Now anybody can use Robinhood the nofee trading app backed by Snoop Dogg and Marc Andreessen

Post on: 22 Апрель, 2015 No Comment

Its sleek. Its easy to use. Its designed to give first time, small-scale investors a leg up on Wall Street hotshots.

And after months of waiting, its now open to anyone who wants to join.

Robinhood, a zero-commission brokerage app for iPhone that launched in December to a 700,000-person waitlist, is now available to the general public.

Heres why Robinhood is unlike any existing stock market app.

For starters, its mobile first. That has allowed the company to rethink traditional brokerage cost structures. With no human traders to pay or ancient infrastructure running the trades theyre able to cut out those overhead costs.

As a result, Robinhood doesnt charge a commission for standard trades, nor does it require any minimum deposits.

Imagine youre a first-time investor in your early 20s. You have a few hundred dollars maybe a thousand dollars to put in the market. You want to learn how it works. Seven to 10 dollars eats into that quite a bit, said cofounder Vladimir Tenev.

Thats the going rate for most other apps. But Tenev and cofounder Baiju Bhatt think even a modest fee like that is prohibitive for younger, smaller-scale investors.

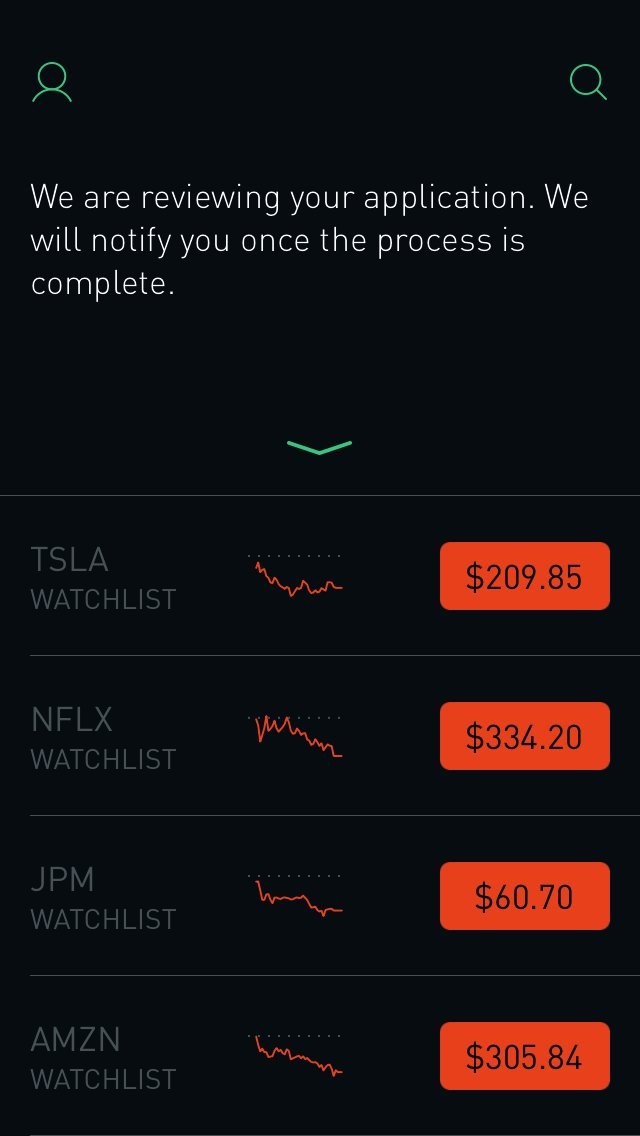

Their freemium model allows customers to buy and sell US-listed stocks and ETFs, place market orders and limit orders, track data in real time, and customise watchlists for free. The app will, however, charge customers for premium services like margin lending.

The co-founders were inspired to democratize access to the financial markets by the 2011 Occupy Wall Street movement, in which protesters, upset about large bank bailouts, occupied Zuccotti Park and other financial districts for months, denouncing Wall Street and the governments leniency toward bankers.

At the time, Bhatt, now 29, and Tenev, 27, had just built their first finance startup, an equities-trading software company based out of California. They saw their institutional customers placing trades at no cost, and wanted to help everyday customers do the same.

We kind of asked ourselves, Could we do something bigger than this? Couldnt we try to do something a little better than this? Bhatt said.

Tenev and Bhatt, former roommates who met while studying physics at Stanford, used their new finance experience and tech backgrounds to build Robinhood.

With it, they hope to inspire a new wave of investors.

In the 12 months since Robinhood was first announced, nearly 500,000 people have joined a wait list to download the app. Nearly all of those people are in their twenties, and the co-founders know that most of them wont be coughing up for its premium features.

But theyre ok with that.

Its true that a 20-something is going to have less funds than a 50-year-old, but they will become a 50-year-old at some point, said Tenev. He and Bhatt are confident they will still be there when that happens.

Robinhoods angel investors are confident too. The company has raised $US16 million from an array of investors, including Snoop Dogg, Jared Leto, and Andreessen Horowitz.

Its really, really, important that this country as a whole trusts its financial system, said Bhatt. I think its really important that there actually is a company that thinks like that.

Though the app rolls out on iPhone first, the founders plan to expand to Android and web as soon as possible.

You can download Robinhood over at the App Store

Heres what the set-up looks like:

Check out the apps pretty layout. This is where youll need to enter your invite code. (Theyre being sent out in chronological order to each person on the waitlist.)

Once you log in, you can link your bank account and transfer funds to your Robinhood account by selecting your bank and entering your online banking password.