New ETF offers play on US energy boom just without the oil

Post on: 10 Апрель, 2015 No Comment

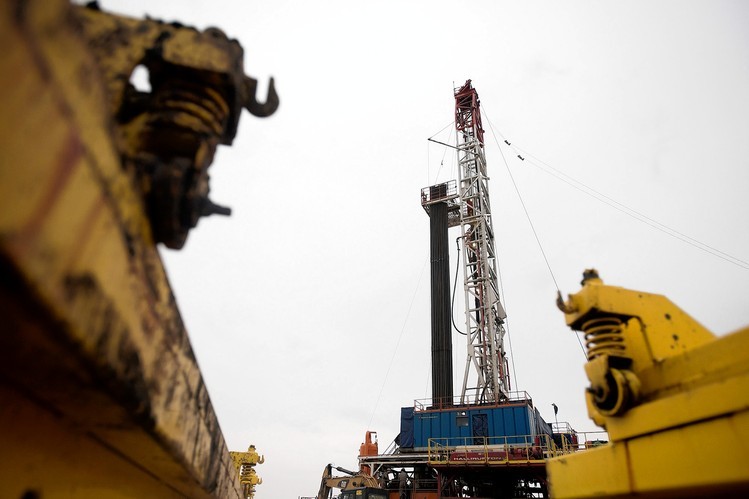

Artpartner | Image Bank | Getty Images

Oil, one of the most volatile asset markets, is being whipsawed by the global economic outlook and mounting turbulence in the Middle East.

Yet a new exchange-traded fund offers a way to play the U.S. energy boom, using midsized oil and gas pipeline operators as investment vehicles. Just last month, Global X Fund —with more than $2 billion of assets under management—launched the MLP & Energy Infrastructure ETF, a $16 million fund that has 35 different holdings in its portfolio.

The fund follows the Solactive MLP & Energy Infrastructure Index, a benchmark for midstream energy infrastructure companies. Its holdings include names like Access Midstream Partners. The Williams Companies. Enterprise Products and EQT —all of them with extensive assets in oil and gas infrastructure, such as pipelines. In this way, investors get to play the U.S. energy boom without direct exposure to unpredictable oil prices.

The more crude that gets pumped through the arteries of U.S. energy markets, the more these companies stand to profit.

This is what some people refer to as the toll road business model in the energy space, explained Bruno del Ama, Global X’s CEO, in an interview. By holding the fund’s ETF, you in essence own a pipeline that connects refinery down to distribution. They are collecting a fee every time as long as there is natural gas or oil flowing through those pipelines.

Zacks Research recently cited the new ETF’s low cost and comparatively lower volatility as key benefits. Because of its focus on infrastructure rather than commodity prices, the fund isn’t impacted by whipsawing in oil markets—which can be dicey, given events in the Middle East and the global economy.

Big oil left in the dust by smaller players

It’s the type of asset that’s really not correlated with commodity prices, it’s correlated with activity, del Ama said, calling energy infrastructure a type of arbitrage to move oil from point A to point B.

The fund’s offering is a reflection of one of the more curious byproducts of the U.S. oil boom. The world’s largest economy pumps more oil than ever, but the largest oil companies are struggling to grab the benefits. Companies like ExxonMobil. Chevron. BP and Royal Dutch-Shell have been left in the dust by little-known companies—several of which comprise Global X’s energy ETF.

Judging by the numbers, the stocks in the Global X fund’s components illustrate the dichotomy of Big Oil versus midstream companies. The smaller players have market capitalizations that are a fraction of their far larger counterparts.

Nonetheless, the numbers suggest a case of David beating Goliath, at least for now. Year-to-date, Access Midstream’s stock has surged 55 percent, while EQT has jumped by a whopping 60.4 percent. Meanwhile, Exxon is virtually flat on the year, and has become one of the Dow Jones industrial average’s worst-performing blue chips.

Global X’s del Ama says the abundant U.S. natural gas and unconventional oil plays create pretty significant pipelines to transport that energy around. As long as the boom continues, smaller players are in the best position to benefit, he added.

To the extent that the energy renaissance we’ve experienced, if that continues, it certainly is a positive for the industry, del Ama said.

—By CNBC’s Javier E. David.