Natural Resources Investing

Post on: 5 Июль, 2015 No Comment

Frederick G. Fromm, Stephen M. Land and Matthew J. Adams

Franklin Equity Group

Outlook 2015

We believe many energy stocks have become more attractive following 2014’s weaknessenergy-related equities now appear to discount commodity prices at or below the low end of our estimated long-term intrinsic value ranges.

In our view, 2014 represented another year of transition for the natural resources sector as commodity-related markets sought balance amid slower global economic growth and growing supply for several key raw materials. In response, many companies aggressively cut costs and deferred or cancelled projects. Although not a surprise for some industries such as gold mining, which has experienced rising costs and weak gold pricing, the trend of greater capital discipline was also evident among companies enjoying relatively stable conditions.

In our view, the trend of price volatility for crude oil and related equities will likely remain as 2015 gets underway amid growing global oil supplies and moderating demand growth that have been weighing on investor sentiment. Though we believe recent market fundamentals are not as dire as market action would imply, crude oil trading activity has been taking its cues from easing economic conditions and current supply trends, which appear to indicate a significant loosening of the supply-and-demand balance in the first half of 2015. The impact of these factors was exacerbated by a lack of action by the Organization of the Petroleum Exporting Countries (OPEC) to help balance the market in apparent recognition that non-OPEC supply growth needed to be curtailed in tandem with any potential OPEC actions. In the short term, any supply curtailment will likely be a function of OPEC members stricter adherence to the cartels existing quotas. Although there are some signs this has been occurring, which we believe could help stabilize the market, it may not be enough to prevent further price declines. In the meantime, some US-based oil and gas exploration and production companies have announced spending reductions for 2015, while others have highlighted flexibility in their spending plans should crude oil prices remain at or below year-end levels. We believe these moves are important signals that supply and demand could become better aligned in 2015.

We believe oil markets are likely to stabilize over the next several quarters if demand improves and production growth slows to a more manageable pace. However, as always, trends are fluid and timing is uncertain. More importantly, we believe energy-related equities appear to discount commodity prices at or below the low end of our estimated long-term intrinsic value ranges. Although sentiment can turn exceedingly negative at times, and equity values can and often do decline more than we expect, we believe many energy stocks have become more attractive following 2014s weakness. We have therefore been favoring companies we believe can weather current commodity weakness and thrive in a recovery scenario. Critical to this assessment is in-depth, fundamental research to identify companies with the lowest cost of production and greatest balance sheet flexibility. Many high-quality companies that fit this description have become more attractively valued to us over the past several months, and we are seeking to increase exposure at a pace commensurate with our views on near-term downside risks.

Although our outlook for natural resources sectors is varied across related industries, we believe the trend of cost reduction and capital discipline should ultimately be positive as most companies would be in stronger financial positions to navigate prevailing 2015 market conditions, while spending reductions could lead to tighter supply-and-demand balances. Ultimately, we believe improved cost positions, slower supply growth, resilient demand and rising commodity prices could lead to the potential for rising equity values.

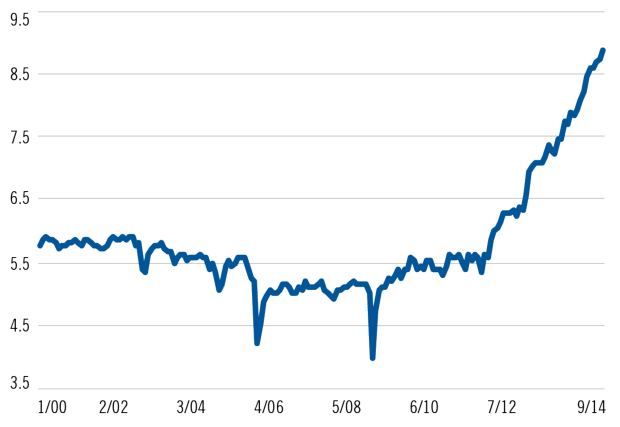

US Field Production of Crude Oil (Million Barrels per Day)

January 2000September 2014

Source: U.S. Energy Information Administration, Petroleum and Other Liquids.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Generally, those offering the potential for higher returns are accompanied by a higher degree of risk. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with their relatively small size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Value securities may not increase in price as anticipated or may decline further in value. Smaller-company stocks have historically had more price volatility than large-company stocks, particularly over the short term. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Puerto Rico municipal bonds have been impacted by recent adverse economic and market changes, which may cause an investment portfolio’s value to decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. Lower-rated bonds and distressed debt entail higher credit risk. Mergers, reorganizations, liquidations and other special events involve special risks as pending deals may not be completed on time or on favorable terms. Short sales of securities involve the risk that losses may exceed the original amount invested. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—the prices of such securities can be volatile, particularly over the short term. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Investments in REITs involve additional risks; since REITs typically are invested in a limited number of projects or in a particular market segment, they are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. Diversification does not guarantee a profit or protect against a loss. These and other risks pertaining to specific funds or strategies, such as those involving investments in specialized industry sectors or use of complex securities, are discussed in the relevant fund’s prospectus.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment managers and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (FTI) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FTI affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc. One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com — Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

See www.franklintempletondatasources.com for additional data provider information.

CFA and Chartered Financial Analyst are trademarks owned by CFA Institute

You need Adobe Acrobat Reader 6.0 or higher to view and print PDF documents. Download a free version from Adobes website.