Nice Nest Eg Simplify It

Post on: 16 Март, 2015 No Comment

After a lifetime of investing, your portfolio may be an unwieldly mess. Fix that now.

WHEN YOURE INVESTING for retirement, you have a single focus: building a nest egg large enough to support you for decades. But as you close in on your goal, youll have to tackle a more complicated problem. How will you manage your money as you ageand what happens if you cant do it yourself?

Face it, once you reach retirement, youll want to spend time traveling or volunteering; double-checking your asset allocation probably isnt on your bucket list. You also need to consider what could hamper your ability to manage your money well. Studies show theres a growing risk of cognitive decline as we age, yet we are increasingly confident of our abilities, which is a dangerous combination, says Lewis Mandell, professor emeritus of finance at SUNY Buffalo and author of What to Do When I Get Stupid.

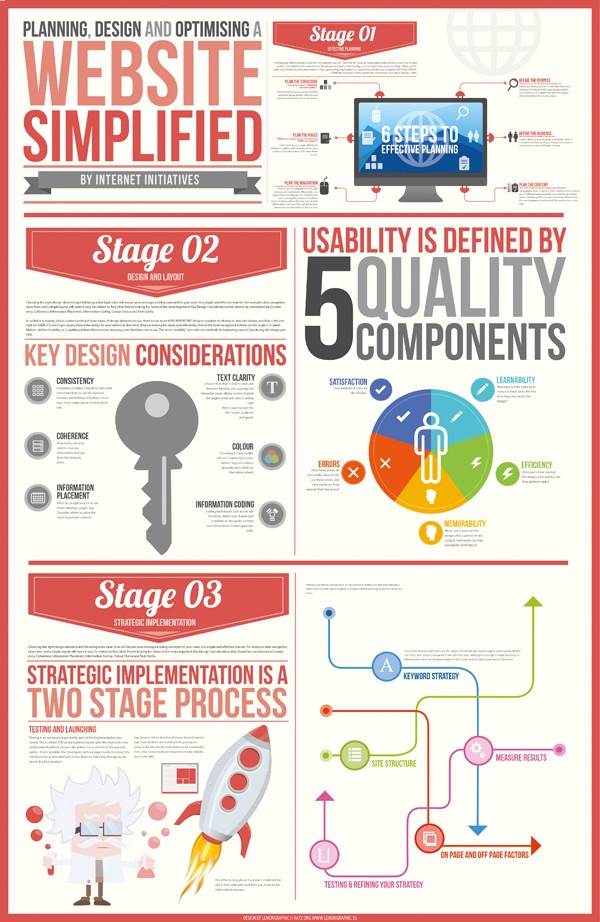

At the same time, your finances may be more unwieldy than ever. As retirement accounts grow, so does the tendency to load up on lots of different investments (see the graphic below). Plus you and your spouse may also have taxable accounts and far-flung former workplace plans. Ive had clients who completely lost track of old 401(k)s, says Boca Raton financial adviser Mari Adam. So start streamlining. Heres how:

Consolidate your accounts. Transfer everything to a single low-cost brokerage. This strategy will make it easy to monitor and manage your investments, as well as create an income stream; once you know how much you need to live on every month, you can arrange to have that amount automatically deposited in your bank account. At age 70, when required minimum distributions kick in, that calculation will be easier if your IRAs are in one place, says Ed Slott, an accountant in Rockville Centre, N.Y. And with higher balances you may pay lower fees and qualify for free or low-cost advice.

Consolidate your funds: As you shift your IRAs and other funds into a single brokerage, trim your holdings too. You dont need a dozen investments to be well-diversified, and fewer funds will be easier to manage, says Adam. Just four or five broad index funds or ETFs may be enoughyou can find candidates on our Money 70 list (see page 105). You may face a tax bill if you sell a taxable fund in order to consolidate (see if you can offset that with an investment loss). But if you own a poor performer, perhaps one charging a high expense ratio, you may be better off selling and moving that money to a lower-cost fund.

Delegate as needed: Talk to a family member or trusted friend about helping you with paying bills or other financial chores if you need backup. You may also want to enlist a financial adviserbut be sure to find out what the advisers plan is for her own retirement. Many advisers are 50 or older, so you want to know how they will handle their own transition, says Mandell. If theres a younger partner, make sure youre comfortable with her approach. In retirement, the fewer surprises, the better.