New to Investing Use DollarCost Averaging Yahoo India Finance

Post on: 12 Май, 2015 No Comment

If you want to build wealth over time, one of the best things you can do is start investing. Unfortunately, many people are stymied because they think that they need a great deal of money to get started.

The good news is that this isn’t the case. Modern investing is set up so that nearly anyone can get started, and keep investing over time, with the help of dollar-cost averaging.

What is Dollar-Cost Averaging?

Dollar-cost averaging is a simple technique that allows you to invest over time. You invest a pre-determined amount of money each month. So, if you have $100 available to invest, you buy as many shares as you can with that money.

Many investors use dollar-cost averaging in conjunction with an automatic investment plan. Most brokers will automatically deduct a specified amount of money from your bank account each month, and then use that money to automatically purchase shares of your preferred investment.

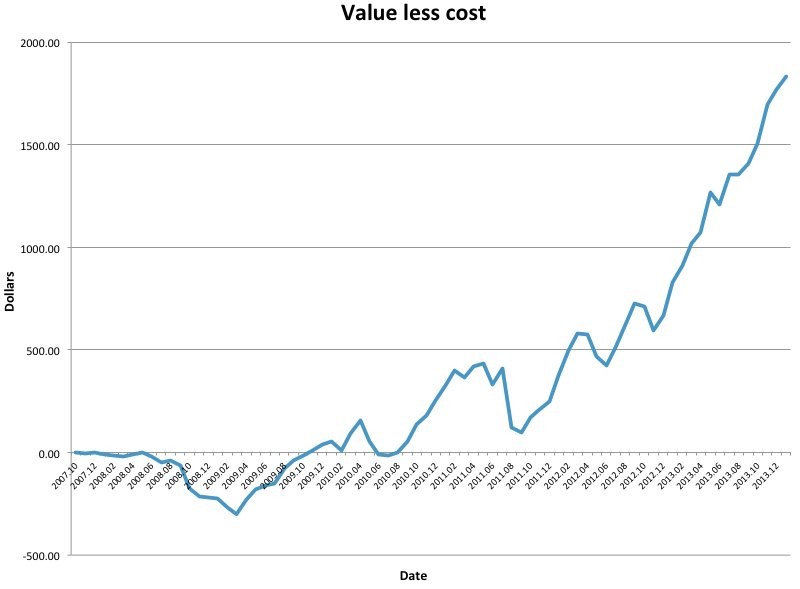

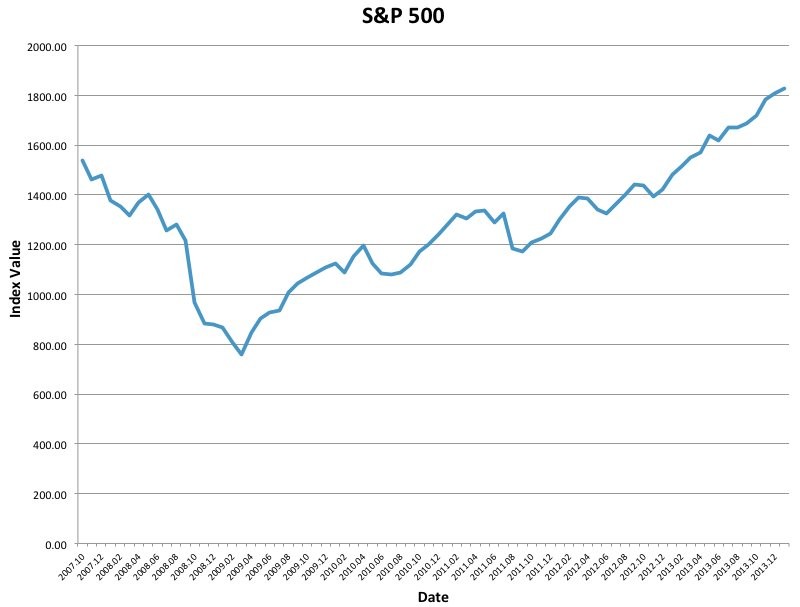

Over time, your consistent investment starts to add up. You can usually buy partial shares, so your entire investment (minus any fees charged) goes toward building your portfolio. Your investment amount remains steady, but the number of shares you purchase changes depending on stock price. So, if you have $100 buying shares at $50 apiece one month, you receive two shares. However, if shares drop in price to $40, you will receive two and a half shares the next month.

The theory is that over the course of decades, your investment averages out so that you are paying an average amount for your stocks. Your investment purchases more shares when the market is down, and when the market rises your investment purchases fewer shares.

How Dollar-Cost Averaging Helps You

One of the main draws of dollar-cost averaging is that it allows you get started investing with a relatively small amount of money. Start with something simple to understand, like an index fund, and you can add more complex investments later if you want.

As you are able, you can increase the amount of your regular investment. Dollar-cost averaging is generally considered a good way to get started investing with a small amount of money ; many brokers will let you open an investment account with as little as $25, and let you set up a plan for as little as $50 a month. If you want to get started, and if you want to build your portfolio consistently over time, dollar-cost averaging is the way to go.

Another great thing about automated dollar-cost averaging is that you are always building your portfolio. If you have the process automated, every month you know that your portfolio size is growing. Over time, your portfolio can grow to a substantial size, especially the longer you invest consistently.

There are some downsides to dollar-cost averaging, however. When you use an automatic investment plan, the number of shares you buy is determined by the price on a set day of the month, you might miss out on a chance to scoop up an extra share or two depending on the share price that day.

While over time the impact of missing a few buying opportunities is offset by the benefits of regular investing, keeping some extra funds available for buying extra shares at opportune times is worth the effort if you’re willing to watch the market a bit more closely.

Miranda is a freelance contributor to several investing and personal finance web sites. She also writes for her own blog, Planting Money Seeds .

More From US News & World Report