Mutual Funds and Index Funds

Post on: 16 Март, 2015 No Comment

Morning! Today I welcome back Derek Sall from LifeAndMyFinances.com , for the third installment of our investing series. You can check the first post, Investing-What is the point? where Derek talked about the importance of investing, even in small amounts, and how to start investing , where he reviews the costs of different brokerage accounts. Today, Derek compares mutual funds and index funds. Enjoy!

The Mutual Funds

While I’m certain that you’ve heard of a mutual fund, do you really know what it is? In the simplest terms, a mutual fund is a combination of many like-stocks and are put together in a single fund for you to invest in at a reasonable price (since you and other investors mutually share in the overall cost of this assortment of stocks). Within one single mutual fund, there may be an assortment of over 30 different stocks. If you did this on your own, it would likely cost you over a thousand dollars to buy just one share of each of these stocks (and that’s not including all the transaction fees either). Mutual funds are a great way to diversify your investment among many stocks at a relatively low price per fund share.

The Index Funds

Mutual funds help you diversify various stocks into common industries such as retail companies, real estate firms. or maybe even an assortment of oil refineries. Index funds have the same premise, but are slightly different in nature. Instead of investing in various related stocks, index funds actually model their funds after various indexes, like the DJIA, NASDAQ, or S&P500. I am currently investing in an index fund that has each of the stocks that the S&P500 does. So, if the S&P500 goes up, then I can be confident that my investment went up too.

Investing in Index Funds is incredibly simple (just like mutual funds). All you have to do is search for “Index Funds” within your online brokerage account. There should be many to choose from.

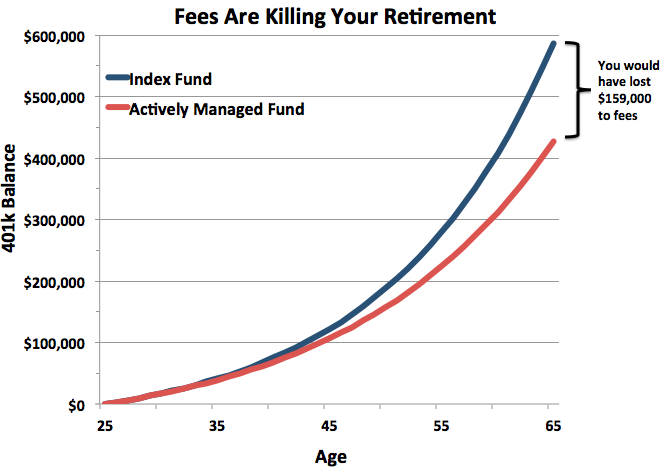

Once you find all of the index funds that are available, you will be happy to note the fees that are associated with these funds (because they are nearly 0% in many cases). Mutual funds often charge fees from 0.5% to 2% or more. You’ll most likely never seen an index fund that charges a fee of more than 0.5%, which will most likely save you thousands of dollars over your investment life.

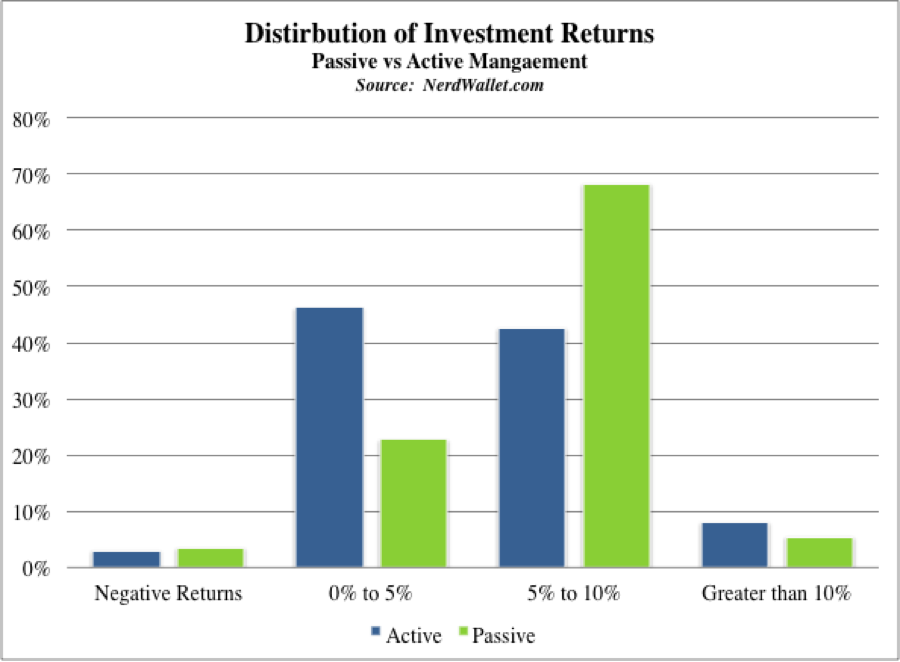

The next question that you might be asking is, “Well yes, Index Funds might be cheaper. but do they earn as much money as a mutual fund? After all, I would be willing to pay more of a fee if the mutual fund earned me twice as much.” There are some mutual funds that perform very well, but over the course of time, the average mutual fund does not perform as well as the general stock market indexes, which means that the index fund (while cheaper) still outperform many of the best mutual funds out there.

It’s obvious that I am a fan of index funds, but even if you don’t believe me, take a look for yourself! Check the top mutual fund earnings over the course of 10 years and then compare those earnings to that of the index funds. Chances are, the index funds will come out on top.