New Arguments for the January Effect

Post on: 4 Май, 2015 No Comment

Ignore the theory. Here’s an easier way to bank gains every January.

Comments ( )

By Ian Cooper

Friday, December 21st, 2007

The latest January Effect article argues that capitulation lows, short covering sprees, low valuations, high cash and low to no debt, negative analyst coverage, strengthening U.S. dollar, and future M&A activity are good enough reasons to sink money solely into the January effect. While Id agree that a stronger dollar would bring more investment activity back to the U.S. relying on the antiquated, unreliable theory isnt a great idea.

As we said on December 11. the January effect is the expected time of year when tax conscious investors sell stocks to write off losses against capital gains. The tax sell-off would depress stock values lower until buyers came back in early January.

And, yes, for awhile it was a flourishing, profitable theory. Bullish January effect theorists will remind you that from 1925 to 1993, small cap stock outperformed large cap stocks in January in 69 of 81 years. All you had to do was buy small cap stocks in mid-December and hold until the last day of January. It was like having a license to print money, as small caps, on average, returned 7% every January as compared to 2% for large caps.

But since 1994, for example, its had off and on years. Comparing the Russell 2000 to the Dow, using the dates of December 1 st to February 1 st as my parameters, for example, I found that in:

- 1994, the large caps stocks outperformed small caps 1995, the large cap stocks outperformed small caps 1996, the large cap stocks outperformed small caps 1997, the large cap stocks outperformed small caps 1998, the large cap stocks outperformed small caps 1999, small cap stocks outperformed large caps 2000, small cap stocks outperformed large caps 2001, small cap stocks outperformed large caps 2002, small cap stocks outperformed large caps 2003, small cap stocks outperformed large caps 2004, the large caps stocks outperformed small caps 2005, the large caps stocks outperformed small caps 2006, small cap stocks outperform large caps 2007, the large caps stocks outperformed small caps

Truth is, while the theory is still used, its not as reliable as it was from 1925 to 1993.

So how do you profit in January 2008. First of all, ignore the theory. Second, take a look at small cap stocks like MIPS Technologies (MIPS:NASDAQ), and see how theyve technically performed every January, even in an economic slowdown. These are the historical gems you want to own for quick run ups.

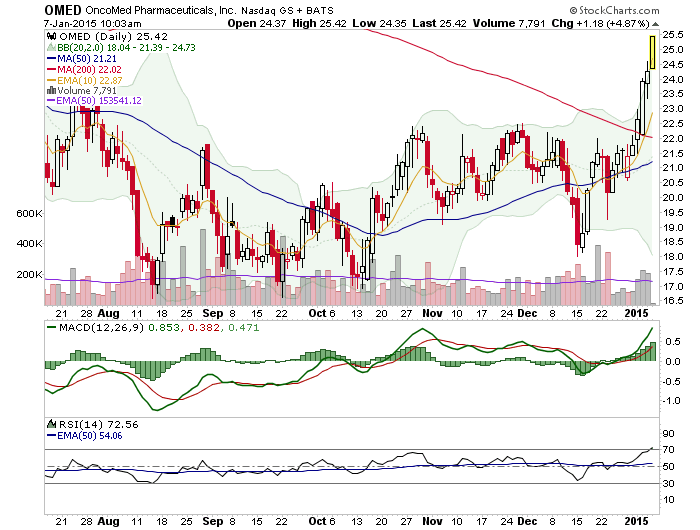

As you can see in this chart, MIPS is sitting at multi-year support levels, as MACD and DMI, our momentum indicators, trade at multi-year lows. Also notice that every January, over the last five years, MIPS had a brief rally, which were looking to profit from. Its then sold off in historic fashion shortly thereafter. This gives us an opportunity to profit from the long and short sides of MIPS.

But what I really like about MIPS is how its historically behaved between December and January, despite slow-downs. Take the dot com, 9/11, and accounting scandal-induced recession of 2001 to 2003, for example.

To identify trend here, we overlay DMI and MACD. Notice in the one-year MIPS chart below that the MACD blue line has crossed above the red line. We’re now waiting for confirmation with a DMI+ cross above DMI-. We should see the beginnings of a nice-sized rally for MIPS when that happens.