No diversification benefits beyond 11 stocks

Post on: 2 Май, 2015 No Comment

This is not a capital protection product. It will lose money when the markets are down. But it will lose less than the index and probably less than other active equity funds.

Shanthi Venkataraman

Aarati Krishnan

Lotus India AGILE is the first quantitative (quant) mutual fund to be launched in the Indian market. Quant funds operate on the basis of computer generated mathematical models designed by the fund management team. AGILE will invest in 11 stocks (owning 9 per cent in each) that are chosen by a mathematical model, with the intention of beating the Nifty index. In an interview with Business Line, Mr Rajiv Vijay Shastri, Head-Business Development & Strategic Initiatives, Lotus India Asset Management, explains how this new product works.

Why should an investor opt for a quant-based fund such as yours?

AGILE is not a replacement to existing funds. This fund is an additional asset allocation option to de-risk your portfolio. From our perspective, we have seen an over supply of plain vanilla equity funds. All investment products on the mutual fund side are discretionary products. That is a risk because a fund manager is human (and can make mistakes). The advantage here is that you can back-test a quant-based fund rigorously and design a model that will suit an investors requirement.

We have designed a product that would perform much better than the market (Nifty), while maintaining a volatility that is in-line with the market, or if possible lower. So you are getting a better risk-return payoff. Using models, we can also create a product that can deliver returns similar to the Nifty but at lower risks, or that can deliver significantly higher returns than the Nifty but with higher volatility.

This is not a capital protection product. It will lose money when the markets are down. But it will lose less than the index and probably less than other active equity funds. But when markets are going up, it will probably make a lot more money. The rolling returns statistics over a one, three-year and five-year period are quite stunning.

On a one-year basis, this model cuts down the probability of loss, delivers close to double the returns although with slightly higher volatility. But it is on the three-year and five-year basis that the model starts delivering superlative performance. Over a three- year period, the returns are almost double that of the Nifty, the volatility is about the same as that of the Nifty and the probability of loss the number of times returns were negative reduces quite dramatically.

The minimum return generated by the model over a five- year period has been a CAGR (compounded annual growth rate) of 9 per cent. This is through times that have been horrible for the markets such as 2000 and 1998.

Why have you narrowed down on this particular portfolio composition of 11 stocks with a 9 per cent allocation to each? Is the concentrated exposure a conscious decision?

We analysed a number of combinations that used five to 15 stocks. For each one we analysed, we calculated the percentage of assets we could allocate to it. The 11-9 combination has worked the best historically.

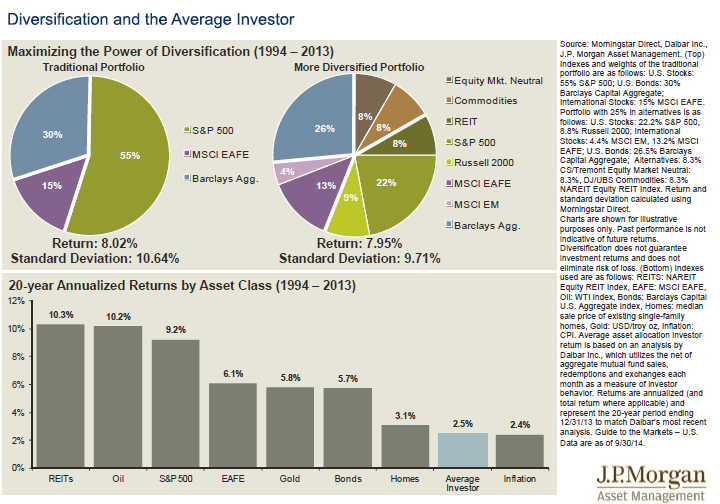

We have found that there are no significant diversification benefits beyond eleven stocks. Though it seems counter-intuitive, it is not necessary that your volatility reduces with more stocks. It can actually go up. And sometimes as the volatility reduces, even returns start to reduce. So 11-9 is a golden mix for this particular structure.

However, if I were to give you similar returns with a much lower volatility vis-À-vis the index, then the combination would not be 11-9, but something else.

How is the short-listing of these stocks done?

The universe is short-listed based on parameters that try to replicate the Nifty universe. We have chosen Nifty because it takes impact costs into account.

In quant modelling, it is essential that the underlying stocks have certain characteristics. They should be highly liquid, they should have efficient price discovery. Information with regard to these stocks should be publicly and uniformly available because insider trading can distort the returns completely. We had to stick to the top end of the market in terms of market capitalisation, in terms of research coverage. These top fifty stocks are over researched, if anything. So there is no information asymmetry. So choosing these fifty stocks and then choosing eleven is how the structure can work.

How exactly does the model work? A quant model might appear quite complicated for the average investor

This is proprietary information. Because we do not disclose this information, it appears like rocket science. A lot of models internationally are very data intensive. We will get there. But right now, it is a very simple model. Because it is so simple, we do not want to reveal it because then it will be replicated.

Are quant-based models typically momentum led? Will they work in a sideways market?

Using a word like momentum or classifying funds into fundamental or technical, value or growth is an oversimplification. The stocks in our universe are large, highly liquid, well- researched stocks, with efficient price discovery. It is extremely difficult to create momentum in these stocks if there is no value in them. So if a model is capturing momentum, it is also capturing underlying value. Momentum without value is possible in the small, mid-cap space, or where impact costs are high. But I doubt if you can create momentum in Nifty stocks.

If there were to be a market trend, where the Nifty does not perform at all and only mid-caps move, will the fund be able to outperform?

The fund is purely large-cap. So if the Nifty is sideways and all stocks in the Nifty also move sideways, which is rarely the case, then this portfolio will also be sideways. The other market situation where the fund can under perform significantly is when there is a sudden change or abnormal event. In May 2004, when the Congress government came to power, not only was there a sharp correction, market activity almost stopped for two-three months.

Do these models predict market trends?

The predictive capability is demonstrated in the model picking Infosys in October 98. Not many funds had a 9 per cent allocation to Infosys. We maintain a strict 9 per cent allocation through periodic rebalancing. If a fund manager bought Infosys in October 98 and held on to it till February 2000, the stock would have been 30-35 per cent of his portfolio. Here the 9 per cent allocation is constant. So the risk is contained.

Would it have been easier operationally had it been close-ended fund?

Definitely easier and better for the investor as well. But since this is a first time we are launching a product of this sort, we wanted the investor to feel comfortable it. We do not want investors feeling trapped. It is more intensive operationally for us to manage on a daily basis. The inflows will be invested on an equally weighted basis.

(This article was published in the Business Line print edition dated November 11, 2007)