Oil ETFs

Post on: 6 Апрель, 2015 No Comment

Use an Oil ETF to hedge Oil Risk and Increase Oil Exposure

You can opt-out at any time.

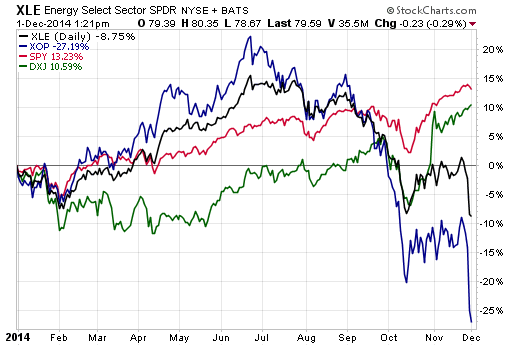

With all the market talk about “price-per-barrel”, oil ETFs have been some of the most actively traded industry ETFs and commodity ETFs. Oil prices are high, oil prices are low. There’s even been a war over oil. But how does that play into your investment strategy. If you want to gain some exposure to the oil sector, an oil ETF might be the way to go.

Why Buy an Oil ETF?

It’s no secret that oil prices have seen record highs and have now come down to more “normal” levels. However, can they go up again? Quite possibly. Just as easily they can go down. But if you are in the camp of thinking oil prices are on the low end, then you can take advantage of your bullish opinion by purchasing and oil ETF .

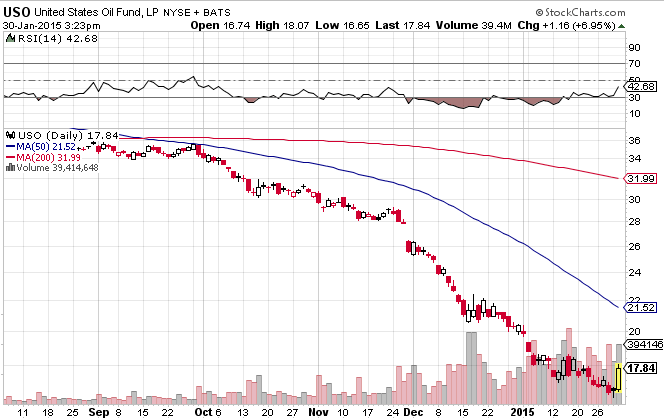

Instead of buying a few select oil stocks, some oil futures, or even an oil index like the OSX (Oil Services Index), it may be easier to buy an oil ETF like the USO (United States Oil Fund). By purchasing an oil ETF, you gain upside exposure with one complete transaction. You don’t have to go after a multitude of securities or futures and chase prices. Instead you purchase a fund that consists of several oil assets without having to deal with the individual purchases. One transaction, one price, instant exposure to the oil industry. Not to mention the money you save on commissions and the capital gain tax benefits as well.

Why Sell an Oil ETF?

Maybe you’re not convinced that oil prices are at a low point. You’re bearish. For the opposite reasons an investor would buy and ETF, you may want to sell an oil ETF. Just keep in mind the risks and ramifications of shorting any asset without a hedge.

However, there are other reasons to short an oil ETF, too. It’s quite possible that you are long a lot of securities in the oil industry. Selling an oil ETF may be a great way to protect against some downside risk. As oil prices fall, you may lose profits on oil assets in your portfolio, but the short ETF position may help cushion the blow. Any time you have downside exposure, using the short sale of an ETF is a sound way to protect your investments. In turn, if one is short oil assets, the purchase of an ETF would understandably make a good upside hedge.

One other way to short oil with oil ETFs is to purchase an inverse oil ETF. Inverse ETFs are designed to increase in value as an investment declines. It helps investors who want short positions but have margin restrictions or selling limitations in their brokerage accounts.

Why Consider Oil ETF Derivatives?

After thorough analysis you decide you do not have an opinion about the direction of the oil industry, but you do think the market is unstable. You see a lot of volatility in the future. One way to take advantage of that strategy is to consider oil ETF options. Purchasing an option straddle in an oil ETF that lists derivatives like the OIH (Oil Service HOLDRs), can help you gain exposure to both downside and upside movement. An opposite position (selling a straddle) can capture a lack of movement in the oil industry and benefit your portfolio. Options can also used as a “time-hedge” against certain oil positions in your portfolio. Keep in mind that trading ETF derivatives is an advanced trading strategy and should only be considered by those who have the expertise to understand the dynamics of the derivatives market.

Find an Industry ETF Near You

Before you call your broker to trade an oil ETF, it is very important to conduct thorough research and analysis. A good place to start is by looking at some of the major oil ETFs and watch how they perform. If you are interested in investing in oil by adding an oil fund to your portfolio to either gain exposure or hedge some risk, then you may want to look into some of the more popular oil ETFs before you get started. Here is a list of some of the most popular oil ETFs and ETNs to analyze (and some energy ETFs, too).