Neutral Options Strategies by

Post on: 9 Август, 2015 No Comment

Neutral Options Strategies — Introduction

Neutral Options Strategies are options strategies that are designed to profit when the underlying stock remains stagnant or within a pre-determined price range.

Neutral options strategies are unique opportunities that only options trading offers. No other financial instruments allow a trader to profit when a stock remains totally still. In fact, the term neutral in neutral options strategies does not mean that you profit only when a stock remains at a fixed price all the time. Not at all. Neutral options strategies allows you to profit not only when the stock remains totally still but also when it is trading within a neutral trend bounded by a fixed price range.

Neutral Options Strategies — Multi-directional Profits

In short, neutral options strategies can be used as long as you are confident that a stock will remain within a predictable price range no matter how wide that range may be.

How Neutral Options Strategies Work?

Even though there are many Neutral Options Strategies, all of them profit in a neutral trend on the exact same underlying mechanic and that is through time decay of options extrinsic value. Stock Options (or options on any other financial instruments) are the only instruments with depreciating extrinsic values and is also why only through options trading can anyone profit from a neutral trend or completely stagnant stocks.

All Neutral Options Strategies contain short call options and/or put options. Shorting options put time decay in your favor so that those options can be Bought To Close at a lower price than they were shorted, or written, for or allowed to expire totally worthless to the buyer during expiration. This results in a profit.

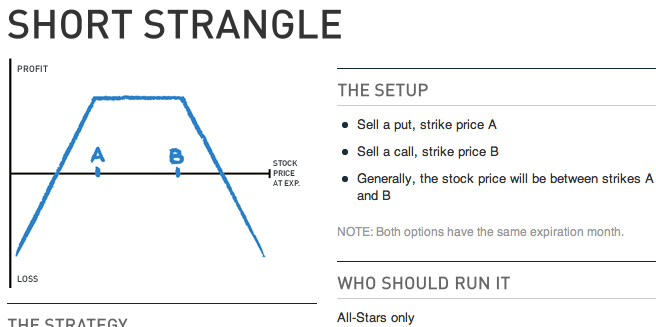

The Short Strangle illustrates this point most clearly. Shorting out of the money call options allows you to make the whole extrinsic value of those call options as profit if the stock fails to move higher than the strike price of those call options by expiration. Shorting out of the money put options allows you to make the whole extrinsic value of those put options as profit if the stock fails to move lower than the strike price of those put options by expiration. Putting the two together allows you to make money from both the call and put options if the stock remains within the range bounded by the strike price of the call and put options, creating a neutral options trading strategy. As you can see, only through options trading can anyone produce a win like this.

Because Neutral Options Strategies profit mainly on time decay, its overall position theta value will always be positive no matter which neutral options trading strategy is being used. Positive position theta represents the amount of money the position will make on a daily basis. This is also why Neutral Options Strategies are mainly credit spreads with just a couple of exceptions.

STOCK PICK MASTER!

Probably The Most Accurate Stock Picks In The World.

Common Flaw of Neutral Options Strategies

The common flaw or disadvantage of all neutral options strategies is that its profit potential will always be limited. There is never and can never be neutral options strategies with unlimited profit potential. All maximum profit of neutral options strategies can be precisely calculated as the amount of extrinsic value that a position can make is fixed right from the moment it is established. Even though it is a flaw, it is also an advantage to some options traders who are options trading to meet a strictly controlled ROI mandate. For instance, if you must produce a return of at least 5% on each options trade, you would be able to calculate right from the start if the trade meets your options trading requirement. The ability to calculate your maximum profit right from the start makes options trading much more predictable.