Oddball Stocks Thoughts on quantitative value investing

Post on: 17 Июль, 2015 No Comment

Thoughts on quantitative value investing

I want to start off by saying that the goal of this post is to get a discussion going. The topic is something I’ve been thinking about for a while and I wanted to formulate my thoughts, but they’re not set in stone.

There has been a lot of talk recently about quantitative value investing, for some reason in the last year this concept has gained a lot of traction. A former deep value blogger Toby Carlisle has even written a book about the concept. I haven’t read the book, but his presentation at UC Davis is very convincing. Joel Greenblatt has been pounding the pavement for the past few years first promoting magic formula investing. then formula investing, then his new mutual funds based on these concepts. Along with this is the proliferation of value weighted index funds.

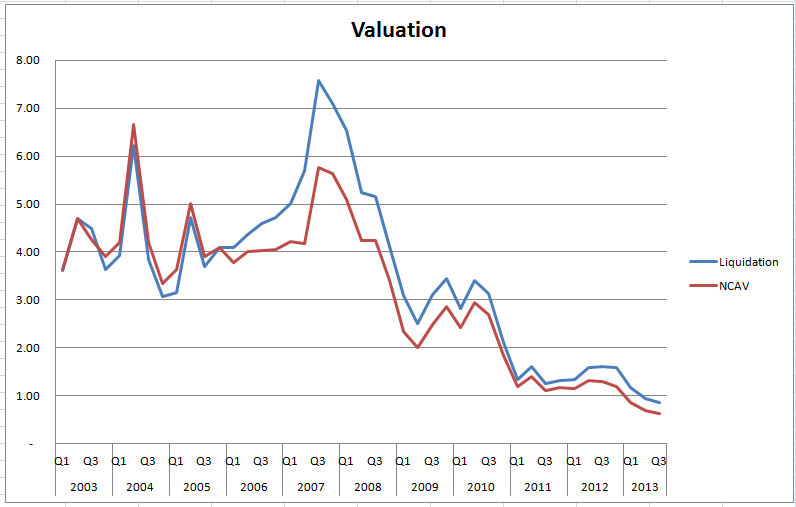

It seems all of these products are trying to capture the value investing returns that appear in academic back tests. It’s no surprise to readers of this blog that value based strategies work, and work over long periods of time. Graham’s own net-net strategy has been working since first published in the 1930s, other low value measures work as well, low P/E, low P/B, and low almost anything. The fact that buying a number of low metric stocks will outperform the market over the long term is a well established academic fact.

My thought is, what do we do with this knowledge? If beating the market is as simple as running a program to buy all the low P/E stocks wouldn’t everyone be rich? Why hasn’t some 17 year old in Utica written a program that buys low P/E, or P/B stocks systematically without human input and programmed himself to riches? It’s not because these ideas are undiscovered, most of Wall Street knows cheap anything out performs. If beating the market is as simple as programming a computer why hasn’t anyone done that yet? Any why are there people working 80 hour weeks in finance when they could be sitting at home drinking scotch and letting the computer do the work?

Benjamim Graham often gets classified as a quant, modern investors boil his 800 pg Security Analysis down into a few terse statements such as buy all the net-nets or buy low P/E stocks. The implication is that he was conducting some rudimentary quantitative investing back in the 1940s and 1950s. I’ve read Security Analysis a number of times, and I’ve come away with a distinctly different impression. When people mention that net-net investing only works when buying all available net-nets I think of the following quote: (emphasis mine)

There is scarcely any doubt that common stocks selling well below liquidating value represent on the whole a class of undervalued securities. They have declined in price more severely than the actual conditions justify. This must mean that on the whole these stocks afford profitable opportunities for purchase. Nevertheless, the securities analyst should exercise as much discrimination as possible in the choice of issues falling within this category. He will lean toward those for which he sees a fairly imminent prospect of some one of the favorable developments listed above. Or else he will be partial to such as reveal other attractive statistical features besides their liquid-asset protection, e.g. satisfactory current earnings and dividends or a high average earning power in the past. The analyst will avoid issues that have been losing their current assets at a rapid rate and show no definite signs of ceasing to do so. Graham. Security Analysis 6th ed. p 569.

That quote to me doesn’t sound like Graham is advocating buying all net-nets, he’s actually very clear that his recommended course of action is to only buy net-nets that either have high past earnings, are currently profitable and paying a dividend, or have a high past record of earnings.

I recognize that Security Analysis is dense, but it’s well worth the read. Each time I re-read it I come away with the impression that Graham was an absolute genius. Rather than the stereotype of a statistical investor Graham advocates evaluating business prospects of potential investments, and even offers advice on how to buy franchise companies in the 1962 edition.

So is value investing really as easy as setting up a computer program and then counting the money? There are a few pitfalls that investors could identify as potentially the reasons that these quant methods exist. The first is that many of the stocks that turn up on a net-net or cheap screen are simply too small or too illiquid for anyone to invest in. I’m an investor in many of these stocks, and I’m guessing many readers are as well. I have no idea who reads this blog, so maybe a few billionaires do, but my guess is most readers are either individuals or work at smaller funds. Having a small capital base is an asset, not a disadvantage. Use this to your advantage by buying small stocks at ridiculous valuations that large funds could never purchase. There is a reason most funds don’t beat the market, they’re all investing in the same 500 stocks or so, and due to the small pool those funds become the market.

A second reason I’ve seen quoted in books is that most of these stocks are hard to purchase on a behavioral basis. Cheap stocks always have problems, they’re never on the Forbes Best 2013 Stocks list. Yet this argument breaks down when considering that a computer has no emotion. If these strategies work and a computer could execute them who cares what’s in the portfolio? Why is there any human bias taint? Let the computer run day and night buying and selling as some formula dictates.

I really don’t think it’s all that easy. The computer buying net-nets would have purchased all of the China frauds back in 2010 and 2011. The computer buying all of the Magic Formula stocks would have had a different performance from the one Greenblatt advertises because so far no one has been able to reverse engineer his formula. Of course that’s the problem, what formula do you program the computer with? The formula is subject to human tinkering, and at some point enough tinkering creates a human driven computer executed fund. What is the P/E cutoff? Is it 10x and below? Is 8x cheap enough? What about cyclical companies, do those get excluded?

I discovered the Magic Formula back in 2007, the book was a solid read and convincing, but I’m glad I never pulled the trigger. I found a Yahoo! Group based on the investing technique. and after reading through all the messages I came to find out that the real life performance diverged greatly from the book. I still skim the messages in the group every few months, and there are plenty of people who followed the formula exactly and have trailed the market by a lot. Greenblatt’s own funds have trailed the market since they were launched in 2009, arguably the best time to invest in distressed assets.

Concluding this post is difficult because I don’t really have a conclusion, I’m unsettled. On paper investing on a quantitative basis seems great. The returns are easy, require nothing more than a computer and some rudimentary programming skills. Yet the fact that the best value investors aren’t computer programmers but are deeply inquisitive and thinking types convinces me there’s more to the story. Many great value investments come from human judgement, being able to identify the intangible. A net-net that’s always lost money but hired a new CEO who’s known to sell companies could be a great potential investment, but how do you program that formula into a computer?