Natural Resources Mutual Funds

Post on: 5 Июль, 2015 No Comment

Natural Resources mutual funds invest in companies that are actively involved in the extractive industries or companies that provide products and services to the companies that are actively involved in extraction. Extraction is usually defined as mining, logging, and drilling for oil and gas.

Mining covers a lot of ground. It can include coal, metallic ore (iron, copper, bauxite etc.), limestone, sand and gravel, salt, potash, peat, oil and tar sands, oil shales, and just about anything else that can be dug out of the ground other than gems and precious metals, which are included in the Precious Metals sector. And the mining of oil and tar sands, and oil shales also are included in the Energy sector.

Logging is usually restricted to the logging of naturally occurring trees, i.e. those not cultivated in tree farms. Drilling for oil and gas are self-explanatory, but they also are included in the Energy sector.

Products and services provided to the firms actively engaged in extraction include such things as oil and gas field services, oil and gas field equipment, mining equipment and logging equipment. Ancillary businesses include such things as railroads and pipelines.

The Natural Resource sector has been an excellent diversifier and a good hedge against inflation, as it includes a lot of raw materials. However, the average Natural Resources mutual fund as of October 2007 had 68% of its assets invested in the Energy sector, which is way too much and diminishes the value of this sector as a diversifier. It also makes it difficult to invest directly in natural resources without having to short the Energy sector.

These funds compete with each other and each strives to outperform the others. With energy stocks doing so well lately, many are loading up on energy to boost their performance. This has been a constant upward spiral for a few years now. Until something changes, Natural Resources funds might better be considered as an Energy play unless you can find a good fund with a relatively low proportion of energy stocks in its portfolio.

You need to be aware that these funds are definitely not created equally, especially with respect to the amount of energy-related stock they hold. When comparing these Natural Resources mutual funds, take a good look at their holdings and, with energy stocks doing so well recently, you need to stay abreast of any changes to a fund’s portfolio after you make an investment, as the energy component is apt to change significantly with time.

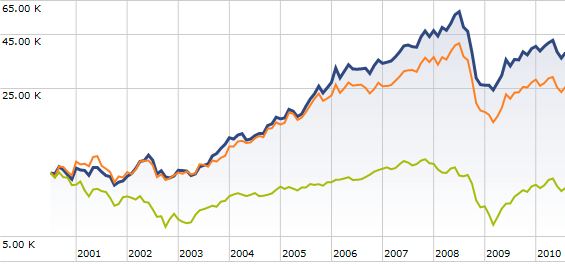

As a group, the Natural Resources mutual funds have done very well over the period 1998 — 2007 and extremely well over the last five years of that period. This is no doubt due to their high level of participation in the Energy sector. Their average returns and their volatility are high, but even on a risk-adjusted basis, they have done very well. There are a few funds that managed to achieve high returns with relatively low volatility. This is yet another example of how a good fund manager can really add value in an area of specialization.

With their high concentration in the Energy sector, the Natural Resources mutual funds are a passable diversifier if you don’t also own an Energy fund, as their degree of correlation with the S&P 500 is only moderate. It’s actually about the same as the Energy sector, which isn’t too surprising.

As I noted above, Natural Resources provide good diversification and a hedge against inflation if you can find a good Natural Resources mutual fund with a low Energy component. Finding one that invests mainly in raw materials is even better.