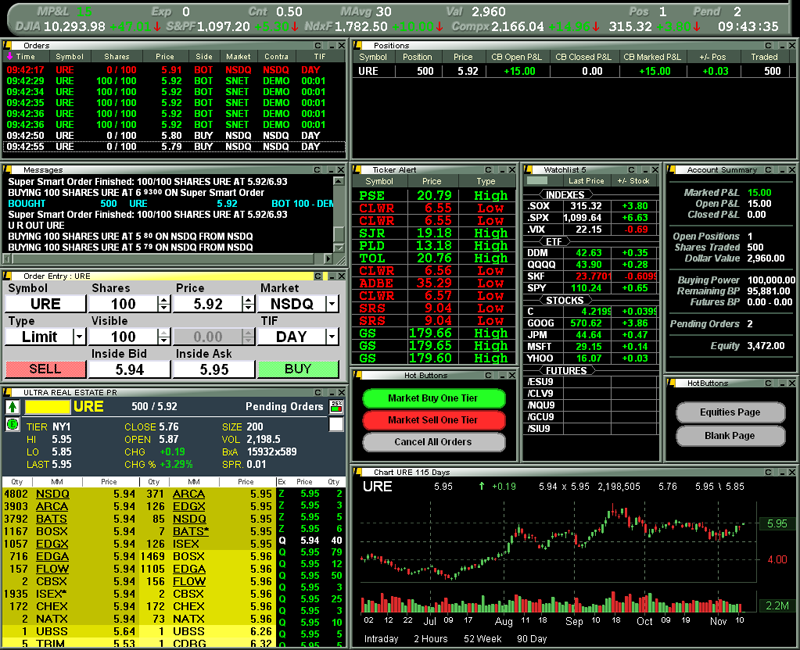

Some trading tools to consider that may or may not be included in each brokers advertised commissions are: the type of trading platforms available; streaming real-time news; streaming real-time quotes; level II quotes; Nasdaq TotalView; charting or advanced charting capabilities; access to specific stock research reports; the ability to place direct routed trades; back testing; and automated trading capabilities.

You may or may not be familiar with some of these, but these are the tools of the trade for specific types of trading. Without having knowledge, and sometimes access to these tools and resources would be like going to a gunfight without your guns and ammunition.

- Speed and execution quality of trades: If you are going to be scalping or day trading, this is going to be very important. The speed of the trading platform that you will be using must be as fast as possible.

The last thing you want to happen is to place a trade and have a delay in the time it takes for the order to get filled in a fast moving market.

The quality of the trade means that once you place a trade, it should be filled at the best possible price available as quickly as possible, not the easiest price to be filled at.

Just because you place an order to buy xyz stock @ $10.50 doesn’t mean it should get filled at $10.50 if someone offers their shares for $10.40 between the time you place your order and the time it gets filled. Your order should be filled at the price you placed your order at ?or better?.

- Customer Service: The level of customer service across the different online brokers can vary widely. You should find out the different ways available for customer service from each online brokerage firm.

See how quickly each one answers the telephone in case you need to reach them in a hurry one day. See if they have email options; live chat options; maybe a forum.

Keep in mind that during major disruptions at the stock exchange or extreme panic selling or buying, any customer service wait times will be longer. I have waited over an hour to reach customer service where it normally takes less than a minute.

- Safety of your deposits: Make sure the online broker you choose has your deposits backed by the SIPC. The SIPC states on their website the following:

Why Was SIPC Created? SIPC is an important part of the overall system of investor protection in the United States. While a number of federal, self-regulatory and state securities agencies deal with cases of investment fraud, SIPC’s focus is both different and narrow: Restoring funds to investors with assets in the hands of bankrupt and otherwise financially troubled brokerage firms. The Securities Investor Protection Corporation was not chartered by Congress to combat fraud.

www.sipc.org

- Discount Broker. An online stock broker that offers very low cost commissions is sometimes called a Discount Broker.

A Discount Broker is basically a no-frills online brokerage firm that keeps their commission costs low by providing only the basics necessary to make trades online and does not provide any investment advice.

Keep in mind though, most Discount Brokers offer a wide variety of upgraded services and capabilities, usually at an additional charge. They do this to cater towards a wider potential customer base.

- Full Service Broker. At the opposite end of the spectrum is the Full Service Broker.

A Full service broker usually has many licensed Stock Brokers on hand that can offer investment advice, personal finance planning, retirement advice as well as usually offering a platform for self directed online trading.

A Full Service Broker usually caters towards higher net worth individuals who are looking for someone to provide research and financial advice for them, either at higher commissions or a percentage fee based on total managed assets.

As a reminder, when comparing online brokers you must check with each of their individual websites to be updated on their current commissions, fees, products available and other information. Their policies may change from time to time just like in any other business.

As always, if you have any questions on this topic, feel free to send me a message through my Contact page.