Nigerian economy leads frontier market opportunities

Post on: 18 Май, 2015 No Comment

Africa forecast to become more important to frontier market investors following the reclassification of Qatar and the UAE to emerging markets

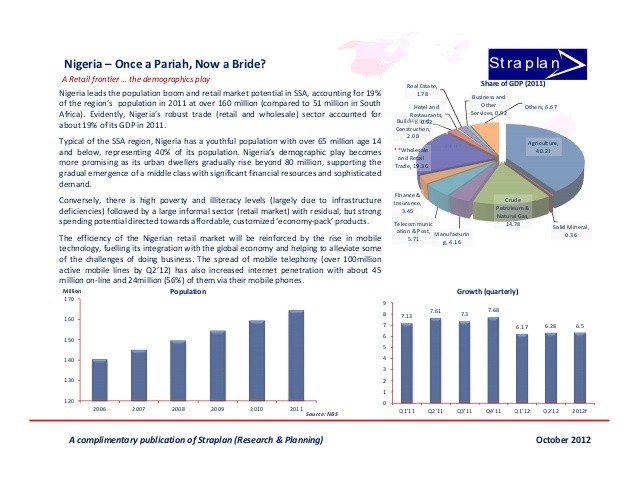

Dubai, 17 June 2014: Companies such as Guaranty Trust Bank, Zenith Bank and Nigerian Breweries have put Nigeria at the forefront of frontier market opportunities, according to Baring Asset Management (Barings). Africa’s largest economy, Nigeria recently rebased its GDP upwards to $500 billion for 2013, ranking the country as the 26th largest economy in the world 1. and the forthcoming general elections in 2015 could provide further opportunities for investors in a country undergoing significant reforms.

Michael Levy, Investment Manager, said. The core reasons to consider frontier markets in an investment portfolio remain the same today as in the past: these markets represent significant potential for long-term growth in a low-growth global economy; they are inefficient markets at an early stage of development, providing many mispriced investment opportunities; and they offer low correlations with developed and emerging equity markets.

Return on equity and dividend yield forecasts for frontier markets in 2015 are significantly ahead of developed and emerging markets, reflective of higher relative economic growth rates and early stage opportunities. GDP growth is also forecast to be at a premium to peers in the near term and for decades to come.

A good example of a frontier market opportunity is Zenith Bank. While the second-largest bank in Nigeria has benefitted from a cautious approach to risk, we forecast loan growth to sustainably and profitably top 15% per year going forward, and its highly liquid balance sheet has a capitalisation ratio among the highest in the world. Other frontier market stocks we like include Kenya’s Safaricom and the largest auto dealer in Laos, Kolao Holdings, which is benefitting from rising car ownership in Laos as well as neighbouring Cambodia and Myanmar.

Africa is forecast to become more important to frontier market investors, believes Barings, following the recent announcement 3 that, as of 2 nd June 2014, Qatar and the United Arab Emirates will be reclassified from the MSCI Frontier Markets Index to the MSCI Emerging Markets Index. Qatar and the United Arab Emirates currently have a 36.3% weighting and their reclassification will proportionately increase the exposure to the long-term growth potential of markets in Africa, Asia and Latin America, as well as other markets in the Middle East such as Kuwait and Oman.