Mutual Funds Versus Index Annuities

Post on: 16 Март, 2015 No Comment

Mutual funds have long been the standard investment by which to plan for retirement. They are included in almost every retirement plan and most brokers and Investment Advisers have a variety of funds to offer. In fact, your insurance agent and your bank can usually offer them. For internet savvy investors they can be find online and most of the time can be invested in directly with the company bypassing the middle men completely.

The widespread use of mutual funds brings to mind a very basic business scenario. If a manufacturer or retailer floods the market with a product then very soon there will be competitors to offer a very similar if not almost identical product. And when the competition is fierce, a new company will come out with an updated or better product to tempt all of us consumers. The new company does really well but the old companies must change or face the consequences.

The mutual fund market is much like the old companies right now. With the recent downturns in the market investors are realizing that mutual funds are not always a safe investment. They don’t always go up and the can come down dramatically. A down market can be detrimental to retirement savings and college savings as well.

The new company is the index annuity. New is in quotes because the new product is being offered by old established companies. The product is new and usually not the company. Index Annuities are the new product that can be a better and more appropriate choice for serious money. Serious money is your retirement savings or investments that you need income from or will need income from to live on.

A lot of brokers and Investment Advisors disagree. Why? Let’s compare the two.

Safety

Mutual funds are equity investments. They take your money and invest in company stocks and bonds. If companies do well, you make money. If the companies do not do well, like right now, your funds will be down. Can you lose all of your money in a mutual fund? Yes! But it is not likely. Most have 80-100 different companies included in each fund. Losing your entire investment would mean that all of these companies would have to go out of business at the same time. It is possible but no probable. Index annuities are not equity investments. What that means for you is that your investment never goes down. If you have owned a fixed annuity in the past, it is a little like that except the interest rate is paid differently into your account. Annuity companies are usually very stable but when they do get in trouble they are usually bought by a larger more successful insurance company. Can your annuity company have problems? Yes. Will you lose your money? I am not aware of anyone that has ever lost money in an Index Annuity. None of my clients have lost money.

Expenses

Expenses should be discussed be rates of return because of the dramatic effect they have on performance. Mutual funds can have high inter fees and commissions associated with them. There can be as much as 5% or more commission on a fund. No load funds have no commission but have higher internal fees. Both have internal annual fees that can exceed 2% and sometimes more. Here are two examples to consider. An initial fund purchase with a 4% commission plus a 2% annual fee costs 6% the first year and 2% every year after that. That is pretty steep especially when funds are down 20% right now. An initial purchase into a no load fund might have a 2% annual fee. That is 2% every year!

Compare that to an Index Annuity. No commission up front. There are no internal expense fees because your money is not invested in stocks or bonds. So comparing to the first example from above, the mutual fund has to climb as least 6% to break even. The Index Annuity breaks even with a 0% return. In the second example, the no load must climb 2% to break even. The Index Annuity breaks even at a 0% return. Let’s say that that Index Annuity has a 5% return for the year. The mutual fund with commission has to come up 11% to equal and the no load has to come up 7% to equal the same return. Not looking good for the mutual fund but let’s move on to how interest is earned or how does the money grow?

Interest

Interest or rate of return is a major concern for most investors. If your investment doesn’t beat bank CD’s then there is no reason to use anything other than CD’s. A Mutual fund’s rate of return or interest is directly tied to how the companies that the fund is invested in perform. The return is also tied to overall market conditions. With a fund, we are not looking at a straight interest rate like a CD or individual bond. Funds have a unique feature that can provide great leverage over time. The fund share price should go up over time but the fund also pays out capital gains each year. If reinvested, these gains begin to provide leverage over time by buying more and more shares. So if you originally bought 100 shares 10 years ago, you might have 350 shares now. If you fund goes up $1, then you make $350 instead of $100. That is a pretty powerful argument for mutual fund ownership. It does work in reverse too. If your fund goes down 1$, you lose $350 instead of $100. This is the reason why retirement accounts can fluctuate so much over time. The more shares you own, the more fluctuation.

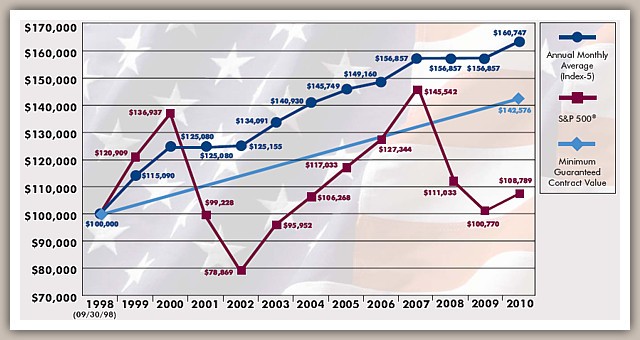

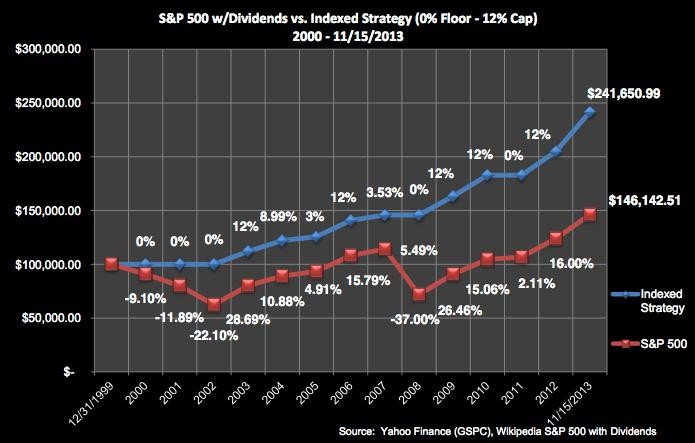

The Index Annuity works much different. It is not share based. It is money based. Being money based means that it does not fluctuate with the stock or bond market. The interest that you earn, however, is based on how an Index performs. Most people are familiar with the DOW and the S&P Indexes. The news reports on a few indexes each day. The Index Annuity will perform similar to the index that it is based on. The index is an indication of overall market performance so the mutual fund will also be closely linked to a similar rate of return. The index annuity can never go down, only up, unless you take money out of course. The interest is paid based on some calculation compared to the major index. These calculations can be complex but basically they will give you three or four options. Choose one of these or a couple of them based on your specific investment needs. An educated Investment Advisor will be very helpful at this point to help decide which to use. The performance will be close between the mutual fund and the index annuity with the exception that the annuity cannot go down.

Bonuses

Mutual funds do not offer any kind of bonus for doing business with them. Insurance companies often offer bonuses for investing in an annuity. For an Index Annuity, the bonus can range from 5 — 15%. There is a lot of talk about these bonuses and some negative publicity about them as well. It is important to understand how the bonus works to clear up confusion. No company is going to give someone 15% on say $500,000 which is $75,000 and not put some restrictions on how the money is taken out. They want some sort of commitment that you will do business with them. Typically that means that they want you to use all of your money first and then the bonus. The bonus earns interest in the mean time so that when it is needed, there is much more money there than there was originally. Recovering losses of 5-15% is a good deal, especially right now while the market is down. A bonus increases earning power.

Access To Money

Access is also a major concern to most people. A mutual fund typically has 100% access to all funds anytime. The only problem is if the funds are down, a loss might occur. An Index Annuity has some rules. It also has 100% access to principal but may have some charges associated with withdrawing it all at the same time. These charges can vary greatly but are clearly stated in each annuity contract. Having a contract is a great thing because you know exactly how much you will have to pay, if needed. In the mutual fund, with the market down you might pay 20-30% in losses. In the annuity, the surrender charge, fee that might charged to withdraw all of the money at the same time, is clearly stated. It is not an unknown.

The annuity also has a great feature that allows it to be used for retirement. Most have a feature called the free withdrawal. A person can take out as much as 10% in any give year. This amount is much more than we would want to take out for retirement income. Typically, a retirement plan suggests 5-6% maximum take out each year for living expenses.

Summary

Safety, Expense, and Interest are the major points of concern when comparing any investment. Bonuses are an added benefit of Index Annuities. Index Annuities are the new product that truly overshadows the mutual funds. After comparing, the annuity seems best but I would stress that for most people, putting all of your investment money into one area is a bad idea. There is still a very valid use for mutual funds and Index Annuities as part of a well rounded portfolio. As always, be sure to check with a qualified Investment Advisor before making any investment decisions.

Thanks for reading! If you have investments that are down right now, please give me a call or contact me through my website. I can show you a way to recover a large chunk of your losses instantly and never have your investments go down again.

None of my clients lost money during the recent downturn!

Give me a call anytime. Office: 918.872.7117 Cell: 918.809.4761

www.TulsaRetirementPlans.com