NYC REITs

Post on: 24 Май, 2015 No Comment

REITs wrestle with new rivals

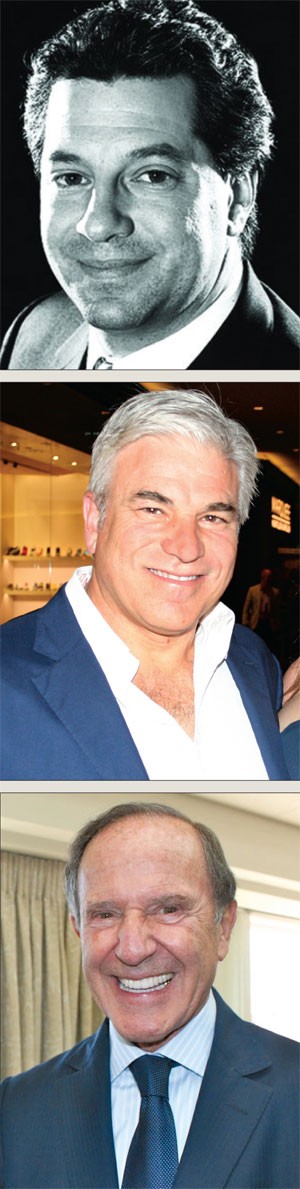

From left: Hans Nordby, Brad Case and Keven Lindemann

Real estate investment trusts are among the most aggressive players in the New York market for trophy real estate.

In the last year, they’ve purchased some of New York City’s priciest properties, including the $778 million acquisition of 338 Greenwich Street, which was occupied by Citigroup, and the $800 million purchase of a portion of the World Trade Center’s retail.

In this month’s Q&A, The Real Deal talked to REIT analysts and professionals about the latest issues and challenges facing the sector.

In 2014, the index that tallies all REIT activity had total returns of roughly 27 percent, compared with about 14 percent for the the S&P 500 Index, said Hans Nordby, managing director of CoStar Portfolio Strategy. However, that strong showing came after a tougher 2013, when REITs only generated about 3 percent in returns, he noted.

Today, one of the biggest issues dogging REITs in New York is increased competition for assets — from both private New York investors and foreign investors. the latter of which are increasingly looking to move capital into the U.S. because of turmoil in their own countries or depressed global bond yields.

As a result of these escalating property prices, Cantor Fitzgerald ’s David Toti said, REITs in New York City are “increasingly focusing investment outlay on development, where they have the potential to achieve higher returns.”

In addition, REITs are branching into new, non-traditional areas, like owning cell towers, billboards and casinos, sources said.

And although REITs are still among the most competitive buyers in today’s market, sources said if valuations on commercial real estate get too high, REITs could very well walk away. They do, after all, have investors to satisfy.

For more on those challenges and others we turn to our panel of experts.

Hans Nordby

managing director, CoStar Portfolio Strategy

How are REITs faring now compared to the past several years?

REITs had a phenomenal year in 2014. [They] had a total return of 27.2 percent for 2014, compared with 13.7 percent for the S&P 500 Index. This was a strong improvement from the previous year, when the total [REIT] index posted just 3.2 percent. There were two big contributors to this outperformance: First, commercial real estate fundamentals continued to improve, and second, the 10-year treasury yield fell by some 83 [basis points] during the year.

Which REITs have been most aggressive in NYC and nationally in the last year?

In New York City, the most active REITs in terms of buying activity in 2014 were those focused on office and retail acquisitions, and on multifamily development. SL Green was a standout last year, in large part due to its $778 million dollar purchase of a partial interest in [the building once known as] Shearson Lehman Plaza, the 2.6-million-square-foot office property in Tribeca occupied primarily by Citigroup. … A single transaction also put the Westfield Corporation near the top of the list of REIT buyers in 2014 — Westfield purchased a partial interest in the new World Trade Center’s retail component for $800 million. Avalon Bay also completed the development of its 413-unit AVA High Line in Chelsea in 2014 and continued construction on its 305-unit Avalon West Chelsea. The trend with REITs in New York is that deals often gravitate to projects with a value-add or development component.

Which other sectors of real estate investment are most and least attractive to REITs in NYC now?

Many investors are expecting accelerating rent growth, or even a rent spike, in the office and retail sectors, making acquisition or development of those assets relatively more attractive. Conversely, REIT acquisitions of apartment properties dropped off significantly in 2014, because pricing has surged in that sector. Cap rates for the highest-quality apartment properties are close to 3 percent, which isn’t particularly attractive for a REIT that needs to pay out healthy dividends, especially considering the competition that now exists in the apartment market by new supply. Construction on about 14,000 new apartment units will be completed in the New York metro area this year. That’s a level not seen since the 1980s.

What new and surprising trends are you seeing among REITs in NYC? How do the trends for NYC differ from national trends?

The most surprising trend in New York is simply the aggressive pricing. On office deals, for example, prime assets are regularly trading at prices 20-to-30 percent above peak 2007 sales prices. You aren’t seeing prices push this far above last cycle’s peak in most markets across the country. In markets such as Atlanta and Phoenix, even prime assets are often still trading at substantial discounts to 2007 pricing.

What are the biggest challenges for REITs in NYC and how do those challenges differ from last year and the past few years?

One of the greatest challenges facing REITs in New York today is the competition posed by foreign buyers. With bond yields depressed globally and the dollar expected to appreciate, international investors are increasingly shifting capital into U.S. and particularly New York, commercial real estate. As a buyer, you have to be willing to bid aggressively to compete with foreign investors looking at real estate as an alternative to low-yielding U.S. or European bonds.

Alexander Goldfarb

managing director/senior REIT analyst, Sandler O’Neill

How are REITs faring now compared to the past several years?

REITs are doing well. They are beneficiaries of the low-rate environment, and we expect that rates are going to stay low. The turmoil in Europe and Asia means that sovereign yields are going to stay low. That bodes well for real estate values.

What are the biggest challenges for REITs in NYC and how do those challenges differ from the past few years?

The biggest challenge is pricing. If you look back five years, the street retail players were a very small group. Now, you have more people playing in that world, and more money being thrown at it. In addition to General Growth Properties entering the field and Vornado, you have private players like Thor and Sutton. Pricing has escalated as a result of that. It’s not just Fifth and Madison avenues between 49th and 60th streets. The areas of street retail have expanded, and prices are being paid for properties in areas that five years ago wouldn’t have commanded those prices. We would expect that surge to continue.

Which REITs have been most aggressive in NYC and nationally in the last year?

General Growth for street retail in New York. Vornado, SL Green — for properties that they want, they are willing to pay the price. By the same token, there are trophy buildings that have traded that haven’t involved the REITs, like the Verizon Building and the Sony Building. Where the REITs see an opportunity, they’re not afraid to be the winning bidder. But they are not the sole bid. There have been a number of trades that have gone privately.

Are there any new REITs either in NYC or the U.S. that the industry should be watching?

Huxton Pacific out on the West Coast has done an excellent job of creating a portfolio that targets tech. The biggest change has been Vornado — the company has gotten out of businesses it shouldn’t have been involved in and has done a great job of getting back to its roots.

American Realty Capital is involved in a scandal for overstating its earnings. Do you think more oversight of the REIT industry is needed?

The disclosure that REITs provide is exceptional — the quarterly supplemental packet that [all] of the companies put out is comprehensive. You can really get almost to the “t” the value of the company, a pretty good handle on exposure, debt maturity, the rent profile, etc. In the credit crisis, there was only one company that ended up in bankruptcy: General Growth. They were over-leveraged. I think the REIT industry has demonstrated itself to be a pretty durable and responsible industry. That said, any industry can have companies that make headlines, but 99 percent of REITs, they are pretty transparent.

Brad Case

senior vice president, research and industry information, NAREIT

What’s going on with REIT stock performance in general? How much are stock prices up or down by?

Total returns in 2014 were more than 28 percent. In 2013, returns were only up marginally, and the broader stock market went gangbusters. Over the last few years, returns have gone up nearly 17 percent per year for REITs, while the S&P has gone up 15.5 percent. The recovery has been stronger for REITs.

The Paramount Group set a record with a $2.3 billion initial public offering a few months ago. Are you expecting another surge of REIT IPOs in the coming year?

The REIT industry experienced a surge of IPOs in the ‘90s — I can’t see the future better than anybody else, but I don’t expect to see that same surge again. There weren’t very many publicly traded REITs then; now there are, and they’re very, very well run. … So if you want to do an IPO, you have to have a good balance sheet, a good management team, and you’ve got to convince investors that if they trust you with their money, their returns will be as good as they will be with the publicly existing REITs. It’s hard to make the case that your IPO is going to do better than the ones that have been around for 40 years. We may well have the same number of IPOs or more in 2015 as we did in 2014, but not a lot more.

SL Green recently announced a 20 percent annual dividend hike on its stocks. What kind of competition is there among REITs right now to lure investors?

The thing to keep in mind is that REITs operate under a fairly restrictive set of requirements — they have to distribute at least 20 percent of their taxable earnings, and often they pay more than that. So what’s the competition? There is fierce competition. Dividends are determined by property performance, and REITs compete fiercely to own the best properties and to manage them better than everybody else.

Keven Lindemann

director, SNL Real Estate

Are you expecting another surge of REIT IPOs in the coming year?

It’s always hard to predict the number of IPOs that will actually get done. There are just so many factors that play into the process. 2013 was a very active year for IPOs, with 13 U.S. REITs going public and raising $4.9 billion. In 2014, there were only six, but the companies raised $4.1 billion. Obviously a big chunk of that was the Paramount deal. If REIT valuations stay healthy in 2015, we would expect to see more IPOs, though it’s less likely we’ll see a deal the size of the Paramount Group IPO. That one was unusually large.

How much money have REITs raised nationally and, more specifically, in NYC in the last year and how does that compare to recent years?

U.S. REITs raised $62 billion in 2014. While that was down from 2013, when they raised $74 billion, it was still a very robust year. … The main takeaway is that U.S. REITs have enjoyed ready access to the capital markets for the past few years. These companies need this access to fuel growth and refinance maturing debt. REITs, like most institutional players in commercial real estate, are taking advantage of continued low interest rates.

What sort of buying activity are you expecting from REITs in 2015 and 2016 in New York and nationally in terms of dollar volume?

If interest rates stay relatively low, as many expect, and if the broad economy continues to improve, REITs should have continued access to capital and will be in the mix. But recognize that REITs will compete for acquisitions with other players like insurance companies, pension funds, private equity and sovereign wealth funds. And if valuations on commercial real estate get stretched, REITs may not be able to achieve the investment returns they need, and may not “win” the bidding for some of these assets.

What are the biggest challenges for REITs in NYC right now?

The challenges for REITs in NYC are the same challenges facing other institutions with a heavy NYC presence — it’s difficult to find acquisitions that make financial sense, and they are increasingly competing with foreign investors.

What new and surprising trends are you seeing among REITs in NYC?

The REIT market is larger and more liquid now than it has ever been, and those are good things for investors. One of the most notable recent developments in the REIT market is the emergence of companies focused on non-traditional property types. We have had REITs that invest in office, retail, industrial and apartments for decades. Then hotels and self-storage facilities came into the REIT market, along with healthcare facilities and student housing. Now we have REITs that focus on the ownership of cell towers, billboards, casinos, farmland, single-family homes, timber, and oil and gas pipelines. There have been complaints that we have ”strayed” from the original purpose of REITs by expanding into these new areas, but in my mind it’s a healthy sign of an evolving industry.

What’s going on with REIT stock performance in general? How much are stock prices up or down by overall in the last year, two years and five years?

In 2014, REITs generated a total return of 28 percent compared with 14 percent for the S&P 500. In 2013, the S&P 500 generated a total return of 32 percent compared with only around 4 percent for REITs. Over a longer time period, if we go back five years, REITs have outperformed the broad market, 122 percent vs. 105 percent. If you were fortunate enough to invest in REITs at the market bottom in March 2009, you would have generated total returns of 374 percent through the end of 2014. Timing is everything.

American Realty Capital is involved in a scandal for overstating its earnings. Do you think more oversight of the REIT industry is needed?

I don’t think so, no. REITs have brought transparency to an investment sector that historically had very little transparency. … Every 90 days, the company opens the kimono to its operations by filing with the SEC and holding conference calls with investors and analysts. There are over 100 analysts who follow this sector full time and regularly publish reports on these companies. And the impact on ARCP’s share price when the irregularities were discovered — the stock fell 35 percent in two days — did not go unnoticed by other REITs. Doubtless a lot of meetings subsequently took place at these companies to confirm there are rigorous internal

controls around accounting and finance.

David Toti

senior managing director, Cantor Fitzgerald

What sort of buying activity are you expecting from REITs in 2015 and 2016 in NYC and nationally in terms of dollar volume?

We expect REIT acquisition activity to fall well below 2012 and 2013 peak levels, given the rich pricing environment for assets. For many REITs, years of portfolio recycling via asset acquisition and disposition are complete.

What new and surprising trends are you seeing among REITs in NYC?

REITs in New York City are increasingly focusing investment outlay on development, where they have the potential to achieve higher returns. Mixed-use, retail and office are sub-sectors in focus. The newest trend appears to be an interest in “off-island” sites, particularly in Brooklyn.

Which REITs have been most aggressive in NYC and nationally in the last year?

In New York City, SL Green remains one of the most active REITs, both buying and selling assets, underwriting mezzanine lending and assembling development parcels — across multiple sub-sectors. Boston Properties also remains active in NYC, although the company has expressed that pricing has hampered efforts to be more active.

Do you think more oversight of the REIT industry is needed?

There could be more oversight of the REIT industry overall, especially with regard to reporting metrics. FFO [funds from operations], AFFO [adjusted funds from operations] and NAV [net asset value] — these are all terms thrown around that are reported differently by each REIT. There are other issues that should be advanced by NAREIT as well, such as governance standards.