Oil ETF Crude Oil ETF

Post on: 6 Апрель, 2015 No Comment

What is an Oil ETF?

We saw a major bull market for oil and oil related stocks from 2003 to 2008; during which time, oil ran up nearly 900%. Since its top, oil dropped nearly 80% in a matter of six months. There was extreme volatility all the way up and all the way down. For the novice investor, it was very difficult to take part in a commodities boom because of the barriers to entry that existed within the commodities space. To invest in the oil directly, one would have to actually buy a futures contract and this was not an option for the majority of the investing community due to its complexity. Therefore, most investors purchased individual oil stocks; however, any oil stock wouldnt do. There are many factors which go into the proper selection of an oil stock; with geopolitical risk assessment being at the top of that list.

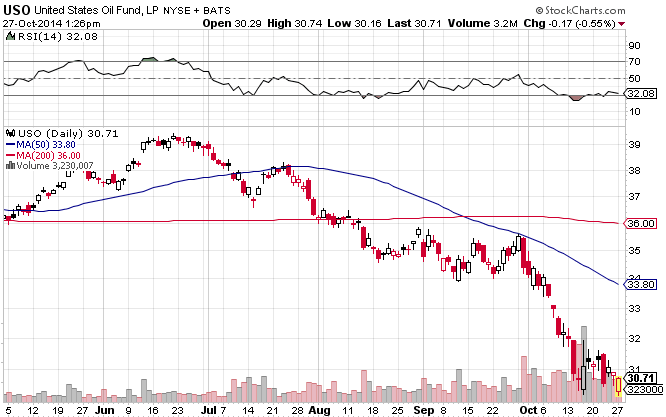

Enter the oil etf. Over the past few years, there have been many oil etfs which have come to the market which actually track the price of crude oil or invest in a basket of highly rated oil stocks; thereby, lowering inherent external risk factors. For example, if you want to gain exposure to the price of crude oil, you can buy a crude oil etf such as the USO. USO trades on the NYSE Arca and tracks the price of the light, sweet crude (WTI West Texas Intermediate). USO allows you to gain instant exposure to the price of oil without investing in a highly leveraged oil futures contract. Similarly, the OIH can be purchased to gain exposure to the top oil service stocks such as Schlumberger, Halliburton, and Transocean.

With speculation riding high as the bull market in oil matured; the leveraged oil etf became a popular choice for investors who believed that there was no risk in buying oil. Some astute traders were fortunate to have put the bullish hype to rest and actually purchase a leveraged oil etf which actually went short the oil market.

All in all, the ETF and ETN investment options have grown significantly in the recent years to provide investors with various options within the oil sector.

Crude Oil ETF

When it comes to investing in a crude oil etf. there are two main options. The most popular is the USO. USO closely tracks the price of WTI using a variety of trading vehicles such as futures and options on crude oil, heating oil, gasoline, and other fuels. The USO is the most liquid crude oil etf available. The Goldman Sachs Crude Oil total return index is an ETN, or exchange traded note, which also closely tracks the price of WTI by purchasing crude oil futures contracts and receiving the corresponding Treasury bill rate of interest. USO and OIL are the two most popular crude oil etfs available, with USO receiving the majority of trading volume, especially amongst day traders.

It is important to take note of a special short term trading opportunity that may arise each month between the 5th and 7th trading day of the month. USO has gotten so large that the fund must purchase between 20% and 25% of the front month crude futures contracts to enable it to track to the price of crude adequately. Now, as you can imagine, the fund will not take delivery of the physical crude so it will roll the contracts forward. This requires the etf to sell its front month contracts and roll them forward to the next month. This selling can cause a shock to the oil futures market as a massive amount of supply is hitting the market within a short timeframe. This can especially cause a problem when the demand for oil is light. When there are no buyers, prices erode much faster to fill the supply hitting the market. Traders who can spot this occurring and sniff out a reversal from the ensuing roll forward can stand to make a nice profit.

Oil Stock ETFs

During an oil bull market, oil stocks tend to do much better than the black gold. ETFs such as the XLE, IYE, XOP, XES, and OIH do a great job of giving you exposure to the best companies within this sector. There are many others that track individual sectors here but I wont cover them due to their extremely low levels of liquidity.

If you want to speculate and use additional leverage, Proshares offers a leveraged oil etf for the bullish and bearish position. DIG is the bullish leveraged etf while DUG is the bearish counterpart.