Mutual Funds Mutual Fund Advantages

Post on: 25 Август, 2015 No Comment

Here we are, the very important section on mutual funds. I’ve repeated several times in this book that mutual funds should be a family’s core investment.

Since there are so many types and kinds of investments and so many ways to invest your money, I’m going to offer some more straight talk — in the long run, there are only 2 things about investing that are really important:

Choose a mutual fund that will make you lots of money in the coming years

Get started right NOW

It’s really that simple? Yep, that simple, well almost — you have to pick a really good fund.

Mutual funds can be a very foolproof way of investing. Mutual funds give people just like you the opportunity to save your money, along with other investors, in an investment account managed by some of the best financial minds in the world.

Mutual Fund Advantages

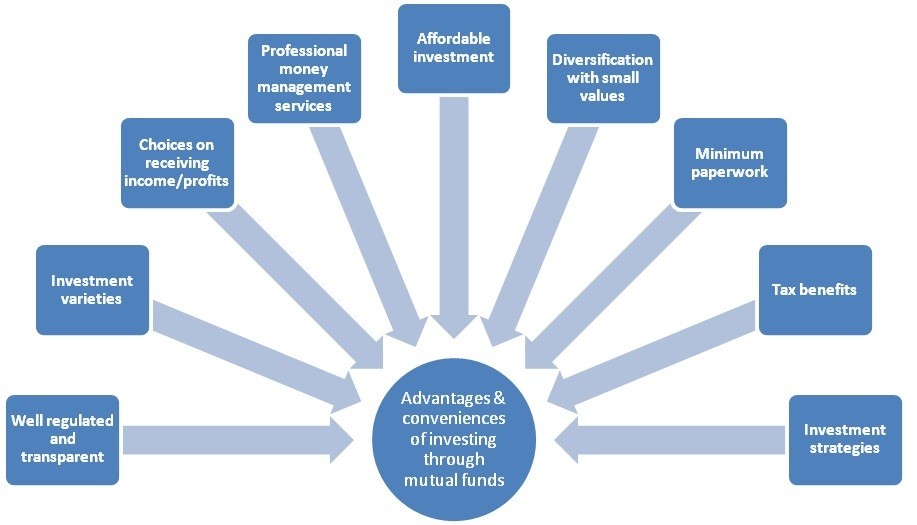

This is an ideal way for you to avoid the complications of picking your own stocks. You can also select funds that invest in bonds, government securities, real estate, precious metals, or even a combination of investments.

Other mutual fund advantages include:

You can get started for as little as $0 (see page 150), but $2,000 is a more common minimum. It’s easy to arrange regular transfers of money from your savings or checking account to buy more shares in the fund.

Mutual funds give you convenient access to your money. With 24 hour telephone 800 numbers, in an emergency you can sometimes arrange next day wire transfers of money back to your bank. If you request a check, it is generally mailed within 2-3 days, although the fund is allowed up to 7 days.

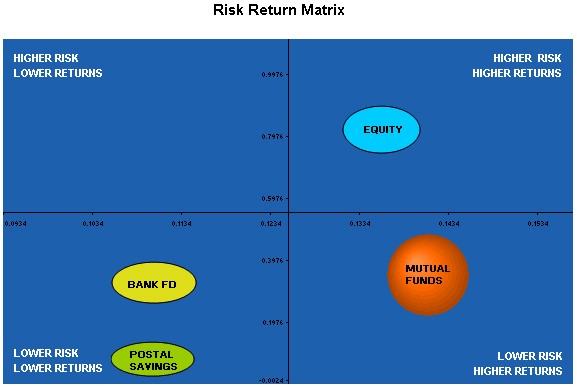

Instant diversification. By carefully selecting your fund, you automatically have a diversified portfolio matching your investment style and risk tolerance.

Most mutual funds are managed by professional stock pickers. These are really smart people whose paycheck is tied to the performance of the fund that they are managing.

A downside is that many people are sold a fund that either doesn’t meet their investing time frame, usually with a hefty sales commission (called a load), or the fund’s earnings don’t even match a basic index-fund that is essentially run by a computer.

Earlier, in this book’s introduction, you saw how $10,000 invested in a mutual fund in 1926 grew to over $64,000,000 in 75 years. This was demonstrated by a Pioneer Fund’s advertisement in many financial magazines, and is actually a typical result for mutual funds over this time period (it was up to $81 million in March of 2000).

Yes it’s true, that the potential is even greater for a successful stock market trader. But unless you can beat the performance of a professional mutual fund manager, a wisely chosen fund is a better choice.