My favourite Canadian equity ETFs My Own Advisor

Post on: 9 Апрель, 2015 No Comment

Posted by Mark on September 7, 2011

While dividend-investing takes some time and effort, investing in some ETF products in my opinion, does not.

In fact, I bet you can construct the Canadian equity portion of your portfolio with relative ease. This post, will hopefully help you do just that.

I’ve said this before, when it comes to part of my portfolio, certainly for my RRSP in particular, I’m pretty lazy. Dont get me wrong, I love dividend-investing and dividend-paying stocks but I honestly don’t have the time (not to mention the cash) to build a highly diversified portfolio that will weather everything Mr. Market throws my way; in both my unregistered and registered accounts. So, I decided some time ago Im going to take a hybrid approach with my portfolio:

Index Investing in my RRSP and Dividend Investing in my unregistered and TFSA accounts.

I do this for many reasons, but one key one is, I want my RRSP to be lazy there is significant comfort in setting-and-forgetting part of my portfolio. To weather Mr. Markets bipolar personality, diversification is key. Always has been, always will be. Over time, while it’s my plan to be diversified with a robust basket of dividend-paying stocks it’s going to take some time to get there. I need to be patient. Until I get to this destination, especially in my unregistered and TFSA accounts, I’m going to use a few exchange traded-funds (ETFs) to keep my investment costs super low, achieve near-market returns and offset a whack of active management risk.

Here is the essence of my index investing approach for my RRSP:

- With the right products, it will produce market returns.

- I use it to keep our management fees extremely low.

- We reinvest all dividends paid whenever possible to buy more units.

- It’s a great compliment to our dividend investing approach.

- It’s an excellent complement to our defined pensions at work.

- It’s simple.

I love the last one.

Exchange-Traded Funds (ETFs) are a simple, easy way to passively invest in the market. I avoid any stock selection decisions with ETFs. Although I’ll never beat the market with them, I’ll always pay low fees and get market returns.

Doesnt that sound like a very powerful RRSP formula? Im biased, but of course it does folks!

This post will identify my favourite Canadian equity ETFs, why I like them, and if and when I plan to hold them.

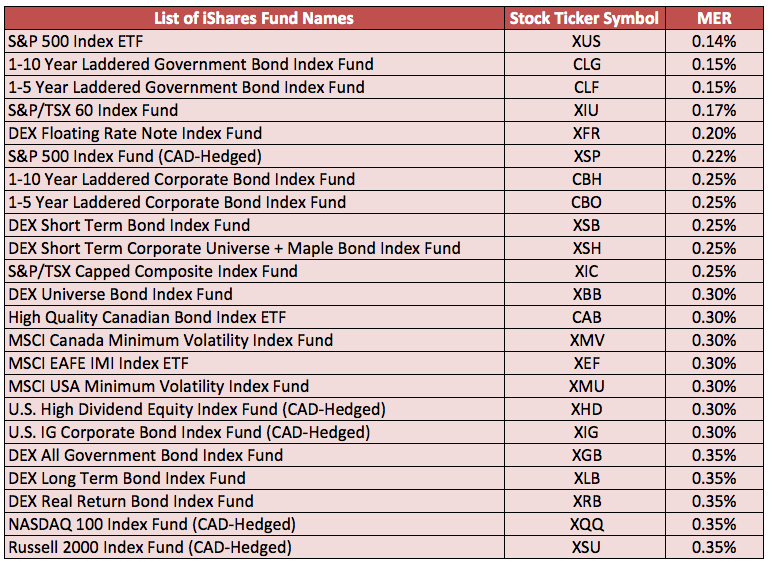

I like the iShares S&P/TSX 60 Index Fund because it tracks the performance of the largest, most liquid stocks that trade on the TSX. The MER is a dirt-cheap 0.17%. That means I get to keep and reinvest more of my money. XIU also pays some decent distributions every quarter yielding about 2.5%. While XIU does not cap any single stock (i.e., recall the Nortel effect?) I’m more than willing to take the risk. I consider this one the best “set it and forget it” Canadian equity ETFs you could own.

Disclaimer: I own XIU and don’t plan on selling it anytime soon.

If you want a capped, low-cost, ETF that tracks the Canadian market, this is an excellent product. The key benefit of XIC over XIU is the built-in diversification, XIC owns 260 companies instead of 60. Diversification and capping the securities though comes at a cost, almost twice as much as XIU.

Disclaimer: I do not own XIC and don’t plan on owning it.

I like the iShares Dow Jones Canada Select Dividend Index Fund since it “seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the Dow Jones Canada Dividend Index.” This index is comprised of 30 of the highest yielding, dividend-paying companies in the Dow Jones Canada Total Market Index according to indicators such as dividend growth, yield and average payout ratio. The weight of any one stock in XDV is limited to 10%. I used to own this product but since I now own more than 10 of the ETF securities via direct stock ownership, there is no major advantage here anymore Im on my to creating my own index if you will. If you’re not comfortable with direct stock ownership, XDV is a nice gift-wrapped dividend-paying portfolio for you. For about 0.50% in fees, you get a tidy monthly yield as well. One downside to this product, it’s heavy in financials. When Mr. Market is happy, you’ll be rewarded but when Canadian banks and lifecos in particular are suffering so does XDV.

Disclaimer: I do not own XDV and don’t plan on owning it again.

This product is very similar to XDV but is not nearly as heavy in financial companies, which can be a very good thing. I think you get more downside protection this way. This Claymore S&P/TSX Canadian Dividend ETF is also a little more diversified than XDV, it has more holdings (39). Another bonus.

Disclaimer: Because I dont own XDV, I also do not own CDZ and dont plan on owning it.

Here are some very good products to consider but these dont rise to the top for a couple of reasons outlined below.

This product is designed to replicate the performance of the RAFI Canada Index; companies in this index have strong dividends, free cash flow and equity value as some key factors. This is a good product. Like XIU, some of the main CRQ holdings include the big-5 Canadian banks, energy and material companies; companies that make money and pay dividends my kind of ETF. Unlike XIU, the upside is CRQ pays distributions every month. There is a downside as well it has a higher MER at 0.72%. This is a little high for my liking, this is my key reason for not owning it. If the MER was closer to 0.30%, Id seriously consider it.

Disclaimer: I do not own CRQ and don’t plan on owing it.

The BMO Dow Jones Canada Titans 60 Index ETF seeks to achieve the performance of the Dow Jones Canada Titans 60 Index, net of expenses and competes in a similar space as XIU. Components of ZCN are capped at 10% and the ETF is float-adjusted quarterly. The MER is a skinny 0.15% which should suit many DIY investors.

Disclaimer: I already own XIU, so I dont plan on owing ZCN.

Horizons BetaPro has a neat and cheap product, the S&P/TSX 60 Index ETF. Like XIU, it seeks to mirror the performance of the S&P/TSX 60 Index but I think you need to be a gambler of sorts to own it. Why? While the MER less taxes is a microscopic 0.07%, HXT uses swap agreements to gain exposure to the index. For me, any ETF that uses the words “swap” or “agreements” or “derivatives” or “indirect” in their investment strategy does not belong in my lazy RRSP portfolio. HXT will not pay any quarterly dividend distributions. Not good for me who likes ETFs and companies that pay distributions and dividends for reinvestment purposes.

Disclaimer: I do not own HXT and don’t plan on owing it.

So, there are my favourites friends. Some ETFs I love, others not so much but all of these should at least be considered for your retirement portfolio. Im not just saying this, Im living it good cooks need to eat their own cooking, dont you think?

What do you think of my favourite Canadian equity ETFs?

Did I leave any of your favourites out?

Do you own any Canadian equity ETFs yourself and if so, which ones and why?

Guess what friends?

You can now follow myownadvisor on Twitter!

Use the Twitter Subscription Option at the top right of my blog to follow my articles, follow my random thoughts about personal finance and investing or just interact with me