New Japan ETF Debuts Targeting Nikkei 225 Index

Post on: 5 Июнь, 2015 No Comment

Precidian Funds. a New Jersey-based ETF newcomer, announced on Thursday the launch of the first U.S.-listed ETF offering exposure to the Nikkei 225 Index. The new MAXIS Nikkei 225 Index ETF (NKY ) will seek to replicate the widely followed benchmark of Japanese stocks, often referred to simply as the Nikkei or the Nikkei Index. That benchmark is a price-weighted index consisting of 225 stocks listed on the Tokyo Stock Exchange. The Nikkei has been calculated by the Nihon Keizai Shimbun newspaper since 1950. There are several investment products linked to the Nikkei in existence around the world, but NKY is the first U.S.-listed ETF to offer exposure to the well known index.

Under The Hood

Like the Dow Jones Industrial Average in the U.S. the Nikkei is a price-weighted index. That means that the index will make the largest allocations to the companies with the highest stock prices, a methodology that has both advantages and potential drawbacks. The approach breaks the link between stock price and weighting that some believe can result in a long-term drag on returns, but also allows certain companies to have a significant impact on the benchmark performance as a result of a somewhat arbitrary factor such as stock price.

The largest components of NKY include robotics manufacturer Fanuc Ltd. (5.7%), Fast Retailing Co. (5.5%), and Softbank Corp (3.7%). By comparison, the largest holdings of the iShares MSCI Japan Index Fund (EWJ ) include large, well known companies such as Toyota, Honda, Mitsubishi, and Canon. NKYs largest sector allocations are to industrials (25%), technology (18.8%), and consumer discretionary firms (18.7%). Energy and utilities combine to make up only about 1% of the portfolio; those two sectors receive much larger allocations in many international equity products.

Japan ETFs In Focus

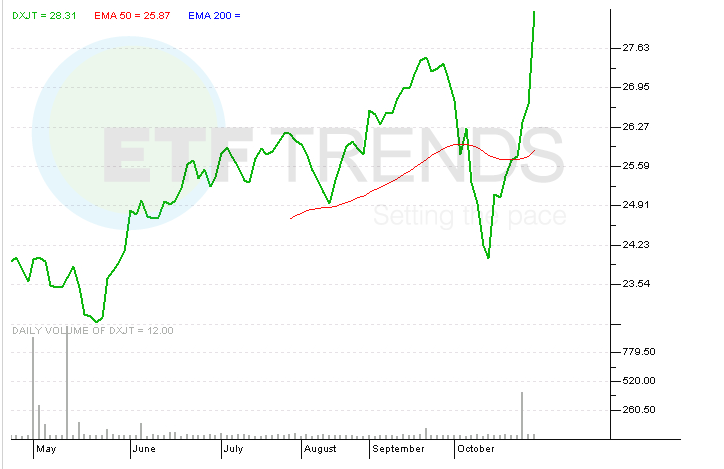

NKY becomes the 11th ETF in the Japan Equities ETFdb Category. a group that has aggregate assets of about $9 billion. EWJ is by far the most popular Japan ETF; that fund offers exposure primarily to large cap stocks and has about 300 individual holdings. There are also several options for accessing small cap Japanese stocks (JSC. SCJ. and DFJ ), and IndexIQ recently debuted a mid cap Japan ETF (RSUN ). Both WisdomTree and Deutsche Bank offer currency hedged Japan ETFs that strip out the impact of exchange rate fluctuations on returns to dollar-based investors (DXJ and DBJP ).

NKY will charge an expense ratio of 0.50%, near the low end of the average for the Japan Equities ETFdb Category. With an expense ratio of 0.48%, DXJ is the cheapest ETF option for investors seeking exposure to Japanese stocks.

Precidian was formerly known as Next Investments. The company is also engaged in bringing to market the first non-transparent actively managed ETFs, according to the firm web site.

[For more on the new Nikkei ETF, see the NKY fact sheet. For updates on all new ETFs, sign up for the free ETFdb newsletter ]

Disclosure: No positions at time of writing.