Neural network Stock Forecast Methods

Post on: 6 Июль, 2015 No Comment

New Improved Version of SMFT-1 Released

Addaptron Software released a new version of Stock Market Forecast Tools SMFT-1. The software includes several improvements: models optimization, more different input file formats, and optional free Downloader. SMFT-1 is an integrated system that includes three major software modules: FTA-2 a modified version of InvAn-4 that is a comprehensive tool used by serious investors for many years, the most popular software program SMAP-3 for stock market cycles analysis and forecast, and Neural Network Stock Trend Predictor NNSTP-2.

FTA-2 itself consists of six major modules:

- Technical analysis more than 50 popular technical indicators; chart analysis; indicators (each separately or all) used as input for Neural Network (NN) to build 10-day price forecast. The forecasts from all indicators result into a single forecast each forecast added with the weight proportionally to the current ability of the indicator to predict prices.

- Waves Elliott Wave NN forecast.

- Candles candlestick pattern NN forecast model.

- Pattern recognition pattern-recognition filter and predictor.

- Correlation correlation analysis tool to perform analysis and evaluate the future trend using a mutually-correlated pair (or in opposite correlation) with time shift.

- Comprehensive 3-month fundamental-technical ratings model analyzing-predicting model that is based on key fundamental ratios and technical parameters reflecting a company-stock state and dynamics.

SMAP-3 is able not only to extract basic cycles of the stock market (indexes, sectors, or well-traded shares) but also to predict an optimal timing to buy or sell stocks. Its calculation mainly based on extracting basic cyclical functions with different periods, amplitudes, and phases from historical quote curve. Additionally, SMAP-3 enables finding optimal timing to buy/sell by analyzing months of year, days of month, and days of week (the calculation is based on statistical analysis).

NNSTP-2 is to help stock traders in predicting stock prices for short terms. It predicts future share prices or their percentage changes (can be chosen in settings menu) using Fuzzy Neural Network (FNN). It operates automatically when creating the FNN, training it, and mapping to classify a new input vector.

Enabling Candlestick Forecast by Neural Network

A new 2012.02 version of Fundamental-Technical Analyzer FTA-2 has been released. Now it has a new module which enables using Neural Network to process past candlestick patterns and predict the future candlestick, i.e. its Open, High, Low, and Close prices. A candlestick can consists of one or many trading days. The module calculates result composed from different historical periods that allows making the forecast more accurate. Also it can perform comparative forecast analysis for many symbols.

More details can be found on FTA-2 software webpage. as well as, in Users Manual that is available from the main menu after the installation of FTA-2. To try the software for free, go to download page and follow the instruction.

About Candlestick Forecast Model

The idea of using the chart with candlesticks (or candles) for predicting market prices is very old. Two centuries ago, Japanese rice trader found that the candlesticks pattern chart could be used as a tool to predict future prices in a free market with a natural demand-supply balance. The method was improved later by others and today it is successfully used by many traders and investors in the stock market.

A candlestick is presented using high, low, opening, and closing prices during a certain trading period, for example, trading day. A regular candlestick figure consists of Real Body, Upper Shadow, and Lower Shadow. The number of candlesticks that is normally used for predicting can range within 1..12. Evidently, the number of different combinations of several candlesticks in a row can be big. Some believe that there are only 12 major candlestick patterns, others consider this number is 70 or even more. Anyway, in case of chart analysis, it is necessary to remember at least major patterns and process many charts in order to make forecast successful.

Apparently, statistical methods combined with computer power can be a good solution to make the candlestick patterns recognition work less time-consuming and more effective. For example, Neural Network (NN) can help to automate a candlestick patterns recognition task. NN should be properly trained in order to be able to recognize and predict further movements. One of the obvious problems of implementing a candlestick pattern NN predicting system is a formalization of inputs, i.e. the way how to express each candlestick shape and relative position of all candlesticks in numerical values.

Useful resources:

- Candlestick basics major signals

- Neural Network basics introduction

- The computer programs that enable using Neural Network to automate many methods of technical analysis and predict future prices stock market software tools

Unusual Use of Parabolic SAR

Parabolic SAR can be improved and successfully used for predicting stock market prices, especially, in trending markets

Traditionally, Parabolic SAR* is considered as a trend following indicator. Probably, few traders would think about using it for prediction. But after testing, I started to believe that it can be successfully used for prediction in conjunction with other indicators, especially, in a trending market. The explanation why it works can be the following. When a trend reverses, the probability of its continuation is more than 50% in average. The software with Neural Network (NN) is able to catch it statistically and show the result in extrapolated curves. The function of SAR in this method is to provide NN with reversal point signals.

The initial hypothesis was the following. Since SAR is able to give a strong signal when a price trend is reversing, this signal can be used for predicting if a new trend is prone to last. To compare predictive ability of SAR with other indicators, it has been implemented into the technical analysis module of Fundamental-Technical Analyzer FTA-2. SAR calculations have been used to collect statistics based on the forecast simulations for major indexes and ETFs during August-October 2011 period. As a result, SARs position was mostly in top ten indicators list.

The research and presented chart are made by Fundamental-Technical Analyzer FTA-2, one of the software modules that enables composing Neural Network forecasts of many indicators with weights accordingly to each indicators predictive ability.

Omitting logical rules for acceleration factor and reversal conditions, a recurring core formula for Parabolic SAR is the following:

where:

AF Acceleration Factor (normally starts from 0.02 and increases by 0.02 if each next point reaches a new extreme, saturates until 0.2);

EP Extreme Point (lowest low or highest high).

Conclusions. SAR is especially effective in a trending market. To make it more effective in a sideways market, it is a good idea to use it in conjunction with other indicators. Parabolic SAR can be enriched and successfully used for predicting stock market prices. Combing it with Neural Network allows extracting more statistically stable patterns and, therefore, providing a better accuracy in the forecast. As simulations showed, improved results can be achieved if SAR is transformed into more sensitive indicator by subtracting it from close price (it indicates the degree of SAR and price convergence).

*) SAR stands for Stop-And-Reverse. It has been used by many traders for decades. Its major application is in trading systems to define a trailing stop, i.e. to protect profit when a price trend changes. The term parabolic appeared to characterize the indicator parabola shape that is due to using an accelerating factor in the formula.

Elliott Wave: Extracting Extremes and Predicting next One by Neural Network

Improved Elliott Wave model can be successfully used as an additional input for making investing decisions in modern market conditions

The Elliott Wave idea is to use in stock market forecast. It is based on a crowd psychology that changes between optimistic and pessimistic trends creating patterns that can be fitted to reoccurred sequences. To use waves for prediction the assumption is made that waves are developing in the sequence of Fibonacci, harmonic, or fractal ratios. So that each wave has a programmed position and characterized by a particular direction and duration with extreme as a reversal point.

In fact, the model has been used by stock market analysts for almost a century. Although it looks very attractive due to its strict formalism and deterministic outcome, its predictive power is weak because of a few reasons. Firstly, the predictive values are dependent on waves that were counted determining where first and next wave start can be subjective. Secondly, according to Efficient Market Hypothesis, using an exact Elliott Wave model by many traders could lead to the disappearance of the patterns they anticipate. And finally, nowadays ones trading success based on predictions is rather a chance game in a modern market with its irrational behavior.

The purpose of this research was to explore if Elliott Wave principle can be used these days in stock market forecast. To eliminate the subjectivity in counting waves, Neural Network (NN) was used to analyze and predict waves. Also instead of assuming that waves obey only the sequence of Fibonacci, harmonic, or fractal ratios, a more general approach used the software processes all extracted waves. Besides, employing NN enables identifying both the price and date of extremes. The first experiment has been done using an artificial data set. The data consist of two sinusoidal functions with different periods. The second group of experiments has been done on real market data.

The main conclusion is that the Elliott Wave idea can be used in predicting stock market. Although it does not generate always accurate and consistent forecasts, its result can be successfully used as an additional input for making a trading or investing decision in modern market conditions.

S&P-500 Forecast for the First Two Weeks of August on the Basis of Technical Indicators Signals

There are many technical indicators. And there are many interpretations of each indicators signal. Some stock investors and traders use particular favorite indicators and insist on own interpretation. Who is right? What if to allow a computer program to decide using back-testing which indicator should be trusted more and another less for particular market conditions and a specific stock?

Nothing in this piece or blog should be construed as investment advice in any way. Always do our own research or/and consult a qualified investment advisor. It is wise to analyze data from multiple sources and draw your own conclusions based on the soundest principles. Be aware of the risks involved in stock investments

Forecasting Helps to Adjust Stock Investing Plan

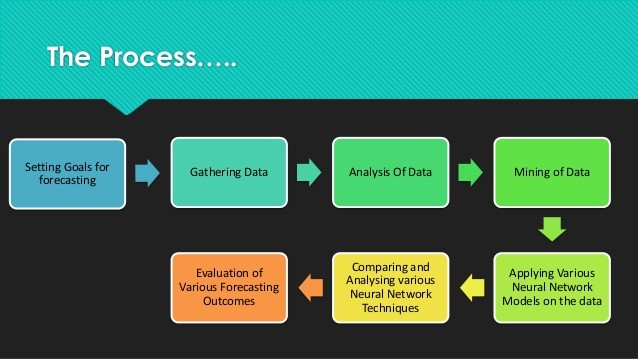

Forecasting and planning are powerful things in stock investing. If an investor create a plan that is based on reliable forecasts, the plan has better chances to reach projected goals. Forecasting methods can be classified as either subjective (judgmental) or objective (extrapolative). Objective methods are regression analysis, time series methods, different moving averages, and other statistical methods.

Some forecasting methods use the correlation between causing factors and output forecasting parameter. For example, quarterly financial reports can help to predict the stock price, i.e. identify how the stock market would react to publishing these reports. The historical data themselves can be causing factors for future movements. Some methods employ this idea together with statistical methods, for example, cycle analysis and neural network.

Investors should try to have all possible information about the stock and its environment before starting investing. It would be easier to have a good investing plan if an investor could predict the acceptable outcomes. As a rule, we cannot change the environment to be favorable for us. However, we can create a good plan to reach our goal. In addition, it is better to have plan B or even a few plans in case if the future will not look like it was predicted.

About Investment Analyzer InvAn

A good investing decision should be based on a multi-dimensional consideration of many criteria. However, making decision on the basis of too large data volume is not easy. To solve this dilemma, Addaptron has developed Investment Analyzer InvAn (IA) that performs fundamental, technical, and timing analyses converting them into three ratings. Then IA combines these ratings into a single number, composite rating, using a special algorithm.

IA fundamental analysis is performed on the basis of several key ratios and parameters (factors) to reflect company and its stock actual state and dynamics. Also it includes stock performance expectations on the basis of analysts opinion and external ratings. IA technical analysis rating is a result of processing the signals from tens of technical indicators and combining them into a single number by using Artificial Neural Networks (ANN) algorithm that allows reaching the best accuracy in the forecast. IA timing rating defines optimal time of a stock to be bought (sold) in the current stock market conditions.

Due to a fast and automatic data processing, IA enables watching hundreds of stocks. IA composite rating allows ranking stocks (stock comparison) daily from the worst to the best. It also has other useful features, such as, calculating optimal cash reserve. It can forecast stocks portfolios or an individual stock (index) on the basis of Fourier series analysis or using pattern similarity. It has also a filter to select stocks with Cup-With-Handle pattern, as well as, correlation analysis tool for advanced portfolio management.

IA helps investors pick the right stocks for their portfolio and determine optimal investment timing. It increases the speed and depth of analysis, makes most necessary calculations for investors, and maximizes profitability. IA is a comprehensive system with user-friendly interfaces that is easy to use.

The main purpose of IA is to provide users with in-depth analysis to maximize the return on their investments. IA has been tested for many years with excellent results; however, it has its own limit as any other tool. According to Efficient Markets approach, news and other public information are incorporated into the price of a stock with a certain time delay (price is supposed to reach and keep a stable equilibrium that change only each time a relevant new information is known). Since IA does not formalize all informational universes, monitoring companies news and macroeconomic trends are very important.

Neural Network vs. Cycle Analysis to Predict the Stock Market

The stock market can be presented by S&P-500 index. It is possible to build its different statistical forecasts using historical data. The purpose of the research was to compare two statistical methods: one that based on Cycle Analysis, another on Neural Network. We used price and volume data to train this particular Neural Network.

A picture below shows how actual 5-day performance (yellow line) differ from predicted performances by these two methods. The top half is the comparison of Neural Network prediction, bottom half Cycle Analysis. Green bars mean buy signals, red sell.

Three major conclusions:

- Cycle Analysis prediction gives signals too early, Neural Network prediction too late.

- In average, Cycle Analysis prediction showed slightly better accuracy than Neural Network prediction for the last six months (from June 2009 to January 2010).

- It it possible to get a superior prediction by combining these two methods.

About

This blogsite is intended for stock market investors and traders

Neither bear nor bull market is bad because both can be used to the benefits of knowledgeable investors the most important thing is stock market predictability. Basically, the stock market prediction can be built on the following approaches: Efficient Market Hypothesis (it states that the prices captures all known information), Fundamental analysis (it considers companies performance), or Technical analysis (it uses historical prices and volumes statistics to detect trend). Using the combination of these methods may improve the accuracy of prediction.