On Volatility Correlation And Sentiment Shifts

Post on: 16 Март, 2015 No Comment

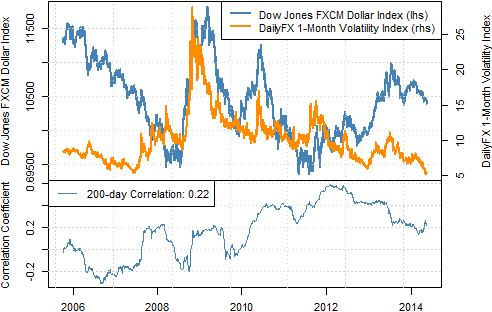

Since the peak in the S&P 500 around two weeks ago, equities and their sectors have traded in a considerably more disperse manner than one would expect given all the talk of central-bank intervention, liquidity-gasms, and monetization. This is borne out empirically as the average pairwise realized correlation within the 100 stocks of the S&P 100 and the 125 credits of the CDX investment grade credit index has dropped dramatically. Extreme peaks or troughs in realized correlation have tended to coincide with notable (and tradable) trend changes in the market — though we note, as shown below, that the moves are not always so clearly bullish or bearish. Critically, the outperformance of Healthcare and underperformance of Industrials and Materials in the last two weeks suggests more than a little apprehension at the Central Banks being able to ‘bridge’ yet another global slow-down with money-printing.

This chart shows the average pairwise correlation between all 100 stocks within the S&P 100 (so it is the average of 100×99/2 correlations for each day). The last few weeks have seen the correlation between these 100 stocks plunge to an extreme.

the same is very evident in investment grade credit.

In the past few years — the extremes in equity realized correlation have produced the following results:

Troughs in correlation (<0.15)

- 4/26/10. SPX fell 12.6% in 8 days — marked top of that cycle

- 11/3/10. SPX rallied 2.5% in a day then fell 4.5% in next 7

- 1/21/11. SPX rallied 1.4% in 5 days then fell 2% in a day

- 4/20/11. SPX rallied 3% in 6 days and fell 8% in next 32 days

- 5/19/11. SPX fell 2.5% in 2 days

- 3/2/12. SPX fell 2.5% in 3 days

Peaks in correlation (>0.75)

- 5/25/10. SPX rallied 8.7% in next 18 days (interim trough)

- 8/11/11. SPX rallied 11.7% in next 16 days (was interim trough)

- 10/27/11. SPX fell 10.4% in next 20 days (interim peak)

- 12/8/11. SPX fell 5.1% in next 8 days

but Volatility seems clearer directionally:

Troughs in correlation (<0.15)

- 4/26/10. VIX jumped 23 vols in 9 days

- 11/3/10. VIX rose 3 vols in 9 days

- 1/21/11. VIX fell 2.3 vols in 4 days then rose 4 vols in a day

- 4/20/11. VIX rose 3.5 vols in 11 days

- 5/19/11. VIX rose 7.2 vols in 19 days

- 3/2/12. VIX rose 3.6 vols in 2 days

Peaks in correlation (>0.75)

- 5/25/10. VIX fell 10.7 vols in 17 days

- 8/11/11. VIX fell 7.4 vols in 4 days

- 10/27/11. VIX jumped 9.3 vols in 3 days

- 12/8/11. VIX fell 9.9 vols in 11 days

So empirically there appears to be some regime shift when correlations become extremely positive or neutral.

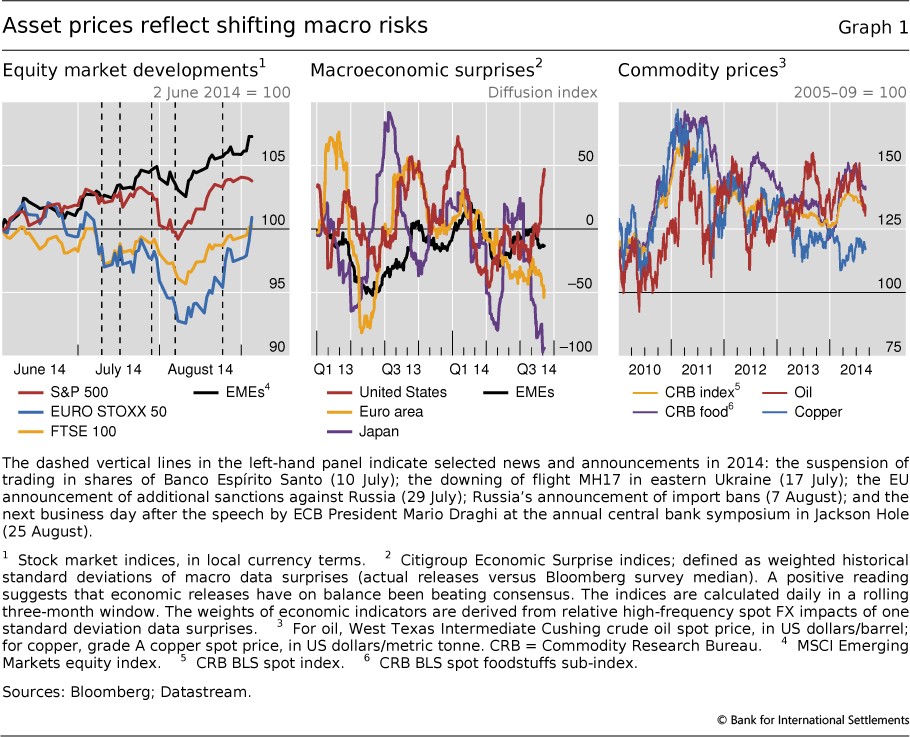

From the lows in early June, sectors broadly speaking rallied together. Since H2 2012 began — post EU Summit and ‘aided’ by the Draghi ‘believe me’ speech — sectors have been notably more disperse, with Energy, tech, and financials leading and Utilities lagging notably, but.

Since the S&P 500 double-topped a couple of weeks ago, it appears the sectors one would expect to be #winning have not been — as Healthcare outperforms and Industrials and Materials underperform.

The relative stability and tiny ranges in the last few weeks may have some to do with the drop in correlation but it does seem that while most ‘expect’ some liquidity-fueled rally to the moon, those expectations were already priced in and now we are seeing selective exuberance unwound into this strength.

One thing seems sure, the plunge in correlation will bring some regime shift — probably rapidly — and we would expect volatility to follow (realized and implied).

Charts: Bloomberg and Capital Context