My Portfolio of ETFs

Post on: 28 Март, 2015 No Comment

Everywhere I go, I have people asking me how I invest my own money and what kinds of things I invest in. I’ve never had a problem sharing what I do, so I thought it would make sense to write about it.

The history

I came into the financial industry right out of University and worked for a big insurance company as their Retirement and Investment Specialist. I spent over 5 years, teaching insurance agents and brokers about the merits of segregated funds and started investing in those segregated funds myself over 22 years ago.

Later, I ventured into business as a financial advisor who sold GICs and Mutual Funds to clients. My first book, Mutual Fundamentals, was a research based book on how to pick top quality mutual funds. Right or wrong, I felt that picking mutual funds needed to be empirically based as opposed to being based on intuition, gut or instinct. I developed a rating system called the Fund Filter and it got quite a bit of media attention, interest and success. As a result, my portfolio also switched my portfolio from segregated funds to mutual funds.

In 2007, I sold my business and gave up my license to sell financial products to build my current business that puts financial education programs into the workplace . Instead of selling products, my focus is on education and teaching.

Welcome to the world of ETFs

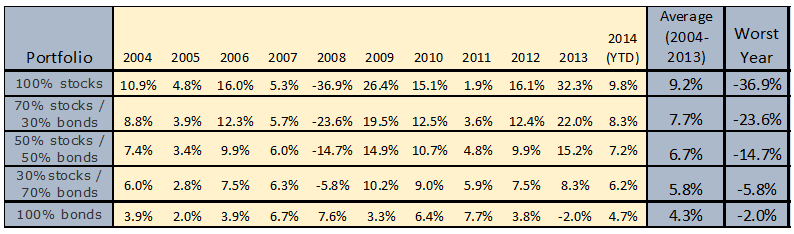

As an empirically based investor, I could not help but be influenced by the amount of research on low cost, passive investing . Even some of my own research lead to the conclusion that Fees do matter and the lower the fee, the higher the probability of higher returns.

If you are a fan of low cost passive investing, you’ll be drawn to the merits of Exchange Traded Fund (ETFs). That’s where most of my portfolio is invested today.

What is an ETF?

Exchange-traded funds (ETFs), are similar to mutual funds in that they hold a basket of stocks, bonds or other investments. The difference between an ETF and a mutual funds is how they are bought and the fees associated with them. Unlike mutual funds, ETFs are bought and sold on an exchange, like stocks.

The origins of ETFs began primarily with passive index based products. In other words, most EFTS were simply mirrors of common market indicies like the TSX, S&P500, MSCI, etc.

Today, the ETF market has grown dramatically and now there are actively managed ETFs with managers just like mutual funds.

What ETFs I own?

Before I disclose the ETFs I own, I must give a huge plug to Dan Bortolotti for all of his great information on the topic of ETFs. His website Canadian Couch Potato and his book The Moneysense Guide to the Perfect Portfolio was very influential and helpful. If you are wanting to learn more about ETF investing, I highly recommend his site and his book.

So, here’s my RRSP portfolio: