My Top 3 Canadian Midstream Stocks

Post on: 16 Март, 2015 No Comment

Our favorite Canadian midstream companies-names that own pipelines and processing capacity-generate the majority of their cash flow from fee-based services, a business model that provides a degree of protection against volatile oil and gas prices.

Nevertheless, depressed energy prices can curtail producers’ development plans, limiting volume growth on existing assets and demand for new capacity. In the worst-case scenario, cash-strapped customers could default on their contracts.

Given the importance of midstream infrastructure to improving producers’ oil price realizations, governments in Canada’s main energy-producing provinces of Alberta and Saskatchewan have proved supportive of the industry-a salutary situation is unlikely to change anytime soon.

The Conservative majority at the federal level is similarly disposed. In fact, Prime Minister Stephen Harper has been a consistent champion of TransCanada Corp’s (NYSE: TRP ) Keystone XL pipeline and projects to transport crude oil from producing regions to the East Coast.

Unfortunately, not even the prime minister can override opposition to energy infrastructure projects in provinces controlled by other parties-British Columbia, Ontario and Quebec all spring to mind. And whenever a proposed pipeline passes through tribal lands, midstream operators must negotiate with representatives from the First Nations.

In this environment, even commercially justifiable projects face the prospect of costly delays and regulatory uncertainty; companies without the underlying profitability and patience needed to navigate this process run the risk of financial ruin if they miscalculate.

To be sure, Canadian midstream companies enjoy an immense opportunity set. And the best-positioned of these names stand to grow their cash flow and dividends significantly as new projects come onstream.

Valuations also appear favorable in the industry, fueled in part by the Canadian dollar’s recent weakness and investors’ preference for US equities. Put another way: The 5 percent decline in the Canadian dollar’s value relative to the greenback means that US investors get more bang for their buck in Canada’s equity markets.

This table highlights 14 midstream operators with significant operations in Canada. We track all of these names in Energy & Income Advisor’s Canadian Energy Coverage Universe .

(click to enlarge)

Here are the criteria we used to whittle the field to our three favorite Canadian midstream operators.

Criterion No. 1: Diversification by Geography and Business Line

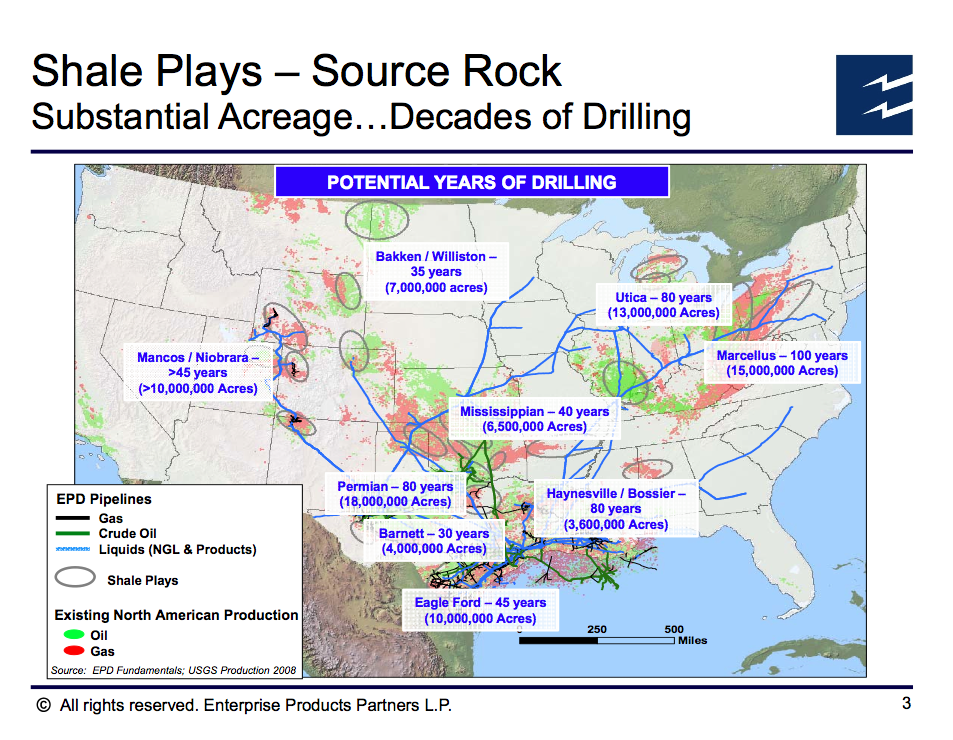

Pipeline companies historically have generated extremely reliable revenue, though overbuilding or shifts in production levels or commodity prices can increase re-contracting risks. Demand for long-haul pipelines to carry natural gas from the Rockies to the East Coast, for example, has been undermined by the rapid development of gas reserves in the Marcellus Shale.

Names that own and operate multiple midstream assets in multiple regions are less vulnerable to weakness in a particular operational or geographic segment.

Criterion No. 2: Financial Strength and Access to Capital

Ten of the 14 midstream companies listed in our table have earned an investment-grade credit rating from at least one major agency.

With the exception of CA$10 million drawn on its CA$40 million credit facility, WestShore Terminals Investment Corp (TSX: WTE, OTC: OTCPK:WTSHF ) has no debt outstanding. Meanwhile, Keyera Corp (TSX: KEY, OTC: OTC:KEYUF ) and Parkland Fuel Corp (TSX: PKI, OTC: OTCPK:PKIUF ) don’t have credit ratings because they haven’t issued enough debt.

Only Gibson Energy (TSX: GEI, OTC: OTC:GBNXF ) is rated below investment grade. However, the firm shouldn’t have trouble accessing debt capital based on the favorable yields to maturity on its outstanding issues.

All 14 companies face light refinancing needs over the next few years, giving them sufficient flexibility if credit conditions tighten. Relatively low payout ratios and stable underlying businesses speak to the sustainability of this group’s dividends. And all but two of these names have hiked their payouts over the past 12 months-an impressive show of strength.

Criterion No. 3: Capital Spending on Worthwhile Projects

Midstream operators have a sizable opportunity set in Canada. We prefer the names that have the best projects and a history of execution, as these names will grow their cash flow and dividends at a superior rate.

Criterion No. 4: Minimal Exposure to Commodity Prices

Although pipelines and other midstream assets usually generate relatively stable levels of fee-based revenue, some companies’ operations and contractual arrangements entail direct exposure to commodity prices.

Criterion No. 5: Fair Value

My favorite valuation tool for these names is to add the indicated yield to the company’s dividend growth rate over the past 12 months. For the highest-quality fare, this total should exceed 10 percent; riskier names should exhibit an even higher number to compensate investors appropriately.

Top Three Canadian Midstream Stocks

AltaGas (TSX: ALA, OTC: OTCPK:ATGFF )

Longtime favorite AltaGas operates three business lines:

- Regulated Gas Distribution in Canada. Alaska and Michigan (46.1 percent of operating income in the first half of 2013);

- Electricity Generation. which primarily consists of hydropower installations and gas-fired power plants in the US and Canada (28.4 percent); and

- Field Gathering & Processing, Extraction and Transmission. which houses the company’s midstream assets (25.5 percent).

Field Gathering & Processing, Extraction and Transmission

When Altagas converted to a corporation from an income trust, the firm’s midstream operations generated almost 90 percent of the firm’s annual operating income.

At that juncture, the company’s business mix entailed significant exposure to energy prices via its gathering and processing assets.

This segment of AltaGas’ midstream operations, which involves systems of small-diameter pipelines that transport field production to gas-processing plants, has struggled of late because low natural-gas prices (see Price Check on Canadian Oil and Natural Gas ) have discouraged conventional drilling in Canada’s Western Sedimentary Basin.

But AltaGas has diversified its midstream business over the ensuing decade to bolster its fee-based income. Recently, the company acquired a 25 percent interest in privately held Petrogas Energy Corp, which owns and operates liquids storage, transportation and blending facilities. This deal includes the option to purchase another 25 percent stake in the company.

Dominion Bond Ratings Services calls the transaction credit neutral, while noting the benefits of diversifying its asset base.

AltaGas has also made progress on two downstream projects that should drive cash flow and dividend growth: a joint venture with Petrogas Energy to ship propane and butane to overseas and a partnership with Idemitsu Kosan Co. (Tokyo: 5019, OTC: OTCPK:IDKOY ) to export up to 2 million metric tons of liquefied natural gas (LNG). (We discussed North American propane exports most recently in NGL Price Update: The Lighter End of the Barrel and US LPG Exports on the Rise, Shippers to Benefit .)

Assuming that AltaGas and its partners reach permitting deals with the First Nations, the propane and butane export scheme could come onstream in 2015 and the LNG terminals could start commercial operations in 2017.

The company also announced an expansion of it Cold Lake transmission system to deliver the natural gas needed to generate steam for two heavy-oil projects in a remote part of Alberta.

Electricity Generation and Gas Distribution

AltaGas has expanded its electricity-generation asset base in recent years and has a number of growth projects under way, including the construction of a co-generation power plant slated and several hydropower installations in British Columbia. All these facilities are slated to come onstream over the next two years.

In recent years, depressed natural-gas prices have weighed heavily on the price of wholesale electricity. AltaGas has sought to mitigate this volatility through strategic hedges and inking long-term contracts with provincial authorities. The firm has hedged about 67 percent of its wholesale power sales for the remainder of 2013.

Factor in the company’s regulated utility operations and you have a diversified energy company that generates extraordinarily steady streams of cash flow, regardless of trends in commodity prices.

A conservative dividend policy that targets a payout ratio of 40 percent to 50 percent of funds from operations likewise provides a cushion in difficult times, while steady growth in this non-GAAP measure of cash flow has enabled AltaGas to raise its dividend on four occasions since converting to a corporation in mid-2010.

The Verdict

With a dividend yield of almost 4.3 percent and the potential to deliver shareholders a windfall if management elects to spin off its renewable-energy operations, AltaGas offers conservative investors an enticing combination of reliable income and potential capital gains.

Keyera Corp (TSX: KEY, OTC: OTC:KEYUF )

Keyera Corp operates three integrated business segments that handle natural gas and natural gas liquids (NGL): gathering and processing (42 percent of 2012 gross margin), NGL infrastructure (32 percent) and NGL marketing (26 percent).

Although many Canadian midstream names that own gathering and processing assets have struggled in recent years, Keyera has managed to grow its throughput volumes through system expansions and targeted acquisitions. In a challenging market for natural gas and NGLs, Keyera has thrived because of its integrated suite of NGL handing services and presence in basins where activity levels have held up reasonably well.

The company has augmented its interests in 16 gas-processing plants in western Canada with new fee-generating assets to improve NGL recoveries, reduce transportation costs and improve market access. Some of the company’s most exciting prospects for organic growth center on delivering condensate to oil-sands producers for use as a bitumen diluent.

And Keyera’s recent project announcements suggest that management remains as opportunistic and disciplined as ever when allocating capital.

The Canadian midstream operator recently unveiled a 50-50 joint venture with Kinder Morgan Energy Partners LP (NYSE: KMP ) to build a crude-oil terminal near Edmonton, Alberta.

This facility will have the capacity to load 40,000 barrels per day and will be served by both Canadian National Railway (NYSE: CNI ) and Canadian Pacific Railway (NYSE: CP ). The Alberta Crude Terminal will receive volumes from the joint-venture partners’ respective gathering systems in the region. Given its flexibility, shipping crude oil by rail will likely remain a part of the energy logistics chain even after new pipeline capacity comes onstream.

This joint venture also gives Keyera a clutch of additional growth opportunities, including a proposed pipeline that would connect the rail terminal to the firm’s Fort Saskatchewan pipeline system.

At the same time, the Canada-based company scrapped a proposed NGL pipeline joint venture with Plains All-American Pipeline LP (NYSE: PAA ) after Alberta regulators questioned the US master limited partnership’s operating record.

The Verdict

Since converting to a corporation in January 2011, former income trust Keyera has raised its payout by 33 percent. With a low payout, steady business, strong balance sheet and robust pipeline of growth projects, the stage is set for further upside to the dividend and stock price.

Now that Keyera Corp’s stock has pulled back by roughly 12 percent since hitting an all-time high in May 2013, investors have an opportunity to lock in a 4.1 percent.

Pembina Pipeline Corp (NYSE: PBA )

A charter member of our Conservative Portfolio, Pembina Pipeline Corp has hiked its payout by 7.7 percent since converting from an income trust to a corporation. Management has targeted annual dividend growth of 3 percent to 5 percent, with the rate dictated by project completions across its four business lines-midstream energy, conventional pipelines, oil sands/heavy oil services and gas services.

The company’s first major customer was Syncrude Canada. a joint venture between seven partners that includes most of the heavyweights that operate in the oil sands. This capacity-based contract ensured that Pembina Pipeline received its allotted fees regardless of Syncrude Canada’s production volumes.

In subsequent years, Pembina Pipeline’s customer base has expanded to include Canadian Natural Resources (NYSE: CNQ ) and Statoil (NYSE: STO ), with which the midstream operator agreed to build the new Cornerstone Pipeline System.

Meanwhile, the company’s midstream business has an impressive pipeline of growth opportunities, from NGL pipelines, fractionators and storage caverns to crude-oil and condensate logistics.

And Pembina Pipeline hasn’t slowed its ambitious expansion plans since CEO Bob Michaelski announced his retirement. The midstream operator unveiled a CA$115 million expansion of its pipeline system that will deliver an additional 40,000 barrels of liquid hydrocarbons per day to the firm’s Fox Creek terminal. Meanwhile, the purchase of an industrial property formerly owned by fellow Total (Paris: FP, NYSE: TOT ) gives Pembina Pipeline an ideal site for new terminal assets.

The Verdict

Although Pembina Pipeline Corp’s combined yield and dividend growth stands at 8.8 percent, the security of its cash flow and impressive pipeline of growth projects makes the stock a buy.

Some of my favorite dividend-paying stocks for the next 12 months hail from cyclical sectors that stand to benefit from the strengthening U.S. economy and investors’ transitioning out of defensive groups such as consumer staples. If you’re interested in learning more, Elliott Gue and I will host a free webinar on Oct. 15, 2013, to discuss our favorite stocks and investment themes for 2014.

Disclosure: I am long PBA. OTC:KEYUF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.